National Instrument 81-106 provides investors and advisors with timely and comprehensive information about their investments. The Management Report of Fund Performance (MRFP) and Financial Statement (FS) are intended to assist investors and advisors in fully assessing fund performance and suitability.

Key components of a continuous disclosure program

Document Creation

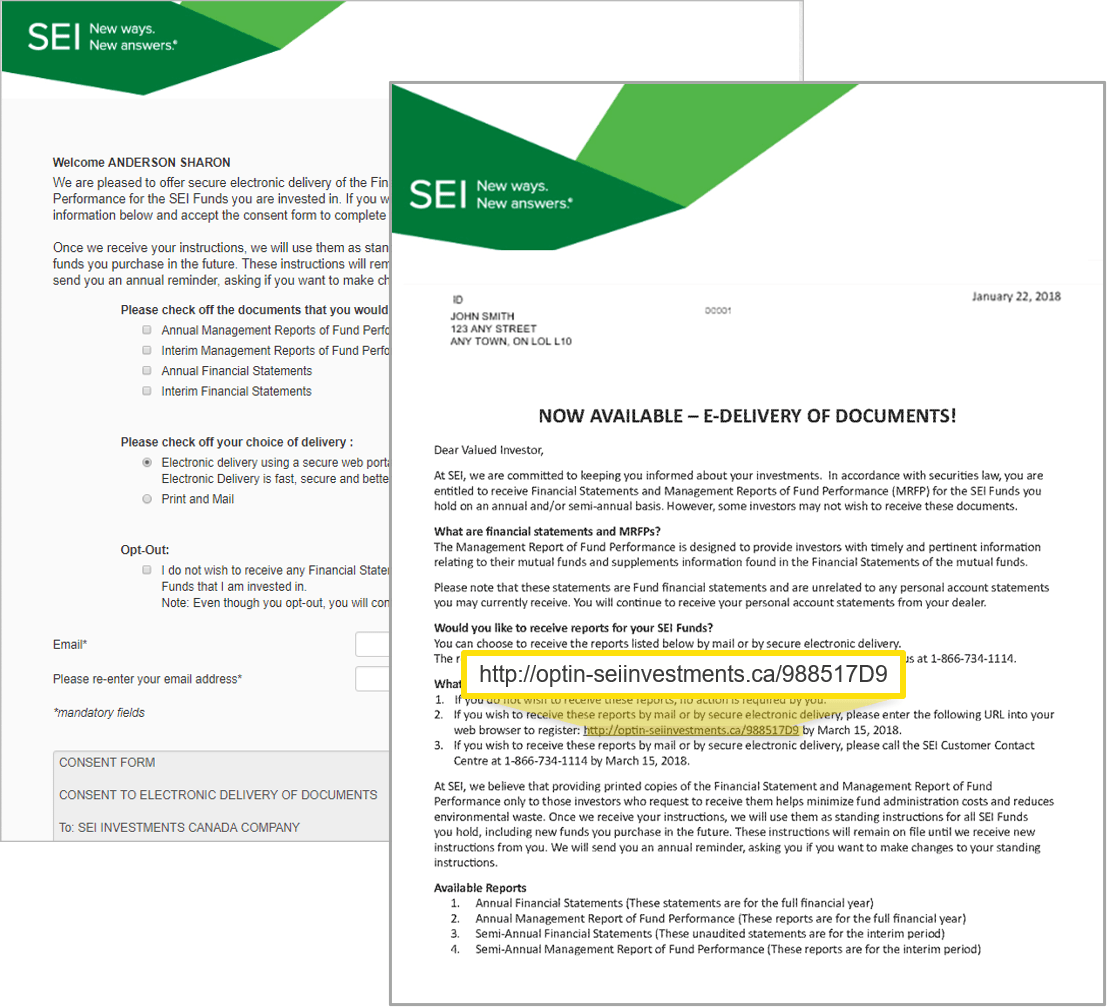

Notification and Preference Management

Distribution

How InvestorCOM helps firms meet Investment Fund Continuous Disclosure

Automated Document Publishing | Reminder Letters | Preference Management | Digital and Print fulfillment

Compose, translate and publish regulatory documents

Producing and translating MRFPs, Fund Facts and financial statements is time consuming and error prone.

Publisher is a drop-in solution that imports fund data and automates the process of composing, translating and publishing regulatory documents.

- Meet Compliance for AODA.

- French translation support.

- 24/7 online access.

- Flexible publishing options – individual, batch, booklets – to support the way you work.

Use Publisher to improve your document quality, create efficiencies and lower costs.

Provide investors with digital access to fund information

Migrate costly print/mail delivery to secure e-delivery of MRFPs and Financial Statements. Consolidate documents into a single dynamic package of compliance documents according to client’s holdings and preferences.

- Turn-key solution for your entire continuous disclosure program.

- Reminder letters.

- One-click preference management with industry leading e-migration rates.

- Document delivery in physical and digital channels.

Asset Manager uses InvestorCOM to Lower Costs

Dynamic, personalized books reduce average page count by 60% and postage costs by 50%.

InvestorCOM Makes Major Technology Investments

We automated our CCM/CDM process leveraging OpenText Exstream and Crawford Operations Express.

InvestorCOM Wins Spot on RegTech100

InvestorCOM recognized as one of the world’s leading 100 RegTech companies by specialist research firm RegTech Analyst.