Securities regulators around the world are increasingly focused on regulation aimed to improve client communications and address conflicts of interest to ensure that investment products, advice and related services are in the client’s best interest.

We help wealth managers meet regulatory compliance challenges and communicate more effectively with clients. Available in English and French, our modular, drop-in solutions are intuitive, cost-effective and fast to implement.

Tackle your regulatory obligations with confidence.

Whether you are looking for a point solution or an end-to-end compliance platform, InvestorCOM has you covered.

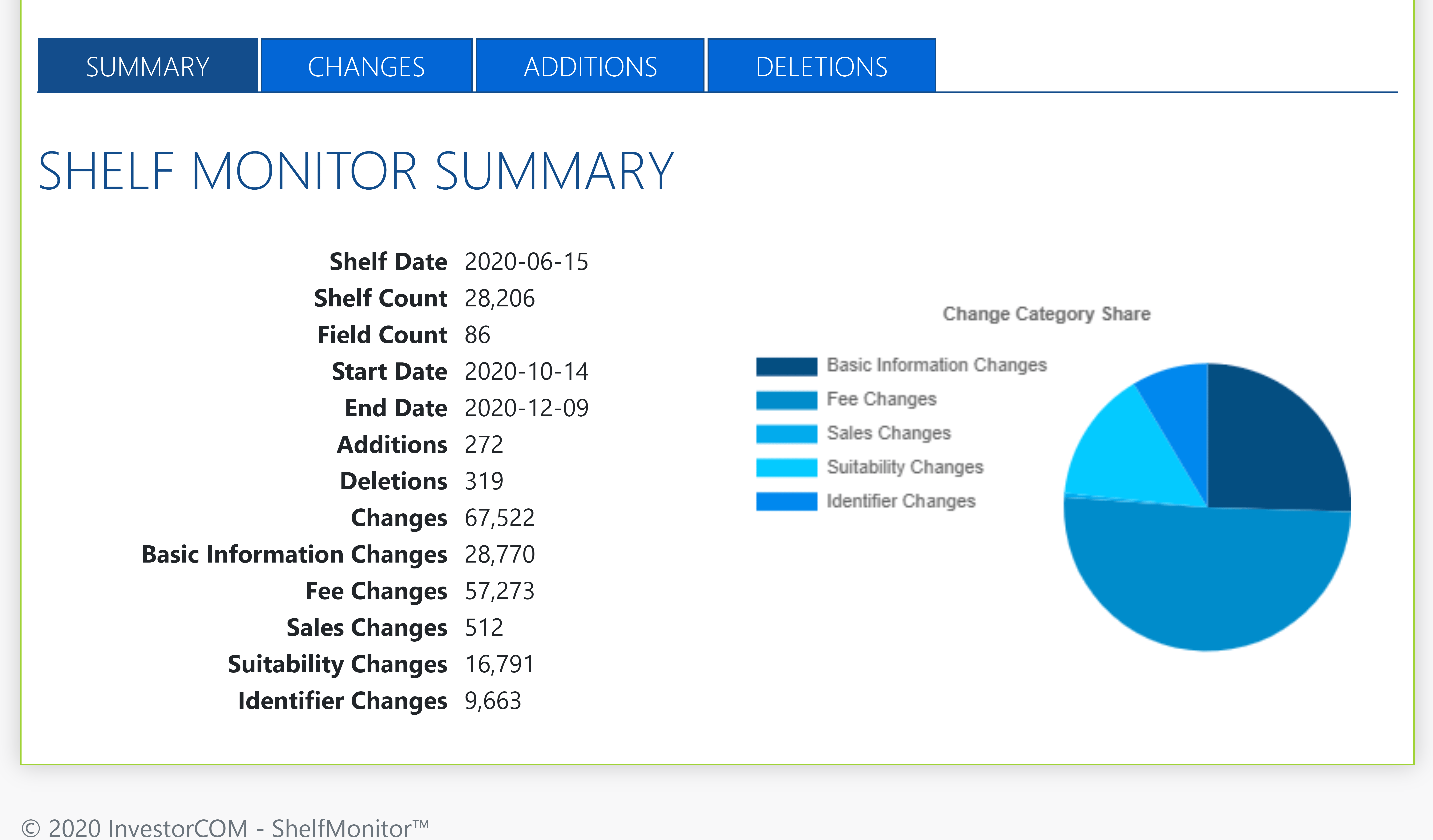

Stay on top of your ever-changing product shelf

Stay on top of material changes on your shelf with custom monitoring and alerts that give you the information you need, when you need it.

ShelfMonitor scans investment products for changes such as sales and fees, management information, product suitability and risk.

