How to Recommend Variable Annuities with Confidence

Reg BI’s Care Obligation requires a financial professional to consider reasonably available investment alternatives (RAA) offered by the broker-dealer (refer to “Reg BI’s Care Obligation and Reasonable Alternatives” for more information on this topic). While some may have implemented an RAA process for assessing mutual fund and ETF recommendations, Variable Annuities (VAs) may present yet another hurdle to overcome.

FINRA describes VAs as highly complex financial products with multiple insurance features that might be appealing to some. It is important to understand, however, that those features come with a myriad of fees and charges.

In this light, manually comparing alternative VAs and their various characteristics can be challenging for both financial professionals and compliance teams. At first glance, assessing available alternatives for a VA recommendation may mean looking for the lowest cost solution. However, a higher cost annuity may present superior contract (or rider) features relative to the needs of the investor. This is why it is important to leverage a consistent and automated comparison framework to readily assess various characteristics of a VA recommendation. For example, at the time of the recommendation, how does one VA with similar benefits (or riders) and share class compare against similar alternatives?

InvestorCOM’s PeerCompare fills this critical analytical and compliance gap by providing broker-dealers and financial professionals the information required to assess RAA for not just mutual funds and ETFs but also Variable Annuities. It then completes the workflow by allowing the user to document or digitally deliver the relative comparison assessment.

How Does PeerCompare Apply to Variable Annuities?

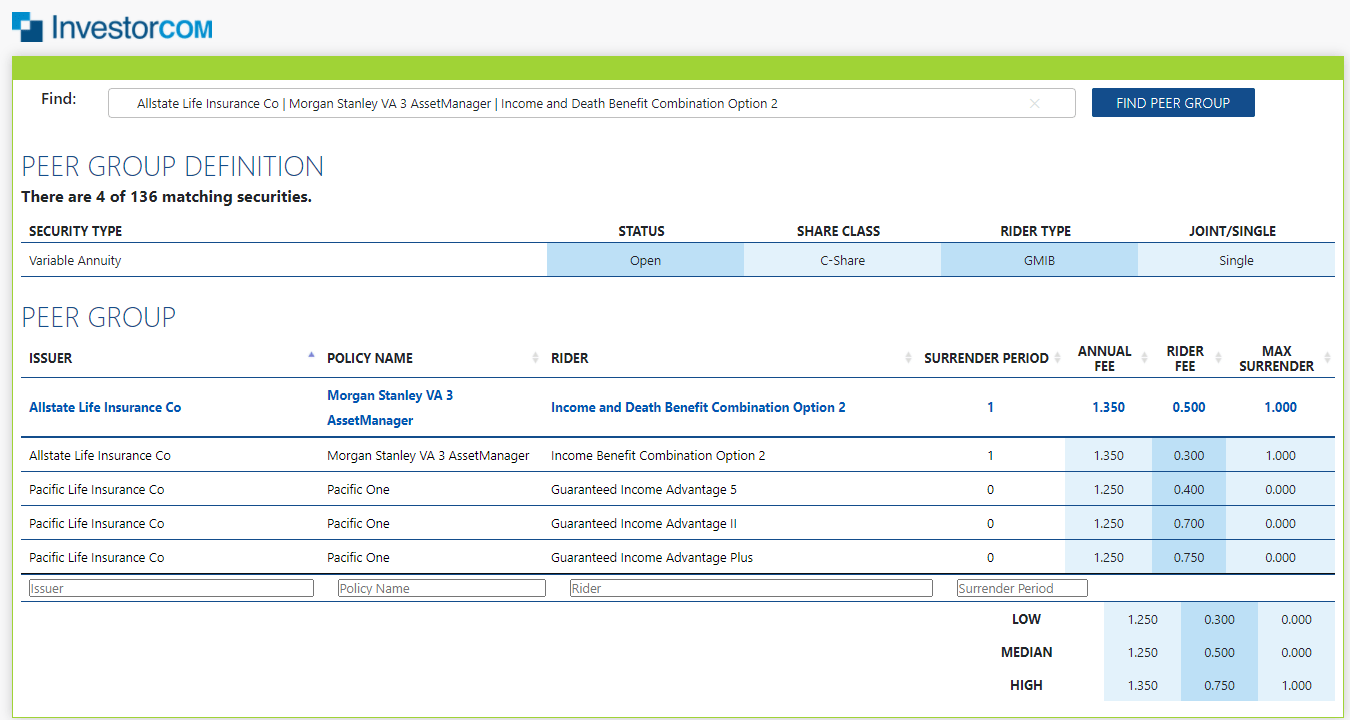

When PeerCompare is applied to Variable Annuities, it examines and deals with different data. Initially, the combination of issuer, policy name and rider are chosen and used to select a policy/rider combination. Other policy/rider combinations in the Peer Group are matched based on the following variables:

- Security Type – Variable Annuity

- Status – Active or Closed

- Share Class

- Rider Type – Living or Death Benefit

- Joint or Single Designation.

Once the peer group is chosen, like PeerCompare for mutual funds, the peer group is displayed.

