Fund Fees are Decreasing – How are You Keeping Track?

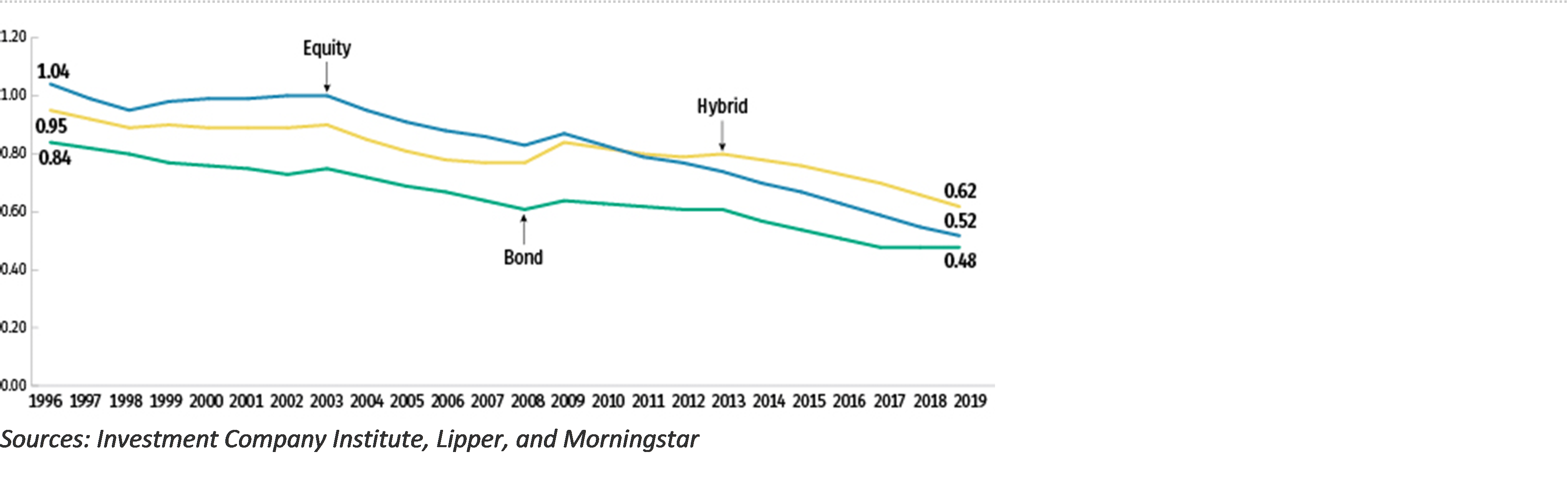

On March 26, 2020, the Investment Company Institute (ICI) announced that the average expense ratios of US domiciled equity, hybrid, and bond mutual funds—including both actively managed and index equity and bond mutual funds have declined substantially over a period of more than 20 years. The report titled, “Trends in the Expenses and Fees of Funds, 2019,” found that since 1996, the asset weighted average equity mutual fund expense ratios had decreased by approximately 50%, while bond mutual fund expense ratios decreased by 43%.

Figure 1: Average Expense Ratios for Mutual Funds

Figure 1: Average Expense Ratios for Mutual Funds

This trend was also evident in the ETF space. With the asset-weighted average expense ratio of index equity and bond ETFs falling by 1 basis point between 2018 and 2019. It should be noted that ETFs generally do not bundle account servicing or maintenance fees in their expense ratios.

While the declining trend in fund fees and the investors’ increasing use of lower-cost funds is not a major surprise, there may be a more compelling story to be told here. Over the years, many have published studies around the impact of fees over the long term. For example, Vanguard’s impact of cost study points to the power of compounding when it states that 2% paid annually could impact 40% of final account value. Another study from nerdwallet.com suggested that a 0.5% increase in fees could mean the difference between retiring at age 70 versus retiring at 73. So, if fees are declining, the reverse must be true and investors should be able to save more money and retire earlier. The opportunity for the wealth management industry then becomes, how are such positive changes in fees, and their corresponding impact on investment goals being communicated with clients?

At InvestorCOM, we’ve studied the characteristics of fund changes for many of our clients’ product shelves. Our observations have been interesting: there are simply too many funds and corresponding data points for an investment dealer to be able to discern what has changed and how the changes impact a client’s portfolio without the aid of technology. In one instance, we observed over 2000 data-point changes in a single week for a single Canadian dealer. Of these changes, over 60% were related to mutual fund fees.

This is where InvestorCOM’s ShelfMonitor steps into the ring to distill mountains of data and produce actionable intelligence. In short, ShelfMonitor enables investment dealers and fund manufacturers to know if features of their product offering have changed allowing the dealer or registrant to communicate these changes to clients in a timely and transparent manner. As noted above, even the slightest change in fund fees can impact a client’s ability to retire earlier. For example, if a client is holding a mutual fund and the fee decreases by even 0.5%, it could be a great opportunity to inform the client of the change and how it positively impacts their investment objectives.

For many investment dealers, the timing of this business need goes hand-in-hand with the Client Focused Reforms in Canada and the Regulation Best Interest in the US. In addition to mandating firms to act in the best interest of their clients; the new regulations require dealers to monitor and assess securities they offer on an ongoing basis. It should also be noted that keeping up with fund changes and communicating them to clients has never been more paramount, especially when considering the volatile markets, anxious investors, and regulatory requirements around disclosure.

Authored by Parham Nasseri, VP, Regulatory Strategy at InvestorCOM Inc.

About InvestorCOM Inc.

InvestorCOM is a leading provider of regulatory compliance software and communications solutions for banks, asset managers, insurance companies and investment dealers in the financial services industry. Our innovative suite of FinTech solutions were developed in response to increasing regulation and the demand for more effective communication and disclosure from the financial services industry.

We recently launched a compliance platform for Reg BI. This intuitive platform is well suited to satisfying the principles set out by US regulators and supports the key categories of disclosure and record-keeping, adviser and process oversight, and investment product selection and monitoring. To learn more, visit investorcom.com.

Tags: client focused reforms, fund changes, mutual fund, Reg BI