Point of Sale (POS) disclosure for mutual funds requires the delivery of a Fund Fact document at or prior to the sale of an investment product. The POS regulation (NI 81-101) is a continuation of the shared vision of securities and insurance regulators to provide investors with more meaningful prospectus disclosure of mutual funds and segregated funds.

Key components of POS compliance

Client Engagement

Fund Fact Disclosure

Reporting & Recordkeeping

Use InvestorCOM to meet your POS requirements

Search for and deliver Fund Facts to investors

Dealers use the InvestorPOS add-on to ComplianceExpress to deliver Fund Facts to investors prior to the sale.

Advisors search the InvestorPOS document repository of all industry mutual fund facts and ETF facts, select their recommended documents and deliver them electronically, in-person, or via print/mail to their investors in a simple, secure and compliant manner.

ComplianceExpress also supports the electronic delivery of compliance documentation including investment recommendations, RDI, and more to your clients at scale.

Track when documentation was sent, received and opened.

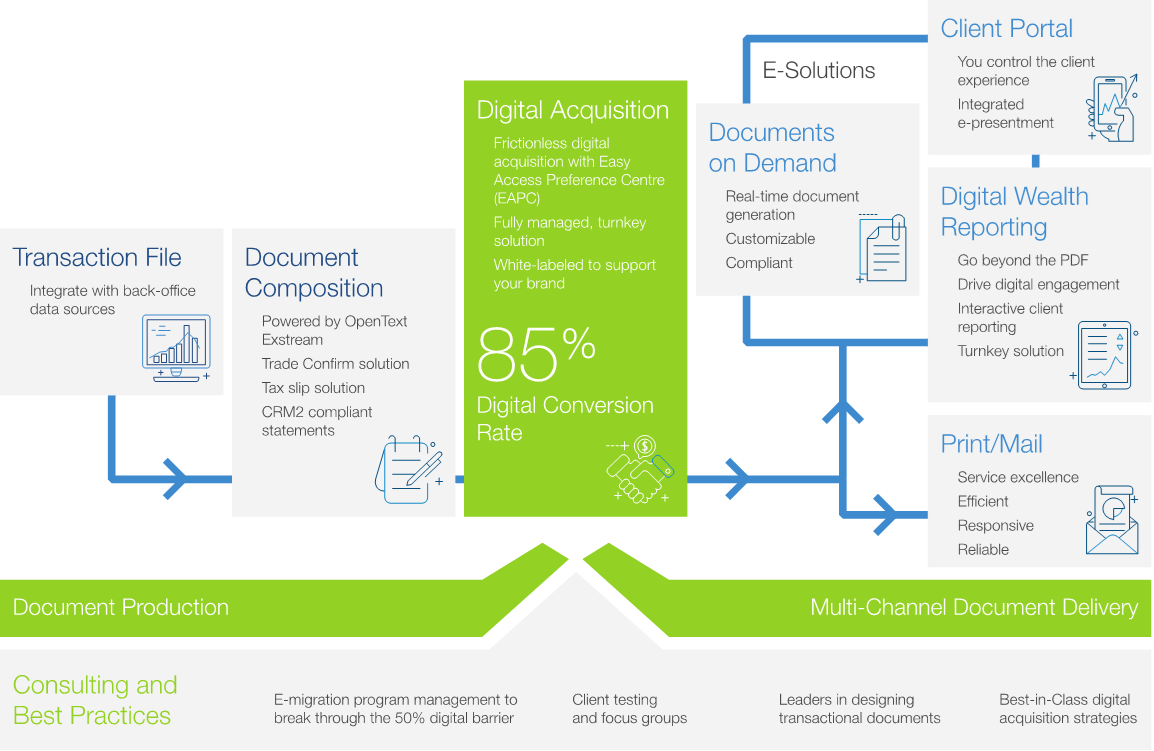

Seamlessly integrates with your back-office processes

InvestorPOS seamlessly integrates with existing dealer systems and processes to deliver a combined trade confirmation and Fund Facts package.

The two solutions can be implemented together or on a standalone basis, depending on a dealer’s strategy.

- Nightly reconciliation between POS disclosures and trade files.

- Exception reporting.

- Automated remediation.

- Traditional print/mail or e-delivery options.

- Cost-effective, multi-channel capability.

- Fully compliant, audit trail reporting of delivery activity.