Intuitive application for financial professionals to make best interest rollover recommendations and to easily and consistently document, and disclose their analysis to clients.

3 easy steps to meet your rollover requirements.

Analyze your rollover recommendation

Compare your rollover recommendation against Cost, Service and Fit criteria.

Fully integrated plan cost data

Instant access to Form 5500 and benchmark data to assess plan costs.

Document and disclose the recommendation

Capture and store the recommendation; share a copy of the disclosure with the client.

Why choose RolloverAnalyzer to meet Reg BI and PTE 2020-02?

Single workflow to analyze, document and disclose best interest rollover recommendations to clients.

Best interest analysis made simple

If your advisors are using manual forms and large text boxes, you know how cumbersome this can be for compliance teams to review and analyze.

With InvestorCOM RolloverAnalyzer, analysis is a breeze. We enumerate the points of analysis making it easy for the financial professional, compliance team and client to review and understand.

Auto-generated compliance text provides the ‘reasons why’ to support the financial professional’s decision-making.

Integrated Form 5500 and plan expense look-up

InvestorCOM makes it easy for financial professionals to assess rollover plan fees.

Using RolloverAnalyzer, your team can input the client’s 404(a)5, look up employer-sponsored plans from the Form 5500 database, and leverage industry benchmark functionality straight from the app.

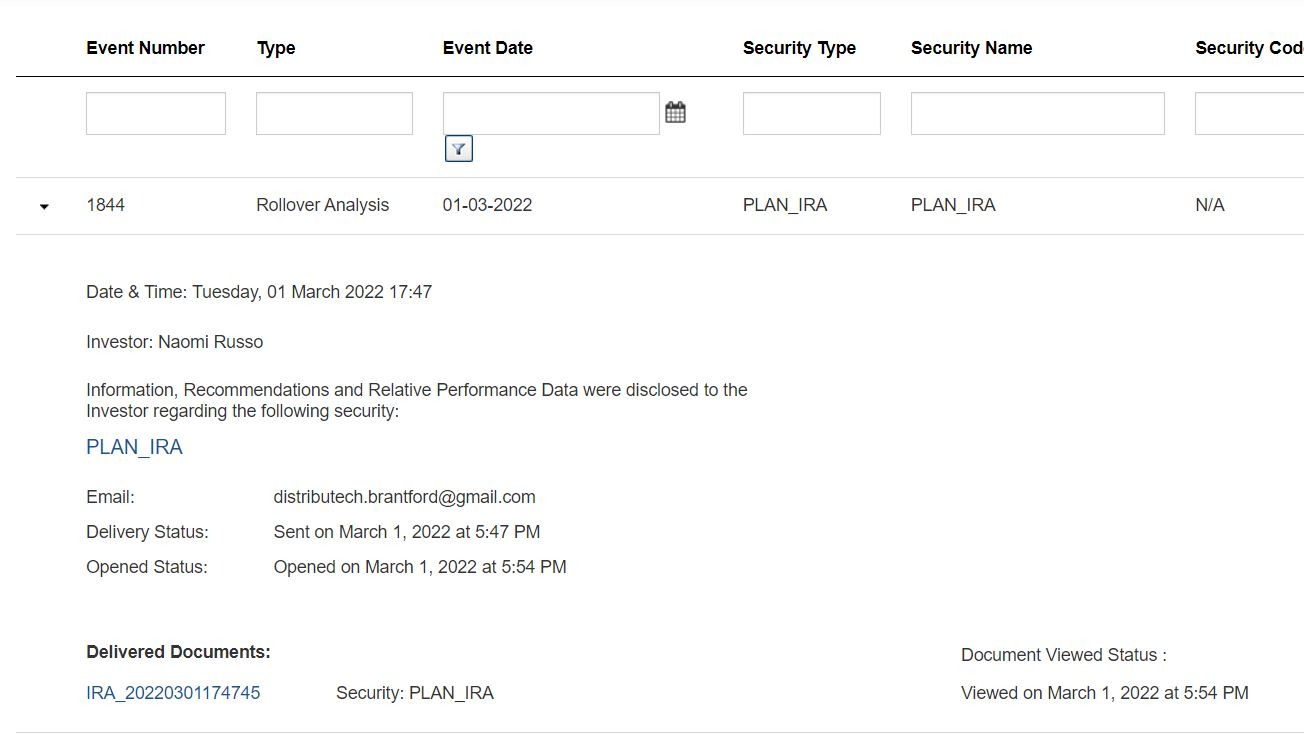

End-to-end digital disclosure and documentation

Eliminate multiple systems and manual processes to meet your Reg BI and PTE 2020-02 obligations.

RolloverAnalyzer allows your team to easily transition from analyzing the best interest rollover recommendation to disclosure and recordkeeping. The entire process is automated and just one click away.

Generate a plain language disclosure report

Once the analysis is complete, RolloverAnalyzer automatically generates a PDF report of the rollover recommendation.

The personalized report includes the rationale for the rollover recommendation in easy-to-understand English. And it’s fully customizable to include your firm’s branding and disclosure information.

Print or email the document to your clients. A copy is retained in a centralized database for easy review by supervisors, compliance teams and senior management.

Transform rollover activity into valuable insights

Now you can get a bird’s-eye view of your firm’s rollover activity and self-correct when required.

RolloverAnalyzer features an intuitive dashboard that displays all of your firm’s transactional data in an easy-to-understand design.

Accurately monitor rollover volumes, drill into details, and identify risk-based scenarios that require additional research and/or remediation.

Schedule and email custom reports to compliance personnel, and easily export data to include in reports for regulators, for example, retrospective reviews.

Easy client look-up lets you match your RolloverAnalyzer records against new accounts opened to ensure advisors are following policies and procedures.

SEC and DOL: Rollover Requirements

Carol McClarnon and Issa Hanna from Eversheds Sutherland discuss the DOL and the SEC’s expectations.

Virtual Roundtable: Preparing for PTE 2020-02

Compliance leaders discuss challenges and strategies for meeting the PTE 2020-02 requirements.

PTE 2020-02: The Case for Deploying Compliance Technology

Taking a manual approach to meeting compliance for PTE 2020-02 is labor-intensive and fraught with risk.