The SEC’s Regulation Best Interest (Reg BI) rule imposes a materially heightened standard of conduct for broker-dealers when serving retail clients. While principles-based in nature, the rule is specific with respect to the duty and obligations that brokers and their representatives must meet when dealing with retail clients.

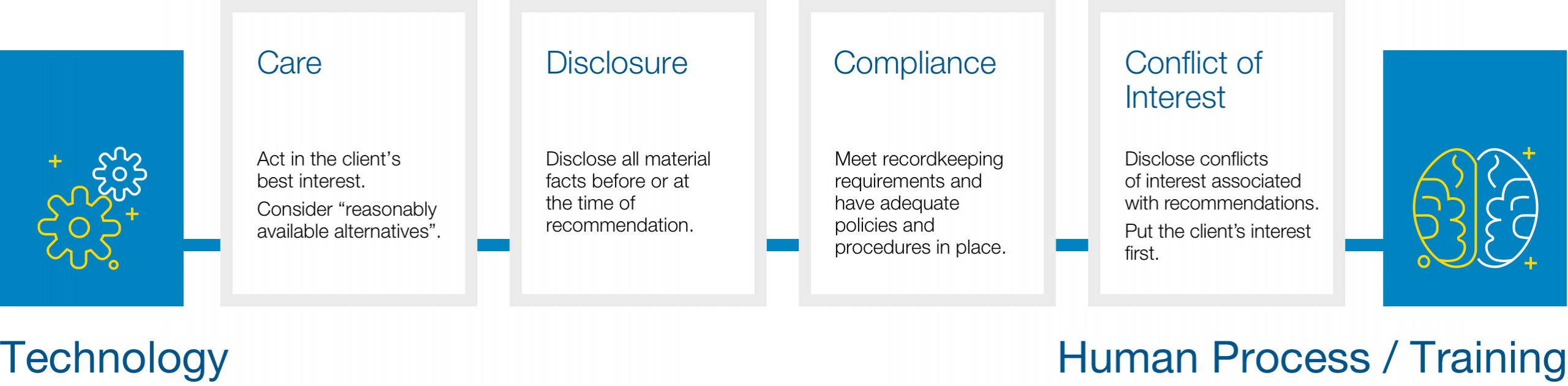

Four pillars of Regulation Best Interest

Compliance Requires a Mix of Technology and Process

Use InvestorCOM to meet your Reg BI obligations with confidence.

Best Interest Recommendations | Relationship Summary Disclosure & Recordkeeping | Best Interest Shelf Management & Monitoring

Make investment recommendations that are in the client's best interest

Broker-dealers and RIAs must have a clear understanding of the potential risks, rewards and costs of investment recommendations and show that “Reasonably Available Alternatives” have been considered.

PeerCompare helps financial professionals intuitively assess and document best interest recommendations.

- Evaluate reasonably available alternatives based on configurable peer groups.

- Compare best interest recommendations based on cost, risk and return metrics.

- Document best interest recommendations by generating recordkeeping transactions in a 17a-4 compliant manner.

Make advisory and brokerage account type recommendations

Regulation Best Interest requires that dually registered individuals consider different types of accounts and different types of account features, products and services when making account recommendations.

AccountCompare provides a step-by-step process that eliminates the complexities around making best interest recommendations.

- Capture the rationale for account recommendations – client profile, suitability, assets, client needs and more

- Our proprietary scoring methodology takes the guesswork out of determining best interest

- Plain language summary of the recommendation and risk summary facilitates understanding

Compliantly manage electronic disclosure and Form CRS obligations

Brokers need to provide “full and fair disclosure” of all material facts associated with their client relationship.

Use ComplianceExpress to meet your recordkeeping and disclosure requirements with ease.

- Manage and e-deliver all compliance documents, including Form CRS at scale.

- In-person document delivery feature generates disclosure record.

- Meet the SEC’s framework for using e-delivery as a substitute for paper delivery.

Monitor and manage

your product shelf

Best interest starts with your product shelf. InvestorCOM monitors industry data highlighting material changes on your product shelf enabling you to meet your care obligation.

- Track shelf updates for material changes.

- Monitor suitability to ensure investor portfolios remain compliant.

- Ensure products meet internal product guidelines for conflict of interest, policies and procedures.

- Assess the competitiveness of the products on your shelf.

Effortlessly document and disclose rollover recommendations

Use InvestorCOM to compare, document and disclose rollovers as part of your PTE 2020-02 obligations.

RolloverAnalyzer empowers financial professionals to intuitively

- Assess how current services, costs, and client fit compare against the rollover recommendation.

- Explain how the client’s unique situation and preferences will impact the results of the best interest analysis.

- Document the rollover analysis via an intuitive, advisor-friendly workflow.

- Meet client disclosure obligation for PTE 2020-02.

Fully compliant with the DOL’s PTE 2020-2 rule and FINRA Regulatory Notice 13-45.

Partnerships with industry leaders

Reg BI Day 2 Implementation Considerations

The Reg BI deadline is now behind us. What you do next depends on your firm’s state of readiness.

The ROI of Compliance Technology

Broker-dealers need to think strategically about how and where to make investments in compliance.

Electronic Disclosure & SEC Requirements

Before going digital it's important to understand the SECs guidance on the use of electronic media.