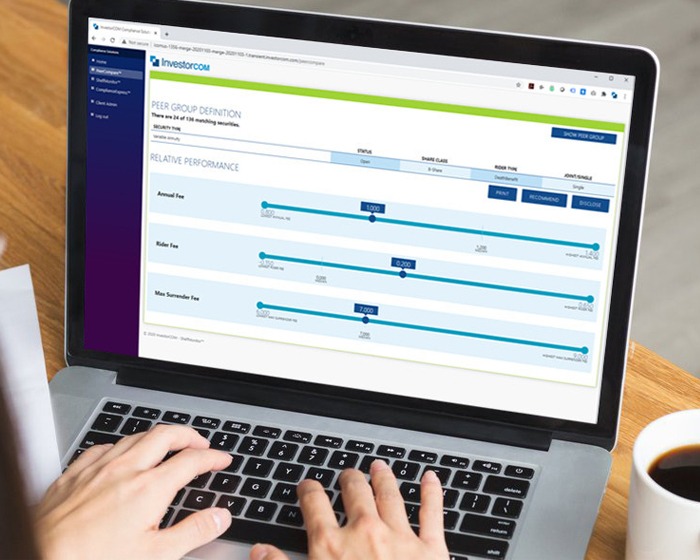

Make compliant investment recommendations

Make it easy for your advisors to demonstrate they are acting in the best interest of retail clients.

PeerCompare generates a product peer group of reasonably available alternatives that compares data on cost, risk and return.

Deliver your investment recommendations to investors, while tracking and logging all activity and relevant notes.

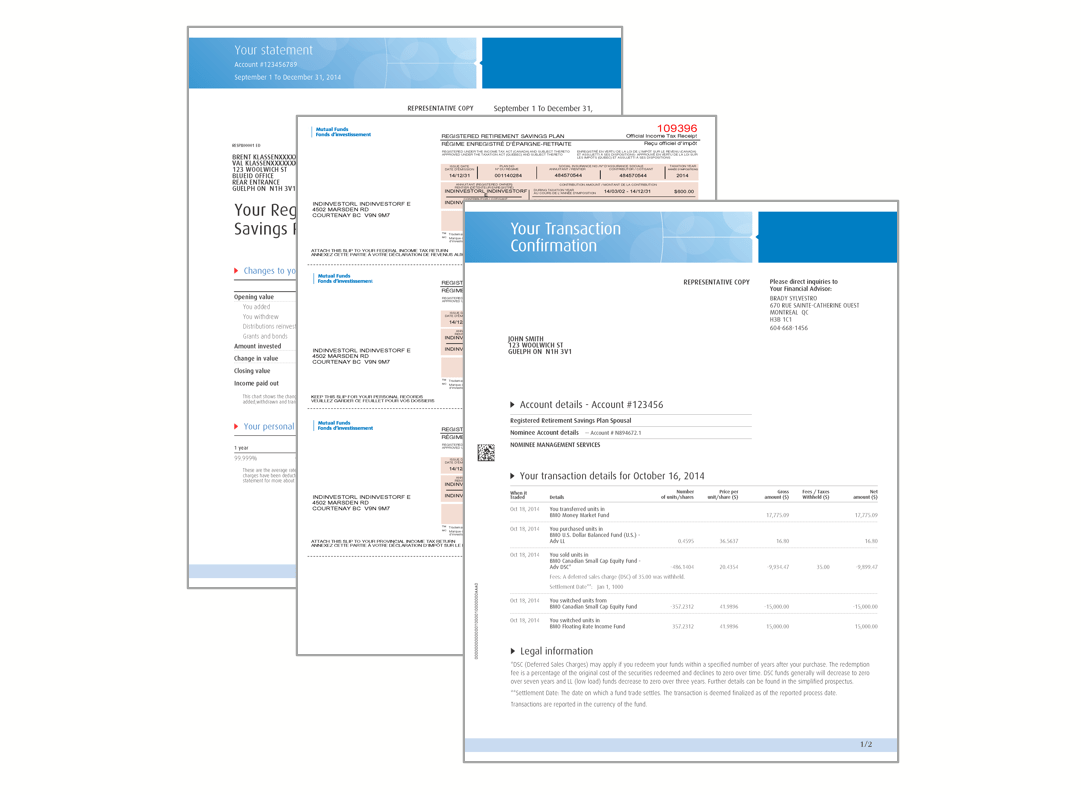

Meet recordkeeping and disclosure requirements

Save time and money by sending your regulatory documents electronically to clients.

ComplianceExpress will manage all of your recordkeeping transactions and document delivery from a secure, cloud-based platform.

Boost operational efficiencies and reduce costs while meeting compliance obligations.

Design and deliver compliant communications

Our Client Communication Management (CCM) solution makes it easy to design and deliver compliant client documents – financial statements, trade confirmations and tax slips – across digital and print channels.

Create, customize and deliver marketing documents on demand

Reduce your marketing fulfillment costs by 30-40% by using DOX to order, customize and deliver customized content on demand.

DOX facilitates the cost-effective and compliant fulfillment of custom Advisor sales kits so that you can focus on advisor engagement and business development.

Challenges and Best Practices for KYP Compliance

Assante, Manulife Securities and TD Wealth discuss best practices on how to stay on top of their product shelves.

Jumpstart your Client Focused Reforms Journey

Find out what firms are doing to prepare their advisors and dealers for the upcoming CFR regulation.

Electronic Disclosure and SEC Requirements

Before going digital, learn about SEC’s requirements for communicating electronically with clients.