Reg BI’s Care Obligation and Reasonable Alternatives

With Reg BI now in effect, broker-dealers and their representatives will need to illustrate how they are complying with the SEC’s Regulation Best Interest (Reg BI). One of the requirements dealers should pay close attention to is the Care Obligation and the consideration of Reasonably Available Alternatives (or RAA) when making a recommendation.

What’s Changed?

Prior to the Reg BI rules, brokers analyzed whether a recommended investment was “suitable” for their investor. At its core, the Care Obligation increases the standard of conduct for broker-dealers. Brokers must now analyze whether the security is in the best interest of the investor. The Care Obligation now requires brokers to “exercise reasonable diligence, care, and skill when making a recommendation to a retail customer.” In practice, this brings representatives at broker-dealers closer to the fiduciary obligations held by Investment Advisors.

To exercise reasonable diligence, care, and skill, a broker should:

- Understand the potential risks, rewards, and costs associated with the recommendation

- Have a reasonable basis to believe the investment is in the best interest of an investor based on their investment profile and the potential risks and rewards associated with the investment

- Evaluate the recommendation against Reasonably Available Alternatives

Best Interest Analysis

With the release of Reg BI, the SEC detailed the type of diligence they are expecting. Reasonable basis suitability requires a broker to develop a sufficient understanding of any security they may recommend by examining factors such as the objectives of the recommended investment, and the characteristics of the investment, including liquidity and volatility. To this the SEC adds as an explicit requirement that a broker consider the cost of the security to the customer, which is not a required consideration under the current suitability rules. The SEC does, however, make it clear that high cost is not disqualifying. A broker-dealer could recommend a more expensive security, or investment strategy, if other factors about the security lead the broker to believe that the recommendation of that security is in the best interest of the customer. All of these factors are important to evaluate for any security, but especially important to review for complex or risky products, including different alternative securities.

After evaluating the security itself, a broker then needs to determine whether a recommendation of the security (or investment strategy) is in the best interest of the particular customer. To do this, a broker needs to understand the customer’s investment objectives, financial situation, and needs. In addition, brokers must evaluate Reasonably Available Alternatives. This refers to other similar investments to the investment being recommended. For example, before recommending a mutual fund, a broker will need to consider the merits (cost, risk and return) of the recommended product against other available mutual funds made available to her.

To be clear, the SEC has indicated that this requirement does not mandate firms to recommend the cheapest alternative or evaluate every possible alternative to the security being recommended, as broker-dealers often have limited menus of products available to them. In this light, firms should consider implementing a consistent process for their representatives to evaluate not only costs, but reasonable alternatives when making investment recommendations.

As broker-dealers look to illustrate their adherence with Reg BI, and consideration of reasonable alternatives requirement, perhaps it is also an opportunity to review their ability to (electronically) deliver and archive recommendations made to clients for regulatory purposes. It is important to remember that the SEC amended Exchange Act Rules 17a-3 and 17a-4 requiring firms to create and preserve records for obligations imposed by Regulation BI.

Notwithstanding the above backdrop, the representative will also need to have confidence that her recommendation is not putting her interests, such as higher compensation or other fees, ahead of the interest of the customer.

Can Technology Help?

Exercising reasonable diligence, care, and skill in making a product recommendation is the core of this Reg BI requirement. Having a clear understanding of the potential risks, rewards and costs, and ensuring that Reasonably Available Alternatives have been considered is required to meet the Care Obligation. Unlike the Compliance and Conflict of Interest obligations, this element of Reg BI cannot be successfully met without the aid of technology.

In our June 23 webinar “Reg BI and the Future of Compliant Investment Recommendations” co-hosted by Morningstar and RumbergerKirk, we considered a “typical day in the Reg BI-life” of a broker-dealer. As the data indicates, it is virtually impossible for a firm and their representative to manually analyze 100-million data points to evaluate Reasonably Available Alternatives and meet the Care Obligation.

During the webinar, Matt Radgowski, Head of Advisor Solutions – Morningstar, highlighted that Reg BI will inevitably foster changes in the firm and representative practices. This includes firms migrating away from voluntary processes, where financial representatives rely on a self-defined process to make investment recommendations, to introducing compulsory practices that are consistent across the firm. What’s key is ensuring a consistent and disciplined process in the investment recommendation process, all while maintaining flexibility for the financial representative’s practice.

To Document or Not to Document?

Under the current regulatory environment, firms will also need to decide on how much they document. As Pete Tepley, Partner at RumbergerKirk emphasized, this adage remains true: ‘If it’s not documented, it didn’t happen.”

While the extent of documentation is a risk-based decision for each wealth management firm, we have observed a range of practices across our clients. Some firms are more prudent and choose to document every recommendation, and then there are firms who make a risk-based decision for each type of recommendation.

Regardless of the risk management philosophy, having a consistent practice around documentation is likely best practice. The three steps of documenting reasonably available alternatives, communicating and tracking these recommendations are central to safeguarding a firm’s reputation. In this light, technology is an absolute requirement to ensure that recommendations have considered alternatives and communicated to clients in a consistent manner.

This message was further supported during the June 23 webinar where speakers highlighted several core areas where the documentation and automation workflows will go hand in hand with ensuring Reg BI compliance:

- Investment Product – Strategy Recommendation

Financial advisor recommends an investment product or strategy in the best interest of a client or prospect by considering reasonably available alternatives, across product categories, within the broker dealers’ product shelf. - Roll-Over – Annuity Recommendations

Financial advisor recommends a rollover from a 401(k) to an IRA with the potential use of an annuity in a client’s best interest across a broker-dealer’s product shelf, home office models or outsourced models. - E-Delivery and Record-Keeping

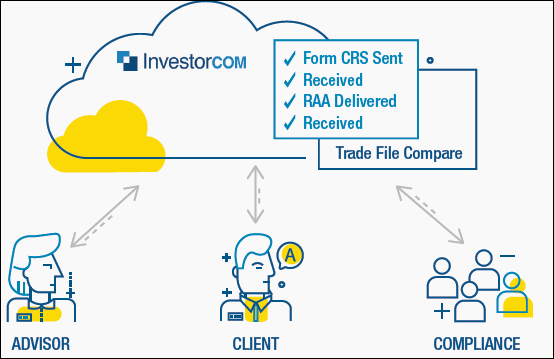

Under the current Reg BI framework, considering investment recommendation alternatives may not be enough to keep the risk of regulatory investigation away. Firms and their representatives should also ensure that they can electronically disclose their investment recommendation, and Form CRS, to clients, all while creating an audit trail of the entire process.

Authored by Parham Nasseri, VP, Regulatory Strategy at InvestorCOM Inc.

Contributions by Matt Radgowski, Head of Advisor Solutions – Morningstar

Learn More

InvestorCOM’s Peer Compare empowers financial professionals to extend their RAA determination and recommendation workflow to include record-keeping, disclosure and reporting.

Watch the InvestorCOM video to learn more.

Morningstar’s RAA workflow can be surfaced through Morningstar Advisor Workstation or Morningstar Enterprise Components to empower financial professionals to select investments and determine reasonably available alternatives with data on performance, risk attributes, fees, and proprietary ratings.

Watch video to learn more.

Sign up to watch a replay of the Webinar co-hosted by Morningstar and RumbergerKirk: Reg BI and the Future of Compliant Investment Recommendations.

Watch now.

Tags: broker-dealer, care obligation, morningstar, RAA, reasonably available alternatives, Reg BI