The ROI of Compliance Technology

Under the Securities and Exchange Commission’s (SEC) Regulation Best Interest (Reg BI) rule, broker-dealers (B-Ds) are mandated to act in the clients’ best interest. To do this, they must adhere to their obligations of disclosure, care, conflicts of interest, and compliance. With the regulations now in effect, B-Ds have taken steps to achieve various degrees of Reg BI compliance.

Regulators have recently moved from ‘good faith’ compliance efforts to a more comprehensive compliance expectation. As noted in our previous blog, the SEC’s Division of Examinations (DOE) has outlined its intentions to expand the scope of examinations and focus on whether firms are making recommendations reasonably and in the customers’ best interests. The DOE has confirmed they will evaluate firms’ processes for compliance and alterations made to product offerings.

As B-Ds consider their Reg BI compliance priorities, several important questions remain:

- How will the firm ensure that their product offerings (or shelf) are aligned with the client’s best interest?

- What is the best long-term strategy to manage the ongoing delivery and recordkeeping of Form CRS?

- What process will be used to ensure that representatives have a consistent approach to assessing Reasonably Available Alternatives (Care Obligation) across multiple asset classes?

As we head into the Reg BI exam cycle, B-Ds will need to think strategically about how and where to make investments in compliance. These decisions will have wide-ranging implications on the B-D’s operations and its ability to truly act in the client’s best interest. Executives will need to assess the ROI of compliance technology investments.

ROI Considerations

Compliance investments have not always been viewed through an ROI lens because they are non-discretionary; when a new regulation goes into effect, B-Ds must comply. Many industry experts view Reg BI as an opportunity to build stronger and more profitable client relationships. This presents an opportunity for B-D’s to consider the benefits as well as the costs of compliance. A Reg BI ROI framework might consider 3 key benefits:

1. Lower Client Attrition

According to PriceMetrix, financial advisors lose approximately 10% of their clients on average every year. A CFA Institute/Edelman study suggests that the main reason clients leave their advisors relates to trust: “Strong performance alone is not enough for investment management professionals to earn investors’ trust.” The survey found that investors value and expect certain behaviors from their financial services professionals: to work under formal ethical codes or professional standards; to be transparent about all things, including business practices, fees, and potential conflicts of interest; and to act responsibly during an issue or crisis.

As the study indicates, investors care deeply that their interests are protected and want those interests to come before those of the financial professionals and firms. Acting in the client’s best interest is the objective of Reg BI. The regulation is designed to address these exact issues and effective compliance will position B-Ds and their reps to reduce the risk of client departure.

If we look at a simple ROI model based on the reduction or elimination of client attrition, the math is very compelling. A recent Kitces Research survey of more than 800 financial advisors found that the average total cost for a financial advisor to acquire or replace a new client is $3,119.[1] Considering the widely accepted rule of thumb that acquiring a client is five times more expensive than maintaining existing clients, a $600 annual investment in Reg BI technology is justified by protecting just one client.

2. Productivity Gains and Cost Management

Strategic technology investments drive higher levels of productivity across an organization while driving significant cost reduction. For example, a B-D’s financial representative, along with supervisory staff will save significant time using technology to assess Reasonably Available Alternatives (Care Obligation). The same concept applies to the delivery of Form CRS which is required under the Disclosure Obligation. By leveraging the right technology, a firm will reduce costs associated with supervision and record-keeping and eliminate the high cost of mailing Form CRS/ADV2B.

Case study #1: Care Obligation and Assessing Reasonably Available Alternatives

Reg BI’s Care Obligation requires B-Ds to consider Reasonably Available Alternatives (RAA) to ensure that the recommendation is in the client’s best interest. The analysis below quantifies the benefit of implementing technology by comparing the time and cost it would take to conduct this analysis manually versus using technology. If the RAA process was undertaken manually, it’s apparent that the rep and the supervisory function would need to spend a significant amount of time gathering and analyzing the attributes of ‘reasonable alternative’ investment products. We estimate that this process alone could require the rep to analyze at least one million data points every, single day.

