Stay on top of significant and material changes on your shelf with custom monitoring and alerts that give you the information you need, when you need it. ShelfMonitor scans investment products for changes such as sales and fees, management information, product suitability and risk. Designed for dealers and advisors.

Rise to the challenge of assessing and monitoring every product on your shelf.

Identify material change as soon as it happens

Your product shelf is constantly changing. Research has shown that in a 12-month period:*

- 2,000 fund categories changed.

- 661 funds got riskier.

- 128 management expense ratios gained at least 10 basis points.

ShelfMonitor scans your product shelf in real-time, captures all changes, and alerts your team so they can adequately assess and take action as needed.

* Source: Research study, Sept 2022.

Focus on the data that matters to you

Advisors use ShelfMonitor to monitor their book of business and get alerted when investment products held by their clients have significant changes.

The advisor chooses which products to watch and the fields to monitor.

By dialing down the volume of change alerts and focusing on what matters, advisors can act in the investor’s best interest by promptly managing any impact on client portfolios. They also have an opportunity to engage clients, deepen relationships and address suitability.

Assess the competitiveness of the products on your shelf

See how your products stack up against peers by comparing cost, risk and return characteristics.

ShelfAnalyzer generates a Peer Rating for each product on your shelf making it easy to evaluate product competitiveness efficiently and without bias.

You can limit the assessment to your product shelf, or expand it to include all products available in the market (the universe).

ShelfAnalyzer together with ShelfMonitor are particularly well-suited to help Canadian wealth firms meet the Client Focused Reforms KYP obligation, requiring them to take reasonable steps to ensure the securities or products made available to clients have been periodically assessed, approved, and monitored for significant changes.

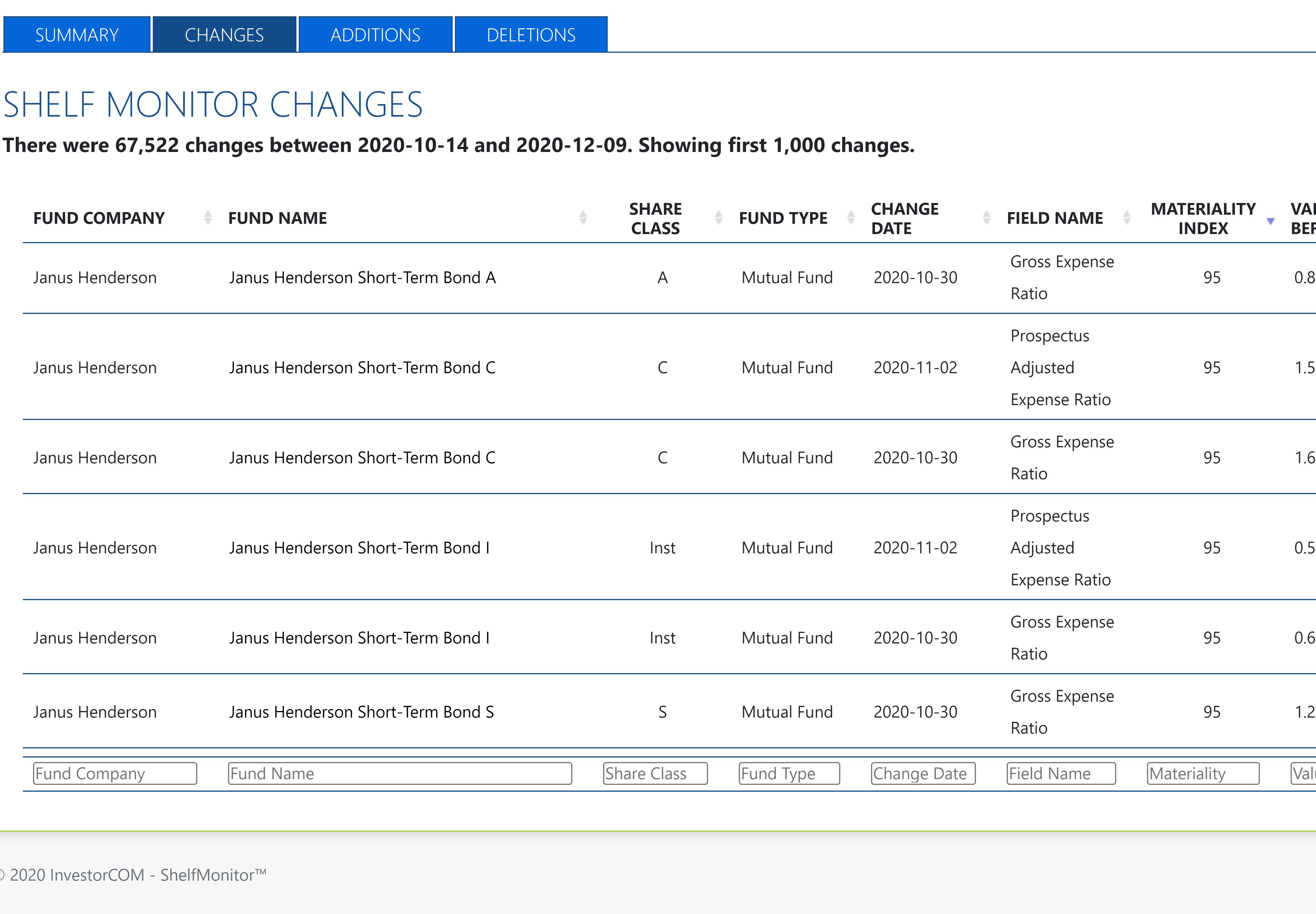

Filter and focus on material changes

With so much change on your shelf, it’s challenging to identify what’s important and what’s not.

ShelfMonitor’s Materiality Index lets you filter the data and focus on what matters. The higher the number, the more significant the change so you can take a deeper look.

Simply define your alert threshold and receive customized reporting on relevant product changes.

Streamline compliance procedures across multiple departments

ShelfMonitor provides multiple departments with the ability to streamline compliance procedures and keep back office operations up to date.

- Compliance Teams track product changes to ensure that investor portfolios remain compliant.

- Operations Teams stay current with material product changes in the market.

- Back office Maintenance Teams keep investment products current in the back office system.

- Product Strategy Teams monitor competitive product changes, trends and positioning.

ShelfMonitor for Dealers is Now Available

Configured for investment dealers that need to understand, assess, approve and monitor their product shelf.

Challenges & Best Practices for KYP Compliance

Experts from Assante, Manulife and TD Wealth provide tips for staying on top of your product shelf.

Jumpstart Your Client Focused Reforms Journey

Find out what firms are doing to prepare their advisors and dealers for the upcoming CFR regulation.