Materiality Index: Monitor for Significant Change

The Client Focused Reforms and the introduction of the new KYP requirements place an explicit obligation on firms to reasonably assess, approve and monitor the securities (or products) made available to clients for significant change. Given the principles-based nature of the regulatory expectations, the ‘reasonable’ actions taken by each firm will depend on a number of unique variables, including the complexity, size, and risks of the products made available at each firm.

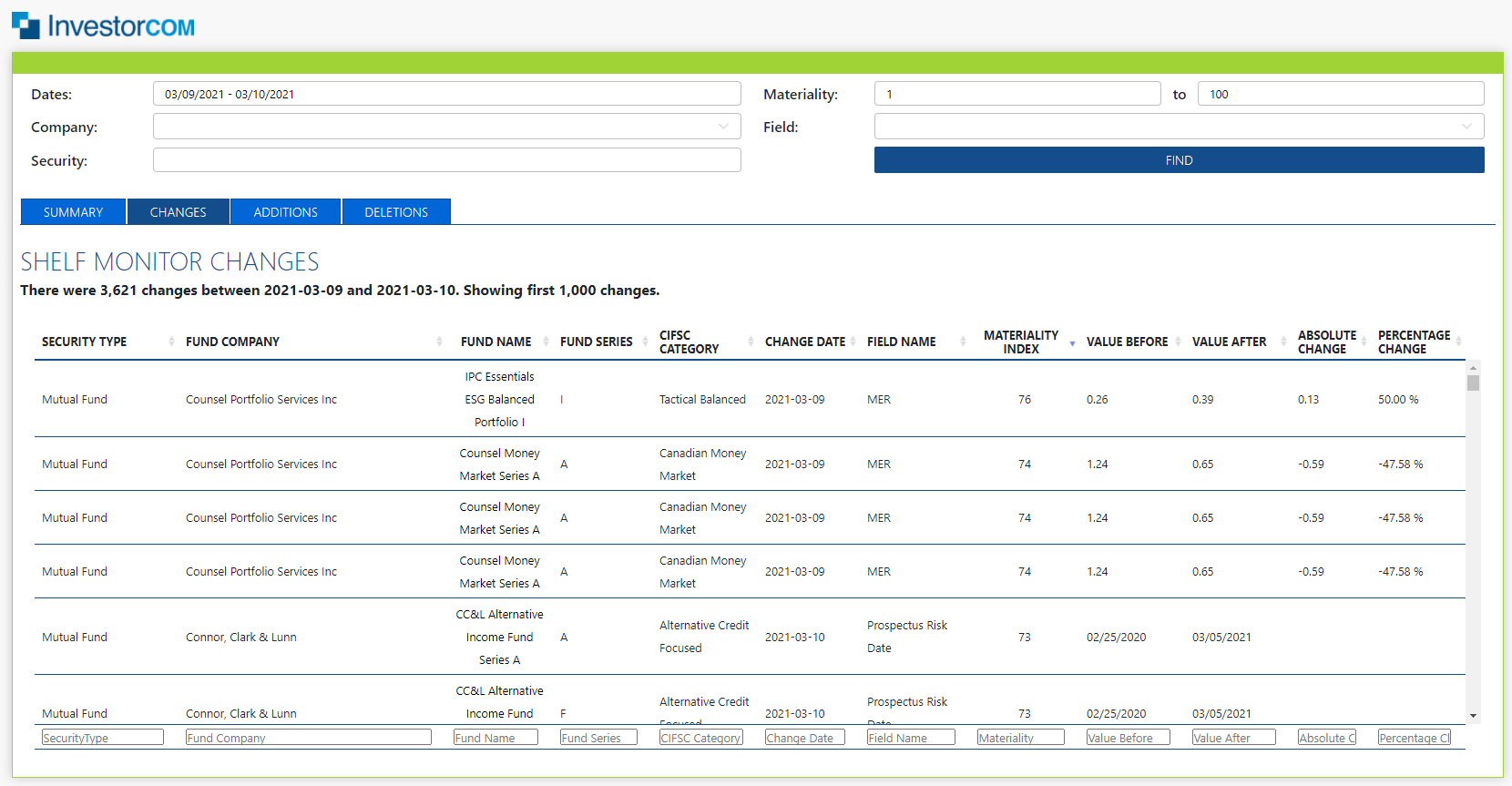

In InvestorCOM’s 2019 study of Canadian mutual funds, we discovered that a typical product shelf sees more than 2,000 changes – every single week. This inspired us to develop ShelfMonitor – a powerful web app that monitors and tracks changes on a firm’s product shelf (data monitored may include mutual funds, ETFs, Equities, Segregated Funds, Annuities, and Fixed Income products).

