Are you Meeting Reg BI’s Requirements in Good Faith?

Much has changed for the wealth management industry in the last month. The COVID-19 crisis has translated into a the most unprecedented event of our lives, not to mention putting an end to one of the longest bull markets in history since World War II. If figuring out how best to wrestle the oscillating markets and attending to client concerns wasn’t enough, on April 2, the SEC’s Jay Clayton announced that in addition to putting health and safety first, “the law continues to apply” and the June 30, 2020 compliance deadline for Reg BI would not be delayed.

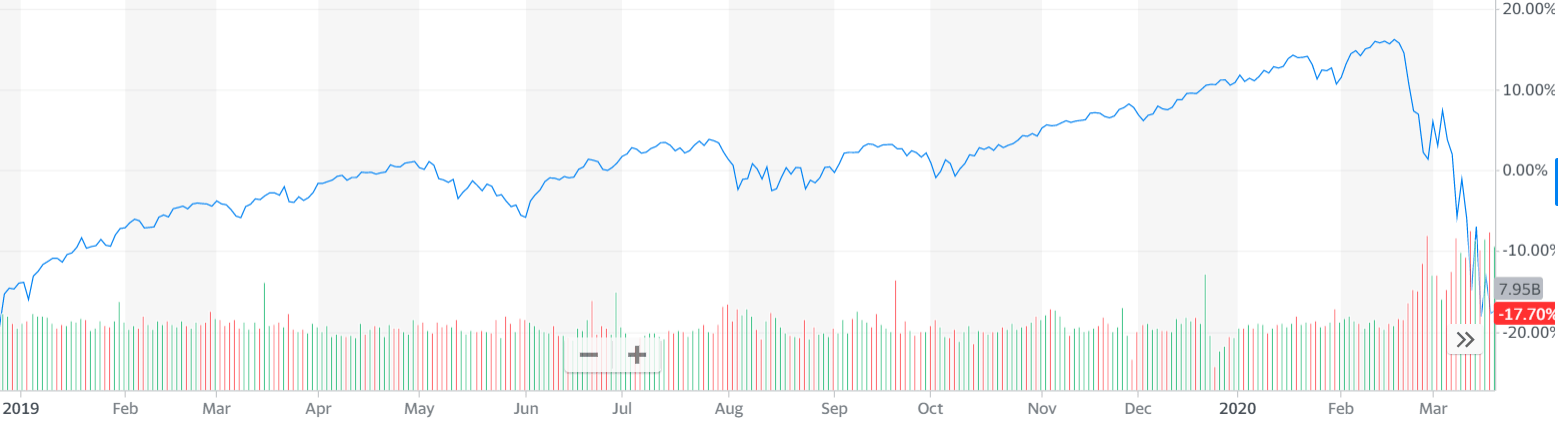

Figure 1: S&P 500 – Jan 2019 – Mar 2020, Source: Yahoo Finance

As a possible measure to alleviate tension, on April 7, the SEC Office of Compliance Inspections and Examinations (OCIE) issued two alerts to broker-dealers and investment advisers about the expected “scope and content” of its compliance examinations for Regulation Best Interest (Reg BI) and the Client Relationship Summary (CRS). By way of background, risk alerts provide broker-dealers and investment advisers information about the expected scope and content of compliance examinations. Regulation Best Interest and Form CRS are key components of a broader package of rules and interpretations, adopted on June 5, 2019 to enhance the quality and transparency of retail investors’ relationships with broker-dealers and investment advisers.

To shed light on the direction of their initial examinations and to help firms assess their preparedness, Pete Driscoll, the Director of OCIE, further stated that “Regulation Best Interest and Form CRS are critical to the protection of Main Street investors, and we feel it is important to share our plans for initial examinations to help firms assess their preparedness.” As the June 30, 2020 compliance date nears, “we understand that this implementation will be an iterative process, and our focus will be on firms continuing good faith and reasonable efforts, including taking into account firm-specific effects from disruptions caused by COVID-19.” A day after OCIE’s announcement, FINRA followed suit and announced it “will take the same approach as set forth in the SEC Risk Alerts when FINRA examines broker-dealers and their associated persons for compliance with Reg. BI and Form CRS”.

