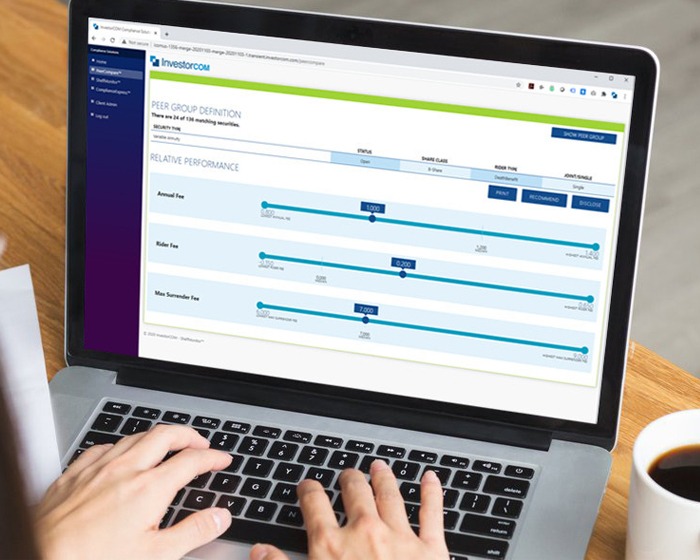

Demonstrate that you are acting in the best interest of retail clients. PeerCompare generates a product peer group of reasonably available alternatives comparing cost, risk and return. Deliver compliant investment recommendations to investors, while tracking all activity and relevant notes.

Why Financial Professionals Prefer PeerCompare

Survey results from a major broker-dealer.

Make ``Better`` Investment Recommendations

Digital Records are Easily Accessible

Intuitive to Use

Digital Documentation Process is Valuable

Be confident that investment recommendations are truly in the client's best interest.

An intuitive app that fits into the financial professional's existing workflow.

Compare and recommend investments with ease

Find out if your investment recommendations are truly in the client’s best interest.

PeerCompare generates a product peer group based on similar products on your shelf – including Mutual Funds, Segregated Funds, ETFs, North American Equities, Fixed Income, Liquid Alternatives and Variable Annuities.

Get an accurate picture of how your recommendation stacks up against its peers.

Compare a specific fund to other funds in the peer group, based on configurable criteria that includes Category, Risk and Time Horizon.

Our proprietary peer ratings capability identifies peer groups for all security types and assigns a rating for each security relative to its peers based on cost, risk and return characteristics.

Flexible application for multiple stakeholders and regulatory requirements

PeerCompare helps firms and financial professionals make best interest investment recommendations to retail investors.

- Investment advisors and broker-dealers are required to compare costs and reasonably available alternatives (Reg BI; SEC Staff Bulletin 4/23)

- Investment advisors must recommend the least expensive mutual fund share class available. (SEC Announcement 5/18)

- KYP and reasonable range of alternatives (Client Focused Reforms)

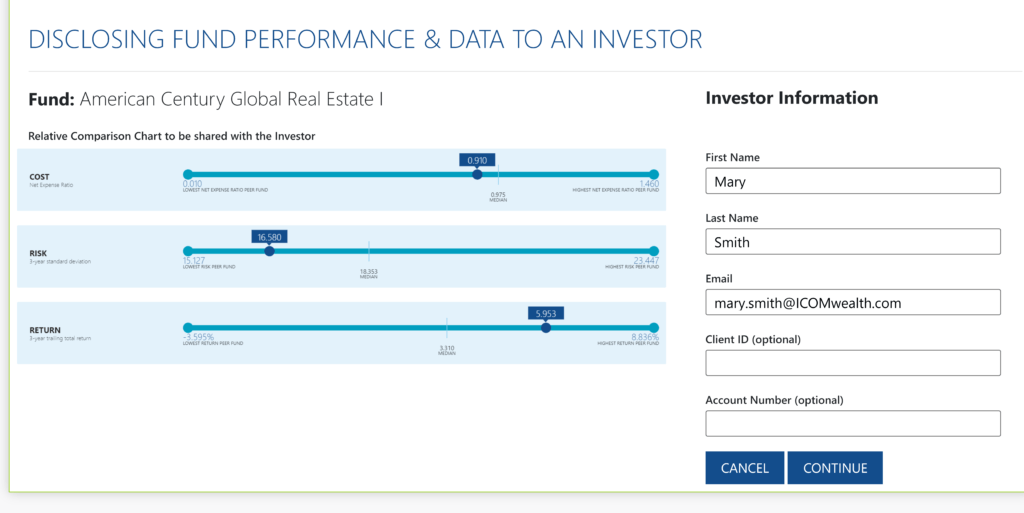

Track disclosure and facilitate supervision

When making an investment recommendation, use PeerCompare to perform a best interest analysis and to disclose and/or record the transaction for supervision and audit functions.

Use PeerCompare with ComplianceExpress to digitally share investment recommendations with your clients and record all activity – including when the disclosure was sent, received, and viewed.

Why technology is needed to make compliant recommendations

It is virtually impossible to meet the new best interest requirements without technology. Let’s look at a simple example:

In a typical day, a financial professional evaluates or makes five investment recommendations.

Her broker-dealer has an open product shelf of approximately 35,000 investment fund products. To meet Reg BI requirements, the advisor must consider a minimum of six data or suitability fields when considering reasonably available alternatives (RAA) including fees, risk, performance, time horizon, share class and fund series.

This will require processing over 1,000,000 data points – per day!

Top Data Challenge Facing Advisors

Meeting the Care Obligation may require advisors to consider one million data points per day.

The Future of Compliant Investment Recommendations

How can BDs demonstrate they are acting in the best interest of retail clients when making investment recommendations?

Reg BI’s Care Obligation and Reasonable Alternatives

Dealers should pay attention to consideration of Reasonably Available Alternatives when making a recommendation.