SEC Staff Bulletin: Care Obligation

InvestorCOM spoke with Issa Hanna from Eversheds Sutherland, Jim Sommerfield from Wintrust Wealth Management and Richard L Chen to discuss the SEC’s guidance on reasonably available alternatives (RAA), and how firms should assess RAA early in the process of formulating recommendations for products.

This is part two of a conversation. For part one, please visit https://investorcom.com/sec-staff-bulletins-and-risk-alerts-reg-bi/

==

Parham Nasseri [PN]: Issa, the SEC Staff Bulletin specifically mentions firms and advisors knowing the product they are recommending to their clients. In your view, how can firms and financial professionals evidence their assessment of costs and available alternatives?

Issa Hanna [IH]: I think when it comes to knowledge regarding the available product shelf, you have to view that from the lens of your product due diligence and training process.

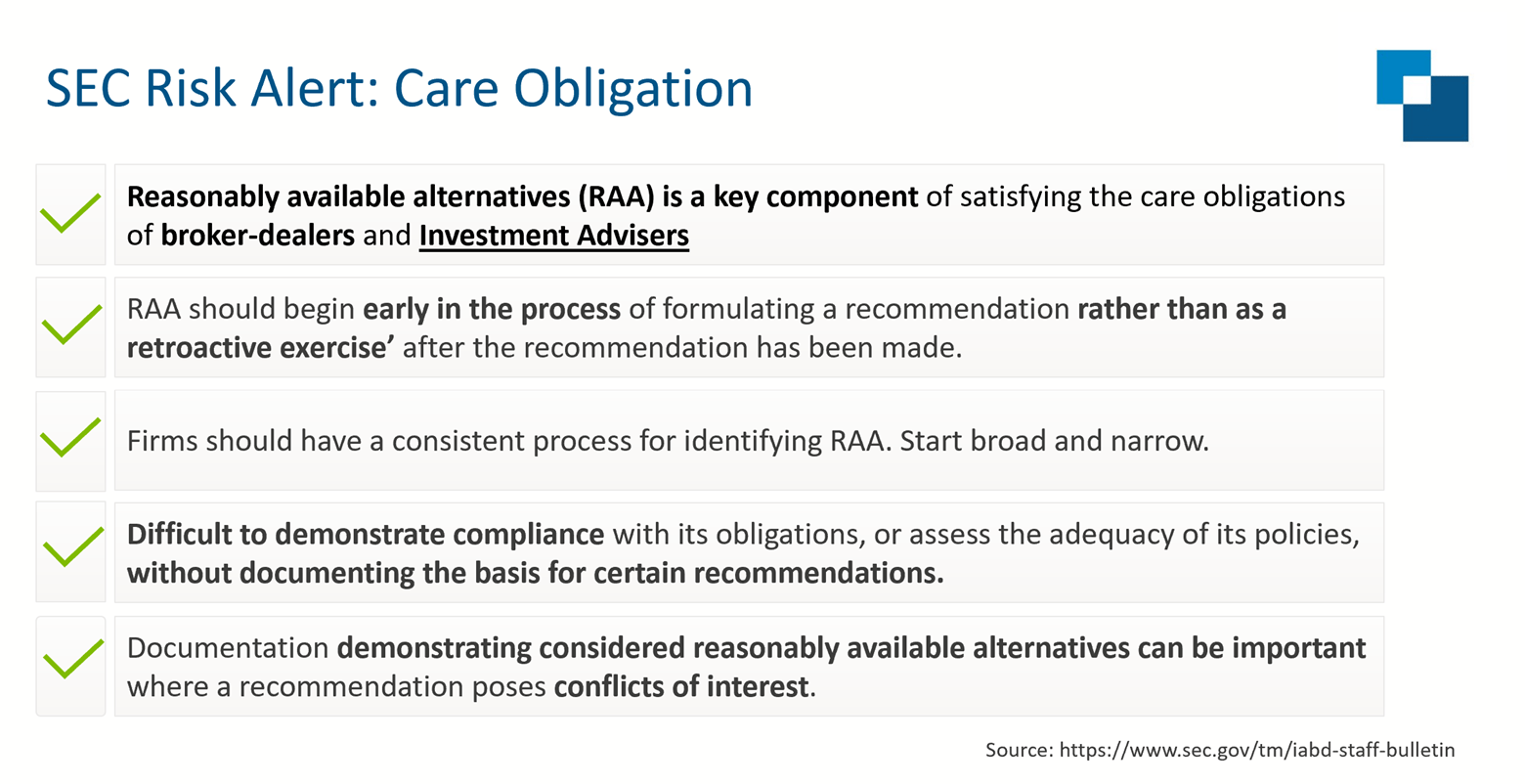

Reg BI’s Care Obligation has three components, which loosely match FINRA’s suitability rule. There’s a reasonable basis, there is customer specific and then there’s that quantitative element.

