How to Determine Reasonably Available Alternatives

The Securities and Exchange Commission’s Best Interest Rule includes several mentions of the requirements and allowances for determining which investment products are considered reasonably available alternatives under Regulation Best Interest’s Care Obligation. It addresses topics like how to handle:

- A limited set of investment products for a given broker-dealer

- An open architecture environment with unlimited products

- Situations in which only proprietary products are available

Yet nowhere does the Adopting Release explain how to compare costs and reasonably available alternatives. Specifically, there is no guidance on how firms and financial professionals can define what falls into the scope of “reasonably available” for comparing recommended products. For example, if a financial professional recommends a U.S. equity-based mutual fund that focuses on large-cap dividend-yielding securities, what should be considered a reasonable alternative?

While InvestorCOM does not provide regulatory advice or guidance, we have helped many of our clients meet the requirements and can provide insights on the best practices we have observed.

Comparing Mutual Funds to ETFs

Comparing costs and reasonably available alternatives for mutual funds and exchange-traded funds (ETFs) is one of the more common debates. While ETFs are generally designed to be passive investment vehicles and mutual funds are actively managed, a new trend is emerging. Over the past few years, more fund managers have launched ETF clones of their popular mutual fund strategies, adding fodder to the ETF and mutual fund debate. These two instruments are similar in their product attributes, such as cost, risk, and return structure. This naturally begs the question: Should ETFs and mutual funds be combined to be considered as alternatives to each other? The answer is simple – it depends, and it is something each firm must decide and build into its practices.

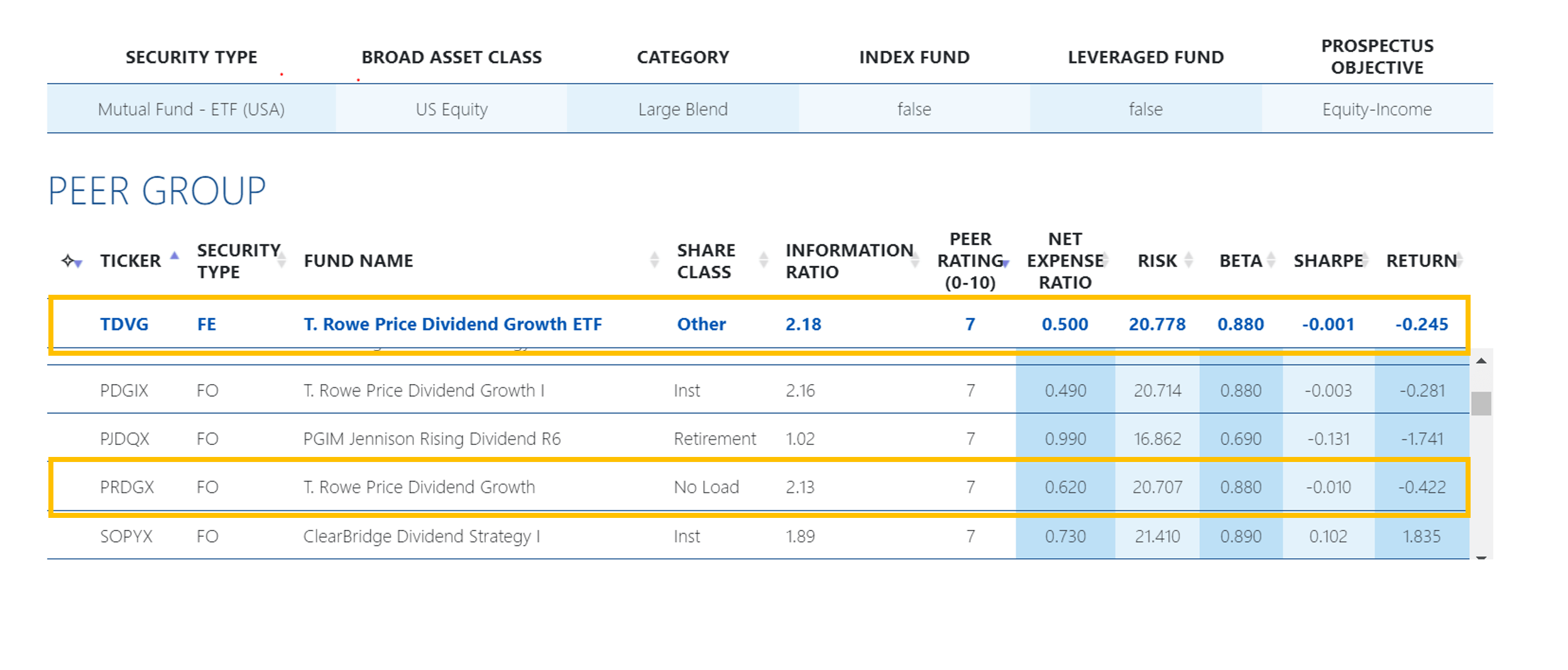

The good news is that the core data points between mutual funds and ETFs are similar and comparable. At InvestorCOM, we analyzed our library of mutual fund and ETF data and found that over 80% of the data points were directly related. As a result, we can build a combined data model that assesses mutual funds and ETFs in the same peer group, or separately. This allows us to provide options for our clients and customize modifications to their policies and procedures. Figure 1 is an example of a peer group that includes a T. Rowe Price mutual fund (PRDGX) and its ETF clone (TDVG) grouped together with other similarly rated mutual funds across the industry.

Figure 1: InvestorCOM PeerCompare Example

Figure 1: InvestorCOM PeerCompare Example

Alternative Investments

The more complex the instrument, the more scrutiny the recommendations will come under. It’s important for firms to consider how to group various instruments together when considering reasonable alternatives. The alternative investment space has a diverse mix of products, and unlike mutual funds and ETFs, their underlying data do not line up well to provide a combined data model. The silver lining is that the universe of alts is small in comparison. In exploring this asset class with clients, prospects and data providers, we determined that it makes sense to treat each type of alternative investment as its own grouping (non-traded real estate investment trust, private placement, interval fund, etc.).

So, what is the answer to the question, “What types of securities make up your reasonable alternatives”? There is no single answer, and it is up to each firm to decide. As you decide on what it means to you, make sure you consider how you implement your policies and that your methodology – whether it is manual/template-based or systematic – can support your decision.