This sobering study provides a dose of reality around the scope of the new KYP requirements. Monitoring 2000+ weekly changes on a firm’s shelf can be an overwhelming undertaking. And manually sifting through the changes to discern which changes should be deemed ‘significant’ is an even more daunting challenge.

As the regulations suggest, keeping these changes in check is critical to ensure client portfolios remain suitable, or in the maintenance and construction of a best interest product shelf. Since its inception, ShelfMonitor monitored products made available on a shelf and firms could choose which data points or investment characteristics to monitor.

We recognize, however, that not all changes on a shelf are equal. Some changes, such as those related to suitability, are more important and will impact a client’s portfolio, while other changes are less important and, in many cases, can be ignored.

In keeping with the regulatory requirements and the goal of making it easier for firms to identify significant changes on their shelf, InvestorCOM recently updated ShelfMonitor to go beyond filtering data and now allows firms to identify which changes are most significant. This is achieved with InvestorCOM’s new Materiality Index capability. Whether out of the box or tuned to your business needs, InvestorCOM’s Materiality Index makes sure that the most significant changes rise to the top.

Introducing the Materiality Index. An Easier Way to Monitor for Significant Change.

The Materiality Index rates the importance of a security attribute change to the firm. Every day, ShelfMonitor scans InvestorCOM’s data sources for changes to hundreds of attributes. Change is reported to firms through the web portal and via alerts.

These changes could include:

- Expense Ratios

- Risk Ratings

- Trailing commissions and 12B-1 fees

- Fund managers

- Prospectus filing dates

- Fund name changes

The Materiality Index analyzes and scores every change according to the firm’s weighting criteria. While all changes are visible, sorting and filtering using the Materiality Index allows firms to identify the securities having the most urgent business impact.

Supporting your Definition of Significance. Configuring the Materiality Index.

Every firm has a slightly different way of interpreting significant change. We work with every client to make sure the Materiality Index is tuned just right. Our multi-factor weighting algorithm allows each client to balance the significance of any change with its size or magnitude. Magnitude sensitivity settings allow firms to generate linear, exponential, or break-point progressions to hone in on the relative significance of a change. It also adjusts for the direction of the change. For example, increases in Expense Ratios or Risk Ratings may be more significant than decreases of the same amount.

With approximately 100 possible attributes monitored per security type, ShelfMonitor’s Materiality Index focuses on what’s important.

Get Audit Ready: Access to Significant Changes at Your Fingertips.

Since changes are evaluated, assessed, and processed every day, ShelfMonitor is always available and up-to-date to investigate and analyze changes:

- Zero in on changes to a particular attribute.

- Identify trends by exploring changes by Asset Manager.

- Assess all the changes to a security over a given time period.

- Isolate all significant changes that require action with the Materiality Index.

- Identify key data to support shelf management decisions.

Every change is identified by date, the value before, and the value after the change. Numeric and ratings data also include the magnitude of the change. Simply sign up for ShelfMonitor alerts to have significant changes delivered straight to your inbox.

Figure – The Materiality Index within the ShelfMonitor Web application.

Learn More.

Now you can rise to the challenge of assessing and monitoring every product on your shelf with ShelfMonitor. Watch this video to see how it works.

Schedule a demo of ShelfMonitor.

About Steve

Steve is the Director of Product Management at InvestorCOM. Steve has been a product manager with financial services software firms for over 20 years, helping his customers by defining and delivering software products that improve their business and allow them to achieve their business goals.

Steve is the Director of Product Management at InvestorCOM. Steve has been a product manager with financial services software firms for over 20 years, helping his customers by defining and delivering software products that improve their business and allow them to achieve their business goals.

Tags: client focused reforms, kyp, material change, materiality index, shelfmonitor