April ’23 SEC Staff Bulletin: Key Highlights

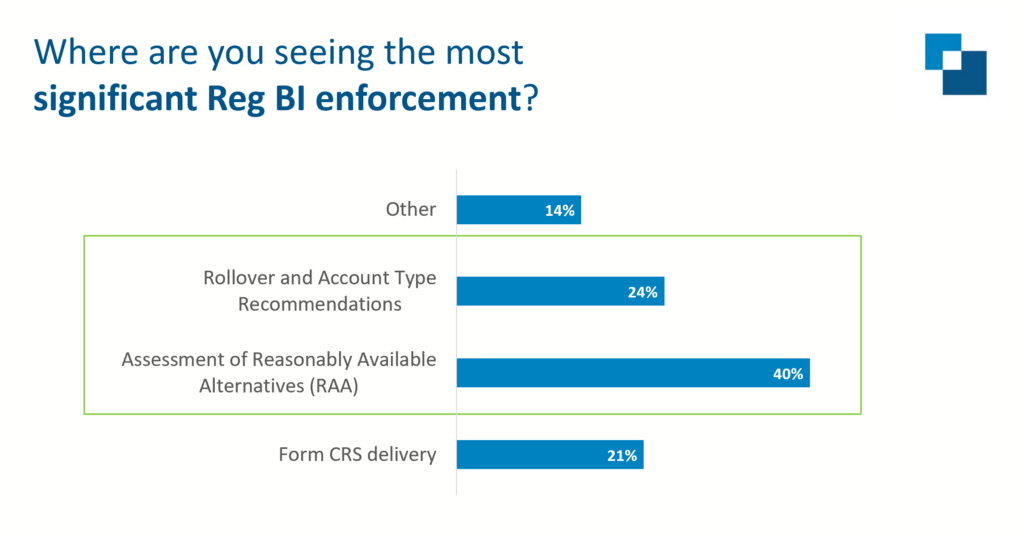

Since 2020, the wealth industry has been looking for guidance from the US Securities and Exchange Commission (SEC) on the application of Regulation Best Interest’s (Reg BI) Care Obligation and the Reasonably Available Alternatives (RAA) requirement. During this same period, many firms have found the RAA requirement to be a significant area of Reg BI enforcement.

Figure 1: InvestorCOM webinar poll results from March 9, 2023

The SEC has published three guidance notes since Reg BI came into effect – account type recommendations (March 2022), deficiencies and weaknesses observed during examinations (January 2023), and most recently, Staff Bulletin: Standards of Conduct for Broker-Dealers and Investment Advisers, in which the SEC provides much-needed guidance on how broker-dealers and investment advisers can satisfy the SEC’s requirements.

The April guidance note provides answers to twenty major questions and is designed to assist firms and their financial professionals with meeting their care obligations such that they comply with their obligations to provide advice and recommendations in the best interest of retail investors.

The answers to these questions will be welcomed by everyone in the industry, as they have been on the minds of many since the inception of Reg BI.

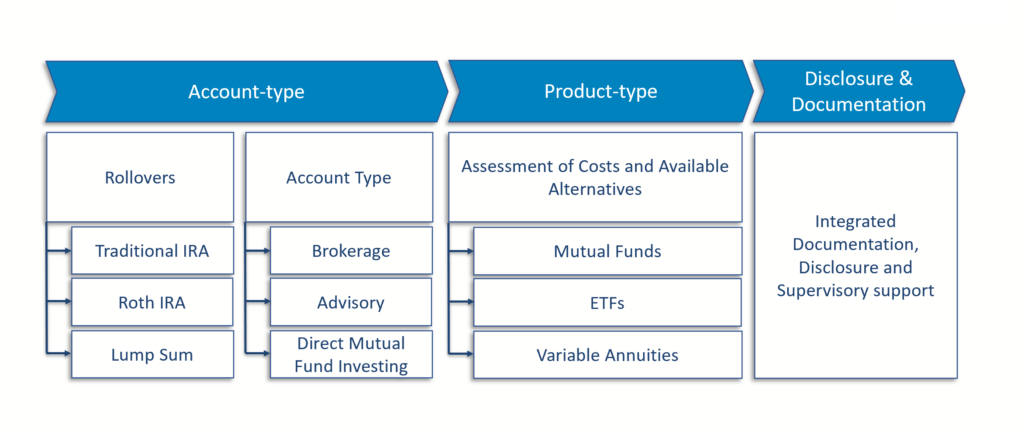

Figure 2: Overview of the industry challenges with respect to Regulation Best Interest: Account type, product and rollover recommendations and documentation and disclosure.

It is important to highlight five key areas from the SEC bulletin that we feel are most critical:

- Reg BI’s Care Obligation Expectations Apply to Broker-Dealers and Investment Advisors

We have been wrestling with this question since the inception of Reg BI and are pleased the SEC has provided guidance that the Care Obligation applies to both broker-dealer and investment advisors.

As quoted in the Staff Bulletin:

“…while what advisers should consider depends on the facts and circumstances, the staff believes that the Commission’s statements about broker-dealers with respect to consideration of reasonably available alternatives likewise may provide a useful framework for investment advisers to consider in satisfying their care obligations when providing investment advice.”1

This is important since investment advisers mostly held the opinion that considering RAA was not required. In the eyes of the SEC, this is not the case.