The Staff Bulletin spends a fair amount of time talking about what that reasonable basis best interest process should look like to make sure that there is a reasonable understanding of the products on your shelf.

FAQ #2 provides some factors to consider when evaluating the potential risks, rewards, and costs of an investment or an investment strategy. Having that understanding is a critical bit of information that you would need in the SEC Staff’s view to help you meet the reasonable basis component of the rule. For instance, when you are dealing with an individual customer, how can you match a product to a particular customer’s investment profile if you don’t understand the features of the product, the potential risks, rewards, and costs associated with that product? It’s a multi-step process and the Staff provide some specific suggestions about what your product due diligence questionnaire should include when you are trying to get an understanding of certain products.

I think it’s important to look at these elements when you’re dealing with particularly complex, risky and costly product types, and also product types that present enhanced or significant conflicts.

Figure 1: SEC’s Risk Alert: Care Obligation

Figure 1: SEC’s Risk Alert: Care Obligation

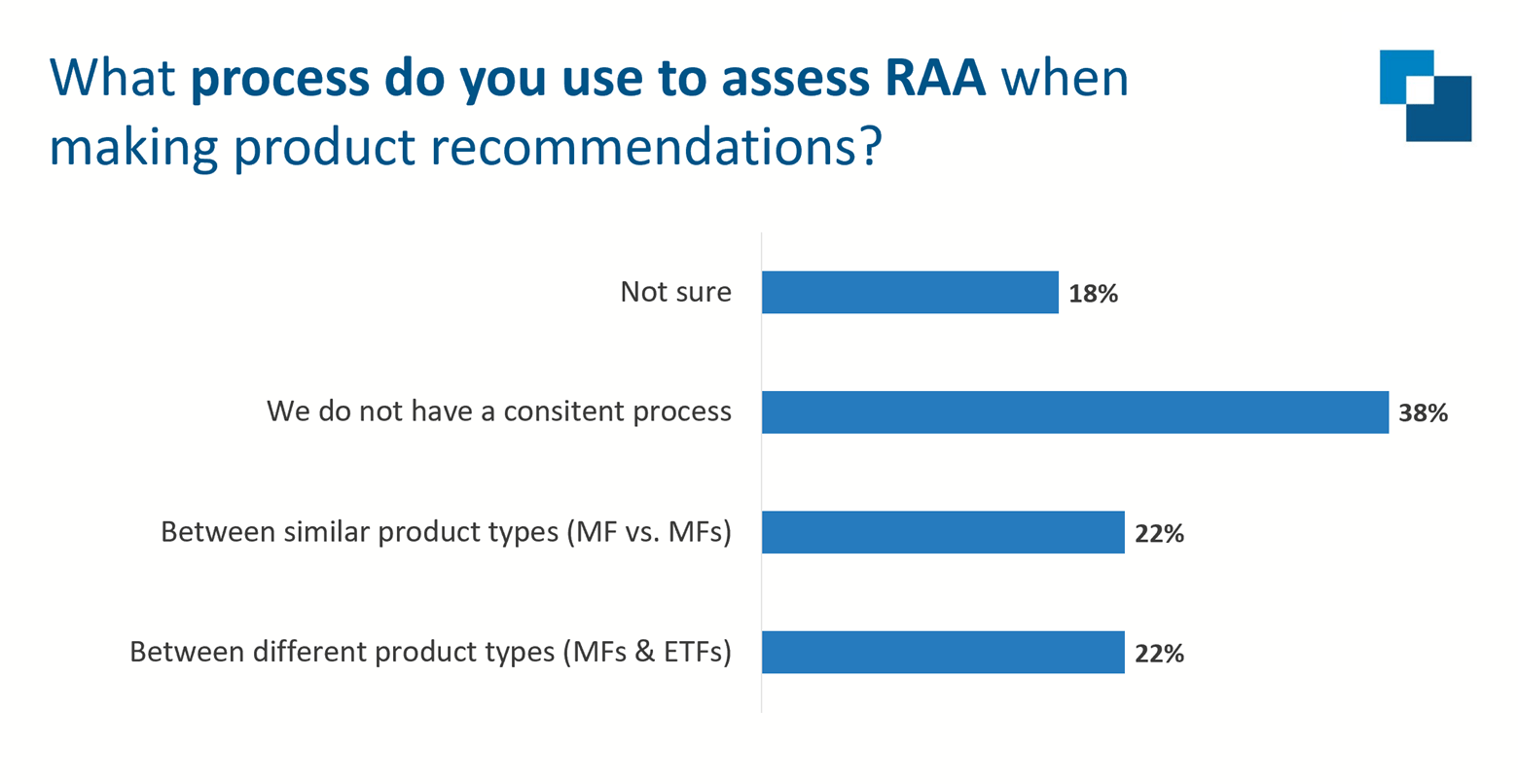

[PN]: Thanks, Issa. Another key principle identified is that firms and financial professionals should have a consistent process for identifying RAA. Start broad and then narrow. Jim, how have you tackled this?

Jim Sommerfield [JS]: As a firm, after reading through the Guidance and establishing our policies & procedures on Regulation Best Interest, we didn’t require our financial advisors to document every single recommendation that they made. That was just not possible.

The focal point, as I recall when we were putting our procedures together, was any time you are making a recommendation of a new product or service to a customer is when you needed to focus on that best interest advice and the documentation surrounding it.

Regarding product recommendations, we started off by focusing on complex, high-cost, limited liquidity products. We looked at those as representing the greatest amount of risk to our customers. When you read through what Reg BI is all about, cost is obviously a key consideration, so we looked at that being the real nuts and bolts of what we needed to focus on.

We established a simple process that was focused on – although more manual at the time – addressing if you are buying a structured product, a variable annuity, a leveraged ETF, or other products that have levels of complexity, higher cost, and how do we provide a disclosure acknowledgment, document our due diligence and the best interest advice from a reasonable basis standpoint. We generated a disclosure form that was signed by the client.

