Navigating Reg BI: The Top 3 Insights from SIFMA C&L Annual Seminar

As conference season kicks off, the InvestorCOM team recently had the opportunity to participate in the SIFMA C&L Conference, a pivotal event in the financial industry. Amidst discussions on the evolving landscape of regulatory compliance, particularly in the wake of Regulation Best Interest (Reg BI), there were remarkable insights and new concepts unveiled that are reshaping the way firms approach compliance.

The Top 3 Key Highlights from SIFMA C&L Annual Seminar:

- Documentation is Essential: SEC panelists confirmed that achieving Reg BI compliance is impossible without thorough documentation. Our automated solutions directly address this necessity, simplifying compliance.

- Technology’s Growing Role: With Care Obligation standards in focus, leveraging technology is a best practice for compliance, as per NASAA and SEC. Yet, the industry’s adoption rate is lagging, underscoring a pressing need for firms to integrate tech solutions.

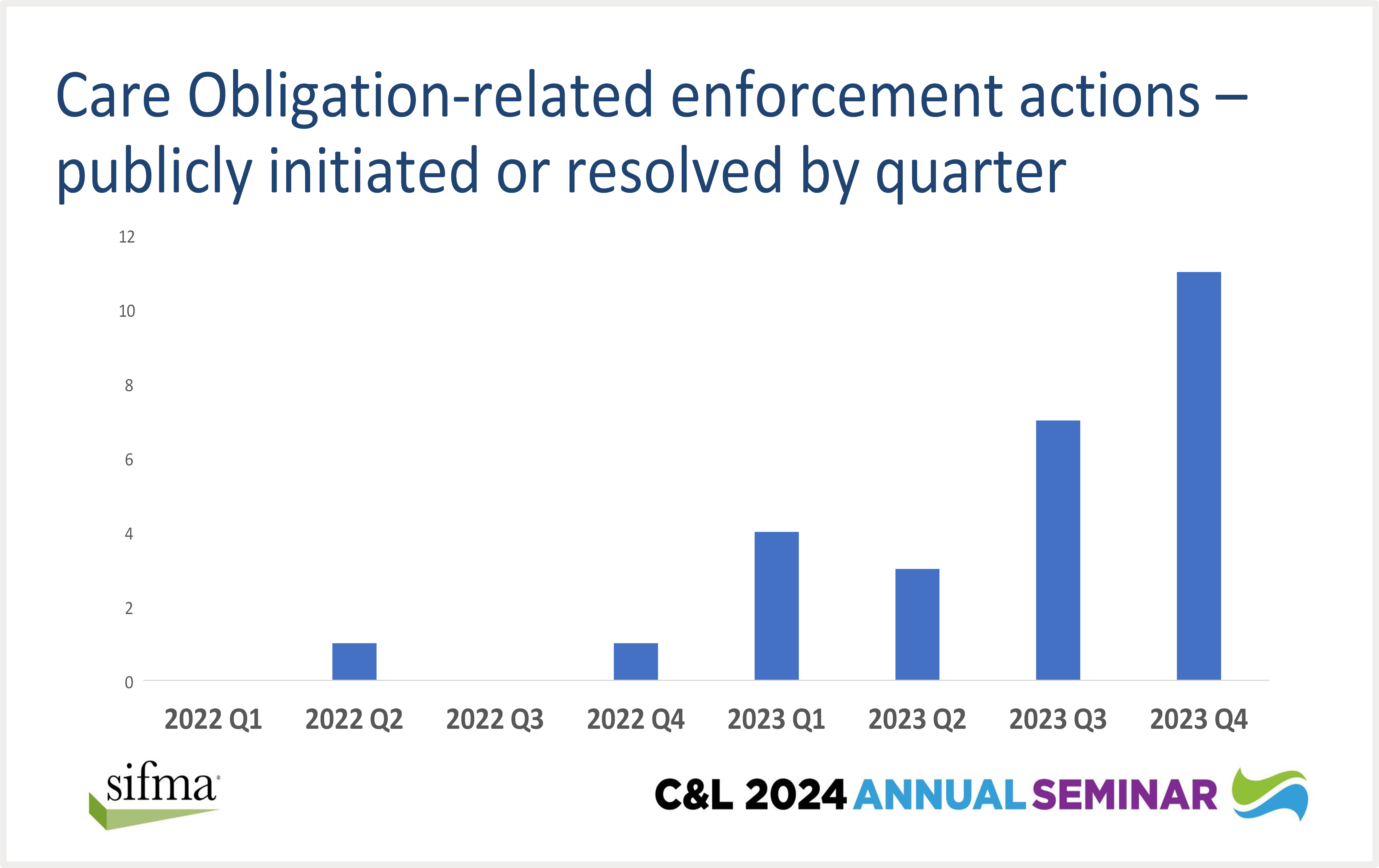

- Rising Enforcement Actions: A notable uptick in enforcement actions related to Care Obligations has been observed, quadrupling over the past six months. This trend signals increasing regulatory scrutiny, making compliance measures more critical than ever.

Read on to dive into each of these key takeaways.

1. Documentation is Essential

Now in its fourth year since implementation, Reg BI continues to be a focal point of discussion. One of the standout themes was the critical role of documentation in achieving compliance. Panelists, including representatives from the Securities and Exchange Commission (SEC), emphasized that compliance is simply not achievable without robust documentation. This underscores the importance of contemporaneous and automated documentation, which aligns closely with InvestorCOM’s value proposition. By offering solutions for automated documentation, we streamline this essential function, making compliance a no-brainer for firms.

2. Technology’s Growing Role

The conference also shed light on the increasing importance of technology in meeting Care Obligation compliance standards. According to the North American Securities Administrators Association (NASAA), leveraging technology is considered a best practice for fulfilling Care Obligations. Furthermore, the SEC highlighted that for firms equipped with technology, its use should be mandated. This emphasizes the regulatory push towards tech-enabled solutions for compliance, signaling a shift towards more efficient and effective practices.