What does this really mean?

FINRA and OCIE’s recent statements serve a much-needed lifeline for the investment advisory and broker-dealer community, especially when considering the looming deadline and the current business environment. In fact, anyone who has operated in a regulatory compliance capacity and experienced the frantic sprint to meeting regulatory deadlines, would recognize the material change in the regulatory expectations. To be clear, the message has shifted from expecting a bulletproof Regulation Best Interest process by June 30, to making good faith and reasonable efforts to ensure the principles of the regulation are in place. Moreover, the OCIE acknowledged that the implementation “will be an iterative process” and the exams are in place to assess preparedness.

If you ask a lawyer, the definition of acting in good faith will mean being sincere in one’s business dealings and without a desire to defraud, deceive, or acting maliciously towards others. But how does this translate into the world of securities regulation and the pending Reg BI implementation deadline?

As the June 30 Reg BI deadline nears, it goes without saying that being in full compliance with the regulations should be the intended goal. However, as stated above, the environment has clearly changed, and regulators have signaled their awareness of the current challenges. This will mean that corresponding regulatory examinations will be less about slapping broker dealer firms on the wrist, and more focused on assessing the progress made and the plan forward.

The broker-dealer and investment advisory firms can use this opportunity to avoid the frantic final hour sprint and focus resources on illustrating their progress and plan in good faith. The following steps are an essential roadmap for those in the wealth advisory profession:

- Prepare and Plan

Although the timing of the implementation deadline is taking place during an evolving landscape, one thing is clear: getting past this hurdle can only start with thoughtful preparation. - Act Strategically

The Reg BI regulatory demands are considerable. A holistic approach that sets the path for being compliant in a timely manner, while finding opportunities for cost savings. While comprehensive compliance is the desired outcome, regulators have confirmed that they will work with you if your firm is demonstrating a plan toward achieving full compliance. - Engage a trusted partner

Finding a trusted partner with the comprehensive compliance solutions that will not only help reduce costs, but increase organizational oversight, and mitigate regulatory burdens and reputational damage.

Investing in high-impact point solutions that meet Reg BI requirements will be the direction that most firms will pursue. Making these investments while considering long-term integration requirements is highly recommended. Solutions that are cloud-based with API integration capabilities will ensure that short-term solutions will also lead to long-term success – learn more here.

InvestorCOM’s Reg BI Ready Guarantee

Recognizing that the approaching deadline, and given that compliance teams have moved to a remote work environment, InvestorCOM is extending our demo period for ShelfMonitor to equip our dealer clients with the KYP tools that will help them manage their business remotely.

Our free trial runs till June 30th. Firms that sign up will be guaranteed to :

- Be audit-ready by June 30.

- Meet compliance for the key categories of disclosure and record-keeping, adviser and process oversight, and investment product selection and monitoring.

- Have the solution up and running within 1 week.

Contact regbiready@investorcom to see a demo and to learn more.

Sign up to watch our Webinar: Reg BI – What does Good Faith Compliance Mean. Learn more.

Authored by Parham Nasseri, VP, Regulatory Strategy at InvestorCOM Inc.

About InvestorCOM Inc.

InvestorCOM is a leading provider of regulatory compliance software and communications solutions for banks, asset managers, insurance companies and investment dealers in the financial services industry. Our innovative suite of FinTech solutions were developed in response to increasing regulation and the demand for more effective communication and disclosure from the financial services industry.

We recently launched a compliance platform for Reg BI. This intuitive platform is well suited to satisfying the principles set out by US regulators and supports the key categories of disclosure and record-keeping, adviser and process oversight, and investment product selection and monitoring. To learn more, visit investorcom.com

Tags: compliance, COVID-19, Reg BI, regulatory compliance