- Reasonably Available Assessment Comparison Needs to Go Beyond Basic Share Class Comparisons

In discussions with clients and industry participants, a common topic was regarding the selection of the right share class for the investor. Many were not sure whether Reg BI requires them to look across products. The

Comparing ETFs and mutual funds may be easier, however, going beyond that will be difficult. It will be important for you to establish your clear criteria and process and demonstrate how you are enforcing your policies.

- RAA Assessment at Time of Recommendation

The question of “when” should a financial professional conduct the RAA assessment is an important discussion point. Is it good enough to conduct the analysis as a retroactive exercise? Our opinion on this has always been to conduct the analysis at the time of the recommendation, or pre-trade, moving the analysis as far upstream as possible to ensure recommendations are compliant.

The SEC provides clear commentary on this point by stating that,

“…in the view of the staff, consideration of reasonably available alternatives should begin early in the process of formulating a recommendation or providing advice rather than as a retroactive exercise undertaken after the firm or financial professional has already decided what to recommend or what advice to provide. The staff further believes that such consideration should involve comparing reasonably available alternatives in light of a particular retail investor’s investment profile.”2

Relying on post-trade processes and surveillance doesn’t appear sufficient, from the Commission’s point of view. Firms need to understand this guidance, and the technical and operational implications that come with it.

- A Consistent and Repeatable Process

There is only one question in the Bulletin that addresses how a firm should consider their RAA assessment process. Essentially, the SEC provides a suggested framework that combines understanding the investments or strategies that are available to the investor and narrowing down to specific investments or strategies that are in the investor’s best interest.

Furthermore, the process used needs to be consistent and repeatable and financial professionals need to be trained on the process, so they have a clear understanding of how it is used.

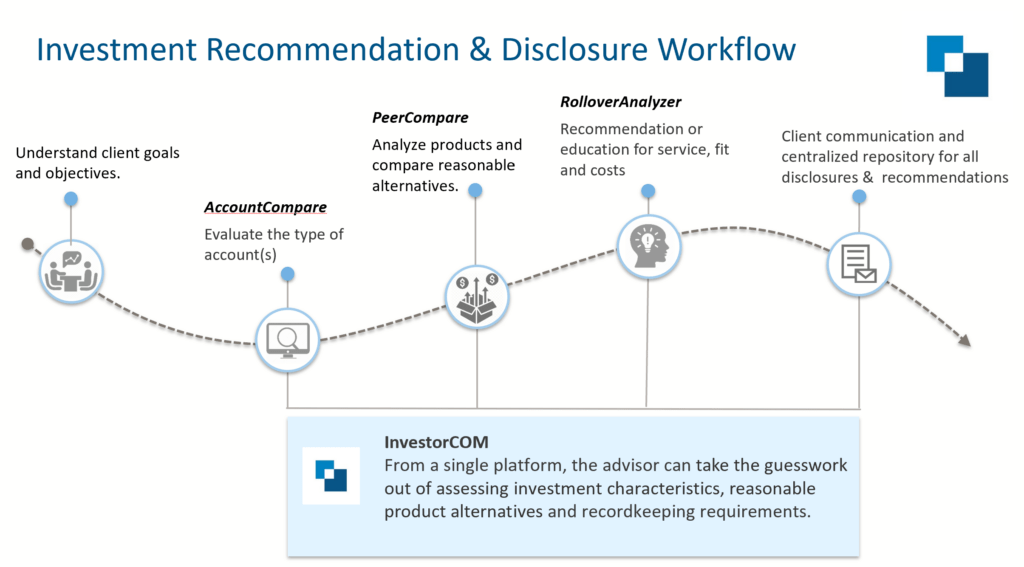

Figure 3: InvestorCOM’s End-to-End Investment Recommendations and Disclosure Workflow

- Demonstrating Compliance Will be Difficult Without Documentation

The fact that Reg BI did not mandate that the RAA analysis be documented and stored is probably one of the largest anomalies. However, the SEC’s response to Question 16 clearly underscores the importance of documentation as it pertains to demonstrating compliance with your policies and procedures.

This is something we discuss with every client and industry participant, and it really boils down to this: if you didn’t document your analysis how can you supervise the activity? How can you prove that you performed the analysis? And how can you avoid the “hindsight bias” if there are ever complaints brought by your customer around a given investment? Some documentation, while not mandatory, is critical for monitoring activity and proving compliance with your policies and procedures.

In summary, we feel that the SEC’s guidance provides the industry with much needed insight into the key open questions that many have been asking regarding Reg BI since the beginning. It is our hope that all of you can dig in and understand how this impacts your firm, your policies and procedures, and your overall business.

Make Best Interest Recommendations with InvestorCOM PeerCompare

InvestorCOM PeerCompare™ is an intuitive app for finding and comparing reasonable product alternatives for your investors based on investment cost, risk and performance criteria. It fits into your existing advisor workflow, allowing you to recommend a suitable investment while ensuring compliance with Reg BI.

- Compare one or more products

- Asset classes include ETFs, mutual funds, variable annuities, alternatives, equities.

- Identify relative performance based on Cost, Risk, Return

- Includes breakpoint analysis

- Captures a copy of the recommendation for disclosure and record-keeping purposes

InvestorCOM can provide your firm with a consistent and repeatable process for making best interest product, rollover and account type recommendations. Schedule a demo to learn more.

We recently hosted a webinar “SEC Guidance and Reasonably Available Alternatives” with industry experts from Wintrust, Eversheds Sutherland and Richard Chen LLC to discuss the SEC’s guidance and steps your firm can take to prepare. Watch the On-demand Webinar now.