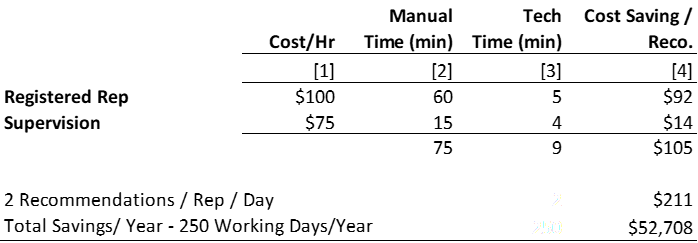

Table 1: Cost savings when considering a ‘Reasonable Range of Available Alternatives.’

As illustrated in Table 1, a B-D is estimated to save at least 60-minutes per recommendation by deploying technology to conduct the RAA analysis. In a scenario where a Rep makes two recommendations a day, across 250 business days a year, the savings exceed $50,000 per Rep.

Case study #2: Time & Cost Savings for Digital Delivery of Form CRS

As part of Reg BI’s disclosure obligation, B-Ds are required to deliver Form CRS to their clients. Given operational challenges of obtaining email addresses for legacy clients and meeting stringent regulatory obligations (read Thompson Hine’s white paper on “Electronic Disclosure: SEC Requirements and the Form CRS Business Case), some have shied away from the benefits of e-delivery. However, many B-Ds are starting to realize that Form CRS will need to be updated more frequently than they expected – specifically, every time there is a material change in the B-D’s business, including a regulatory and disciplinary event. This will require the Form CRS to be an evergreen document and delivered to clients fairly frequently.

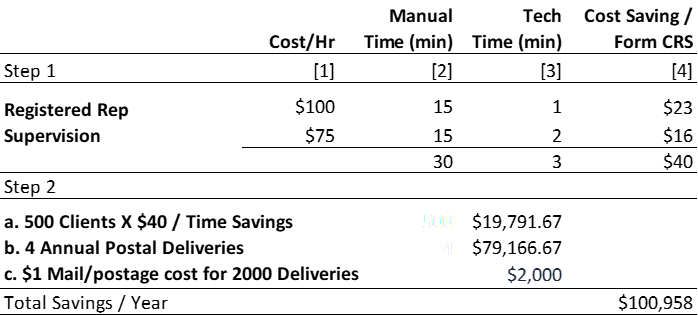

Table 2: Cost savings when comparing physical & digital delivery of Form CRS.

Table 2 estimates savings associated with delivering the Form CRS digitally. The analysis has two steps. First, it calculates the time and cost savings stemming from having a Rep and Supervisory staff process, document, and keep track of Form CRS delivery. Second, it layers the cost implications of repeating step one for approximately 500 clients, four times a year, including a cost for physical delivery. Overall, the analysis indicates that a B-D can save over $100,000 per Rep per year, by electing to rely on a technology solution to deliver the Form CRS.

3. The Intangibles

It is important to remember that when a B-D’s compliance function is strong and effective, its success is measured by what does not happen. This includes a range of possibilities, including fines, client complaints, lawsuits, negative press, reputational damage, lost business, and most importantly – a loss of customer trust. To put these qualitative variables into tangible context, in 2019, SEC enforcement alone reached one of the highest amounts ever, with more than $4.3 billion in fines and disgorgements levied.[2]

An ROI Framework for Compliance Technology

Although new regulations can initially raise operating costs for a B-D, Reg BI is forcing firms to think critically about their overall business model and how they provide wealth management services to clients. As B-Ds embrace the new regulations, they need to consider the ROI from a compliance technology investment. Despite the lack of an easy-to-follow mathematical formula, the benefits of deploying the right technology tools can fall into the following categories:

- Improved client satisfaction and reduced attrition

- Direct time saving associated with tasks such as data entry, manual supervision, and recordkeeping practices

- Mitigating litigation risks, regulatory penalties, and reputational damage

If all else fails, compliance technology costs can also be viewed as an insurance premium. While policies and procedures may guide against misconduct, technology can translate the guidance into every-day practice. Ensuring that the B-D does not find itself on the wrong side of regulatory agencies.

Author: Parham Nasseri, VP, Regulatory Strategy at InvestorCOM Inc.

Contact us to learn more and to schedule a demo.

—

[1] https://www.kitces.com/blog/client-acquisition-cost-financial-advisor-marketing-efficiency-lifetime-client-value-lead-generation-satisfaction/, accessed Oct 5, 2020

[2] https://www.reuters.com/article/us-usa-sec-enforcement-idUSKBN1XG1ZW

Tags: ROI