Reg BI and PTE 2020-02: The Perfect Regulatory Storm

Two major regulatory changes are currently bearing down on financial professionals and broker-dealers. Regulation Best Interest (Reg BI) came into effect on June 30, 2020, requiring that broker-dealers and financial professionals ensure their recommendations are in a client’s best interest. This means evaluating recommendations based on cost, risk and return factors; considering reasonable alternatives; disclosing conflicts of interest and maintaining a record of the best-interest analysis and disclosure.

While Reg BI has been in effect for some time, the Securities and Exchange Commission (SEC) recently signaled that it expects to ramp up Reg BI enforcement action in 2022. In his October 8, 2021 speech, Gurbir Grewal, Director of the SEC Division of Enforcement, made it clear that firms need to take a proactive approach to compliance and “give their registered representatives the tools and information that will enable them to identify, disclose and mitigate conflicts prohibited under Reg BI.”

Meanwhile, the Department of Labor’s (DOL) Prohibited Transaction Exemption 2020-02 (PTE 2020-02) is now in effect. The DOL’s grace period for enforcing specific documentation and disclosure requirements will end on June 30, 2022.

Are You Ready to Face the Regulatory Storm?

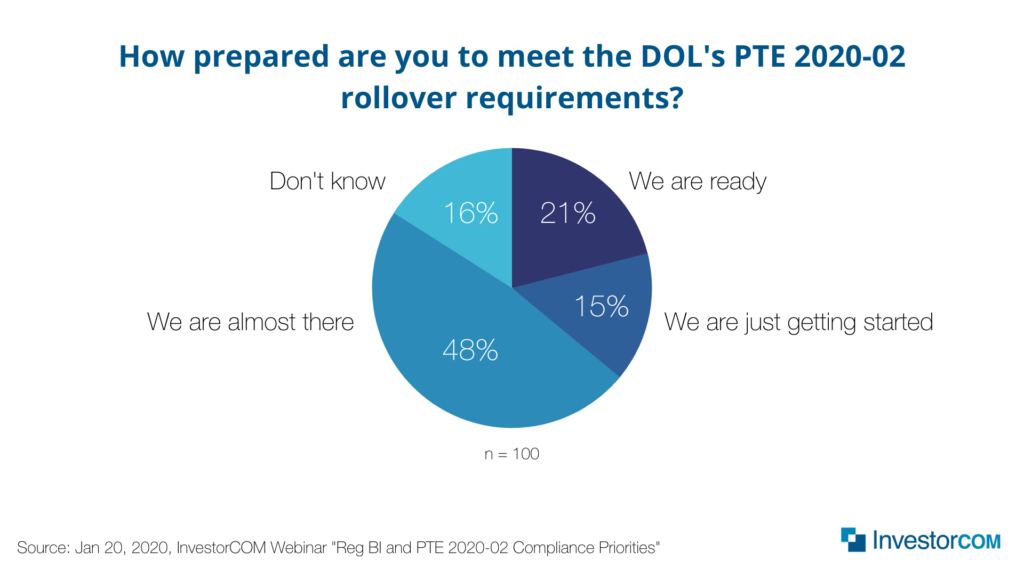

During a January 2022 webinar on Reg BI and PTE 2020-02 Compliance Priorities, we conducted a poll that showed only 21% of firms surveyed said they were fully prepared to meet the DOL’s PTE 2020-02 rollover requirements, and 31% said they were just getting started.

Figure 1: How prepared are you to meet the DOL’s PTE 2020-02 rollover requirements?

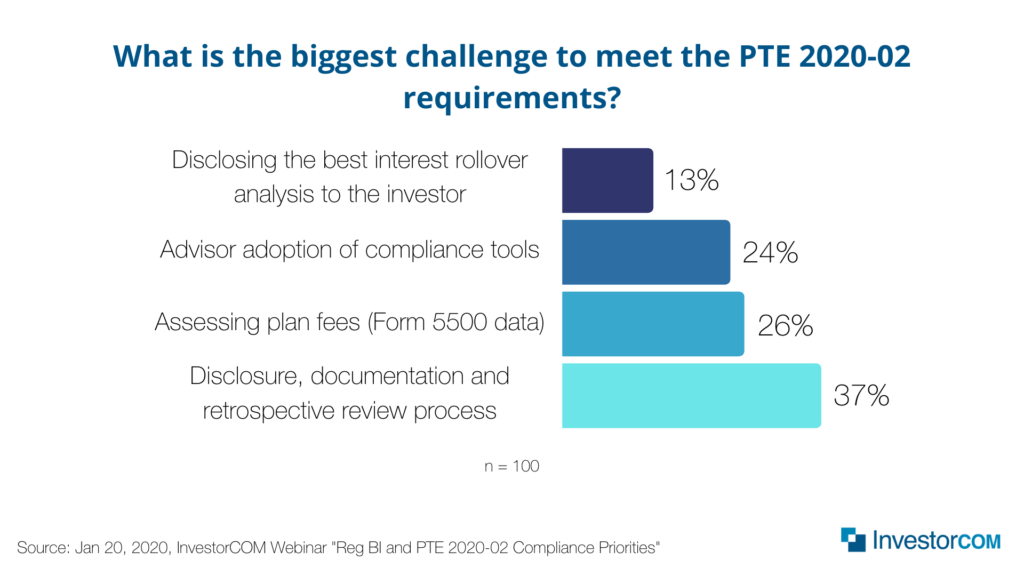

In the same poll, participants indicated that their biggest challenge in meeting the rollover requirements was the disclosure, documentation and retrospective review processes. Assessing plan fees (Form 5500 data) was the second most common challenge.

Figure 2: What is your biggest challenge to meeting the PTE 2020-02 requirements?

Although compliance with the new rollover requirements poses a great challenge to firms, it also represents a massive business opportunity. Rollovers are currently the biggest source of dollars flowing into individual retirement accounts, and rollovers are expected to reach $760 billion annually over the next five years.

Preparing for and Navigating Reg BI and PTE 2020-02

So how do financial professionals and broker-dealers navigate the confluence of regulatory storms and take advantage of the enormous business opportunities ahead? Automation and technology offer alternatives that firms are increasingly embracing to meet the rising tide of regulatory requirements while reducing the workload and stress of financial professionals and compliance teams.

InvestorCOM PeerCompare is a tool that automates the Reg BI analysis of reasonably available alternatives by assessing a recommendation against a peer group of alternatives based on cost, risk and return metrics. Relevant peer group data is automatically generated, organized and ranked, allowing financial professionals to easily analyze the output before making their best interest recommendation. The analysis is saved in a centralized database for compliance reviews and is ready to be presented to clients.

InvestorCOM RolloverAnalyzer is designed to intuitively automate the rollover function. It supports financial professionals by integrating Form 5500 and industry data and by providing relevant questions and scoring to assess client needs against a recommendation. RolloverAnalyzer completes the workflow by creating an electronic record of the analysis with the required disclosures that can be shared with clients and saved to a database to meet obligations around client recordkeeping and retrospective review.

Safely navigating the regulatory waters can be challenging, but with the right resources and technology, financial professionals and firms can make compliant recommendations that are in their clients’ best interests and benefit from the tremendous business opportunities that lie ahead.

Tags: PTE 2020-02, Reg BI, Reg BI examinations