If you think back to FINRA’s old requirements around variable annuity sales, the plain English disclosure, we used that approach with our complex limited liquidity products. Obviously, that doesn’t cover everything from an RAA perspective. There are considerations like other product types, mutual funds, and other different types of investments. The key was looking at how we were going to implement that process and be consistent in that approach. We conducted a number of training sessions, we laid out very clearly in our policies & procedures – this is what is required when it’s required, and this is how we go about it as a compliance team. This ensured from an oversight perspective that we met and complied with our policies & procedures in meeting the RAA expectation and documentation.

[PN]: Thanks, Jim. Another interesting principle that has come up in our conversations with regulators is that the RAA process should begin early in the process of formulating a recommendation or providing advice rather than as a retroactive exercise. What do you make of this Issa?

[IH]: I think it’s more like a reminder, but if you’re a firm that’s relying on retrospective-type of reviews or surveillance to consider RAA, you’re probably going to want to take a second look at that to make sure that you’re in compliance with the Staff’s expectation.

Figure 2: Attendee poll, May 11, 2023, “What process do you use to assess RAA when making product recommendations?”

Figure 2: Attendee poll, May 11, 2023, “What process do you use to assess RAA when making product recommendations?”

[PN]: Richard, there’s a specific call out in the Guidance Note that the assessment of RAA or the cost comparison exercise needs to go beyond basic share class comparisons. What do you make of that particular point? If a firm asked you that question, how would you advise them?

Richard Chen [RC]: I think this was a Staff attempt to right-size the obligation with respect to the universe of investments that are considered RAAs and how advisors should think about right-sizing that obligation.

I think this component was designed to make sure advisors are aware that it’s not simply that you look at the different flavors within the same investment. You have to look broader than that. For instance, talking about this share class issue. If there’s an ETF that accomplishes the same objectives for a client as the ETF or the mutual fund with the share class that you’re considering then it is advisable that you look simply beyond a share class within the mutual fund that’s appropriate, you have to think bigger. I think that this was their attempt to show folks that you have to broaden the alternatives that you’re looking at.

==

If you enjoyed reading this article, Watch the Replay 2023: SEC Guidance and Reasonably Available Alternatives.

If you would like to learn how InvestorCOM’s platform is helping firms and financial professionals meet their care obligation requirement to assess reasonably available alternatives, sign up to see a demo.