PeerCompare allows the advisor to filter based on Issuer, Policy Name, Rider Name and Surrender Period. Key measurement data about the policy/rider combination are also displayed, including:

- Annual Fee

- Rider Fee

- Maximum Surrender Fee

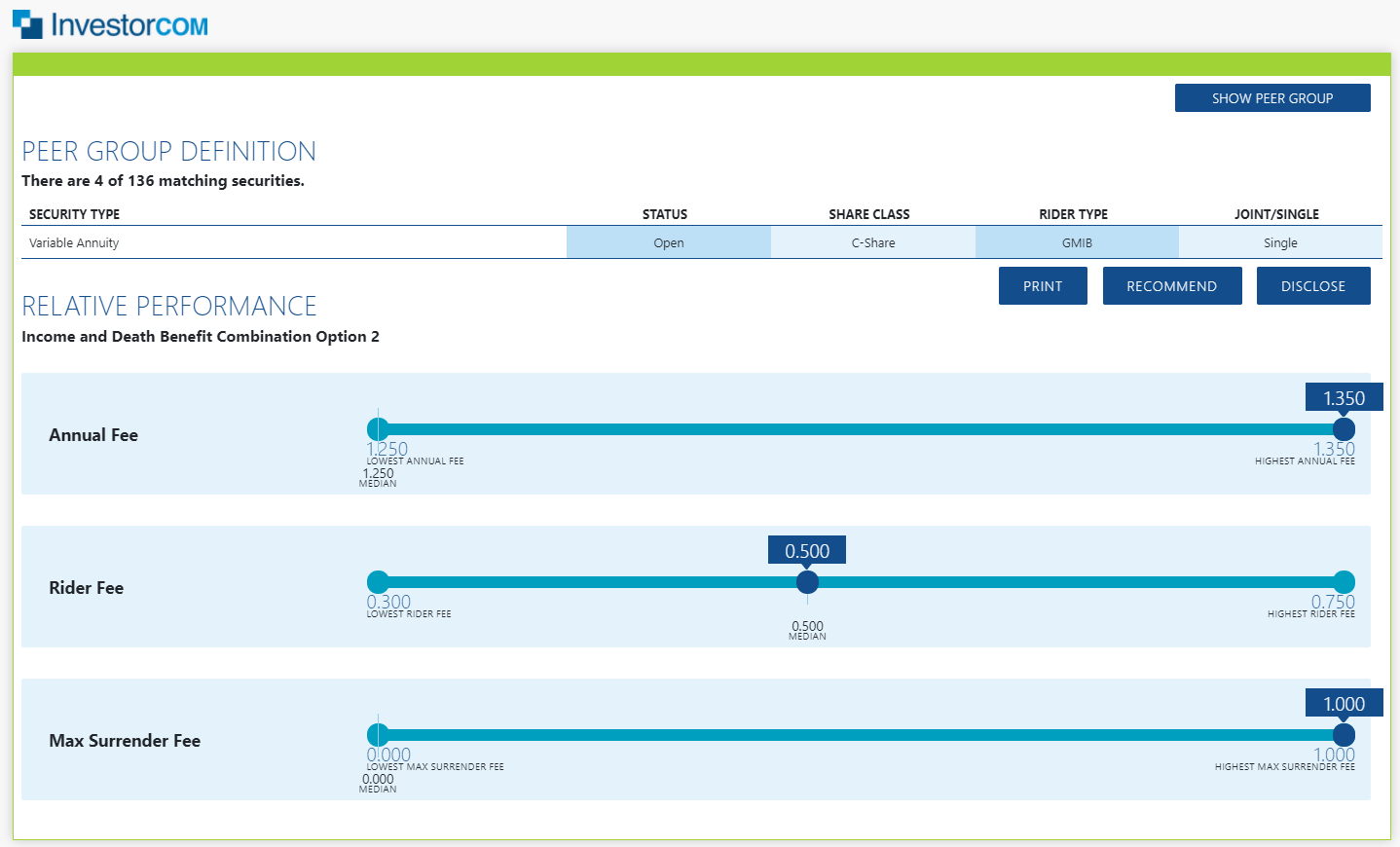

PeerCompare generates and displays a relative performance graph that shows where the chosen policy/rider combination fits on the sliding scale between highest and lowest measurement values in the peer group.

The variable annuity examined can be stored in a record-keeping repository or disclosed to a customer.

Using the basic Peer Group methodology within PeerCompare, we can extend the power of examining reasonably available alternatives and storing the recommendation in a compliance repository to other security types, like Variable Annuities.

If you would like to see a demo of how PeerCompare for Variable Annuities works, sign up here – https://info.investorcom.com/variable-annuities

On-demand Webinar: Reg BI Exams & Variable Annuities

Hear industry leaders from Morningstar and Eversheds Sutherland provide an insightful dialogue on:

- What Broker-Dealers and their compliance teams should expect from the expanded scope of the Reg BI examinations.

- Why regulators are keen to see Broker-Dealers assess investment costs and reasonably available alternatives.

- Best practices for meeting the Care Obligation when recommending complex investment products such as Variable Annuities.

Tags: care obligation, RAA, reasonably available alternatives, Variable Annuities