One concerning trend discussed at the conference was the low levels of technology adoption within the industry. Despite the regulatory emphasis on technological solutions, panelists and surveys revealed that many firms still rely on manual or templated approaches to compliance. This approach may offer short-term solutions but falls short in the face of increasing regulatory scrutiny and complexity. Firms must recognize the importance of embracing technology to future-proof their compliance efforts.

3. Rising Enforcement Actions

A significant highlight of the conference was the discussion surrounding enforcement actions related to Care Obligations. Over the past six months, enforcement actions in this area have quadrupled, indicating heightened regulatory focus. Looking ahead, SEC priorities for 2024/2025 suggest that these enforcement actions will only continue to increase. Firms cannot afford to overlook the importance of robust compliance measures, particularly in light of escalating enforcement activities.

In response to these evolving regulatory dynamics, firms must proactively adapt their compliance strategies. Embracing technology-driven solutions is no longer a choice but a necessity. By leveraging automated documentation tools, firms can ensure compliance with Reg BI and other regulatory requirements while streamlining operational processes. This not only mitigates compliance risk but also enhances overall efficiency and transparency.

Moreover, firms must move beyond reactive compliance measures and adopt a proactive approach to risk management. This includes staying abreast of regulatory updates, conducting regular assessments of compliance procedures, and investing in ongoing staff training. By fostering a culture of compliance within the organization, firms can better navigate the evolving regulatory landscape and mitigate potential risks.

Collaboration and knowledge sharing are also essential in driving industry-wide compliance standards. Events like the SIFMA C&L Conference provide invaluable opportunities for professionals to exchange insights. The SIFMA C&L Conference offered a comprehensive overview of the regulatory challenges and opportunities facing the financial industry. As firms grapple with the complexities of Reg BI and Care Obligation compliance, the imperative for technology-driven solutions has never been clearer. By embracing automation, fostering a culture of compliance, and staying informed, firms can navigate the regulatory landscape with confidence and resilience.

If you are ready to embrace technology to scale your compliance efforts, we’d love to talk with you. See our solutions in action when you book a demo at www.investorcom.com/demo.