The Hold Up on Hold Recommendations

For many wealth management firms, the last few months have gone by in a flash. The combined pressures of working remotely, executing business continuity practices and meeting the Reg BI implementation deadline have kept most teams burning the midnight oil. With the Reg BI implementation deadline now behind us, some may be hesitantly looking back to check if anything was missed. This exercise will be a particularly prudent, especially when considering that the Reg BI regulatory examinations will begin shortly.

Queue the ‘Hold Recommendation’

It isn’t much of a surprise that most people don’t pay much attention to their regulatory obligations when making a recommendation to hold (not buy or sell) a security. Under Reg BI, this will need to change. The Care Obligation states that all recommendation types must be in the client’s best interest, even when a recommendation is to hold a security. For many wealth management firms, this opens the door to increased regulatory scrutiny and customer complaints.

According to the SEC, securities transaction or investment strategy recommendations also include:

- explicit hold recommendations; and

- implicit hold recommendations that are the result of agreed-upon account monitoring between the broker-dealer and retail customer. Special considerations for providing agreed-upon account monitoring are discussed more below.

How then, can a wealth management firm and their representative consistently meet their best interest obligation, even when making an explicit or implicit recommendation to hold a certain security or investment strategy?

Hold Recommendations and the Best Interest Obligation

Our recent blog post “Reg BI’s Care Obligation and Reasonable Alternatives”, covered the required steps in determining if a recommendation is in the best interest of a client. In short, representatives need to understand the customer’s investment objectives, financial situation and needs. She must also evaluate Reasonably Available Alternatives, which are similar options to the investment being recommended. In this blog, we are bringing to light the fact that the same principles apply to recommendations to hold a security or strategy. Specifically, before making a recommendation to buy, hold or sell a mutual fund, a broker will need to consider the merits (cost, risk and return) of the recommended product against other available mutual funds available on her shelf.

As the regulatory examinations ramp up over the next few months, wealth managers should remember that that the scope of their Care Obligation is not limited to only buy and sell recommendations. Examiners will look to see if the wealth manager’s representative had a clear understanding of the potential risks, rewards and costs, and determined Reasonably Available Alternatives when making a recommendation. Even if the recommendation explicitly or implicitly entails holding a security or strategy.

In this post Reg BI or Day 2 chapter, some wealth management firms may face two specific challenges. First, how do they demonstrate that they have met their Care Obligation across their firm and second, how will they keep an audit trail of their due diligence and recommendations across their workforce.

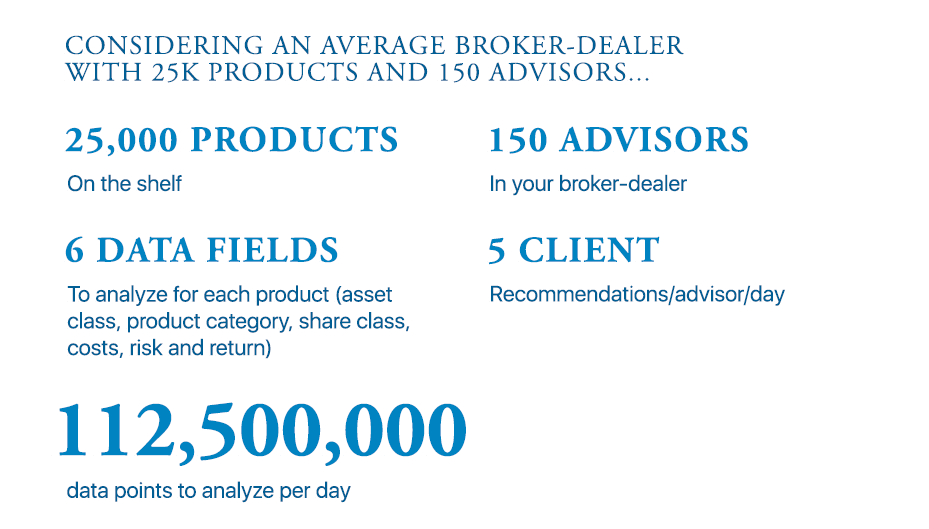

In our view, these are the areas where technology can lend a helping hand. For example, determining Reasonably Available Alternatives can only be met with the aid of technology. As the graphic below indicates, it is virtually impossible for a wealth management firm and their representative to analyze over a 100-million data points.

Meet the Care Obligation with Confidence

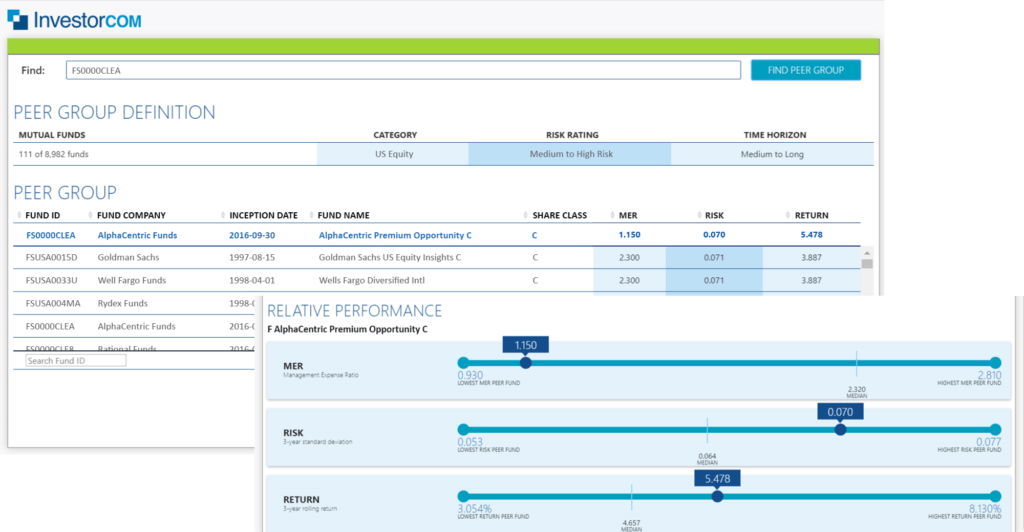

InvestorCOM PeerCompare makes it easy for your advisors to identify and disclose product peers or Reasonably Available Alternatives on your product shelf. The solution seamlessly fits into the advisors existing workflow, allowing them to compare a specific fund to its Peer Group, based on configurable criteria that includes Asset Class, Product Category and Share Class. Advisors can analyze their product recommendation against its peers based on Cost, Risk and Return characteristics. Each recommendation generates a recordkeeping transaction as well as a PDF record that can be electronically delivered with the client.

https://www.linkedin.com/in/parhamnasseri

Author: Parham Nasseri, VP, Regulatory Strategy at InvestorCOM Inc.

Tags: Best Interest Obligation, care obligation, Hold recommendations, reasonably available alternatives