DOL’s Retrospective Review: Current State of Compliance in the Industry

Recently, InvestorCOM spoke with industry experts from Oyster Consulting LLC and Davenport & Company LLC to discuss the practical side of the DOL’s retrospective review process that zeros in on the approach firms are taking to meet the requirement.

==

Parham Nasseri [PN]: Ed, what are you seeing in the industry and what is the current state of compliance with respect to the retrospective review requirement?

Ed Wegener [EW]: Having been a consultant now for a few years, the question that I am asked probably most often is what are my peers doing in this space. Especially with respect to new rules, there is often a lot of greyness. It is good for firms to understand what others are doing so they can see if they are an outlier and what they need to do in that space.

Firms and the DOL have been dealing with this fiduciary issue for quite some time and it has been a very long and winding road. With respect to this PTE in particular, firms have had a lot of time to prepare

- The rule went into effect in February 2021. It was adopted in December 2020 with an effective date of February 16, 2021.

- Enforcement was delayed for the most part until February 1, 2022

- Enforcement with respect to IRA rollovers related to documentation and disclosure requirements for rollovers was postponed until July 1, 2022.

For the most part, our clients are prepared as they have their policies and procedures in place, and they have their processes in place. Now they are dealing with implementation issues, one of which is the retrospective review. The major area where processes differ is around the level of technology and automation that firms are using.

In terms of the retrospective review requirements, most of our clients have been very diligent in getting those completed. We have had some firms that have broken up the review through different points throughout the year culminating in a final review and report with the certification. Other firms are just tackling it one review at a time. We have also seen in some cases and heard anecdotally that there are still several firms that are behind in terms of getting their testing done.

One question we’re getting most often is regarding the Florida Court decision regarding rollovers. That makes sense because it lead to a lot of ambiguity; the decision was very narrow and really focused on the application of the five-part test to rollovers.

We are not attorneys, and before making any changes to your policy I would suggest firms talk to their counsel before making any changes. Some things to consider are:

- The SEC’s recent Staff Bulletins indicate that rollovers are subject to Reg BI and the Fiduciary requirements of the ’40 Act and the analysis the SEC laid out in their recent Bulletins is very similar to those in the PTE.

- It is anticipated that the DOL will be doing more rulemaking including revisiting the 5-part fiduciary test.

The decision only impacts the application of the 5-part test to rollovers. The remainder of the requirements were not impacted.

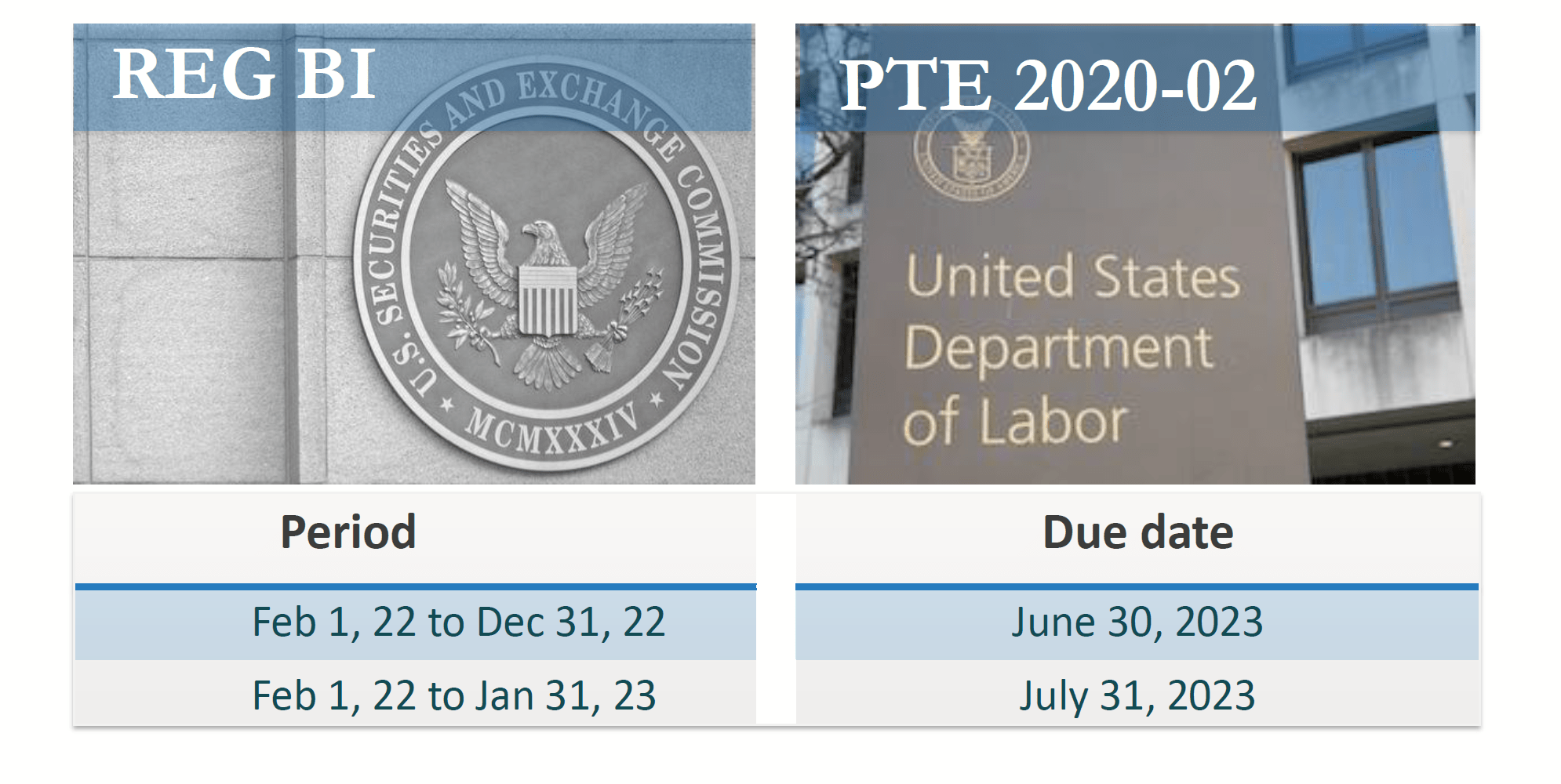

Figure 1: “Rollovers – Retrospective Review Certifications,” presented during the Webinar on June 28, 2023

Figure 1: “Rollovers – Retrospective Review Certifications,” presented during the Webinar on June 28, 2023

[PN]: Theresa, you have firsthand experience in dealing with a lot of this ambiguity, whether it starts from implementing the PTE requirements, all the way to meeting the retrospective review exercise. Would you mind sharing some key outcomes or learnings with your peers?

Theresa Manderski [TM]: The first thing that we did was look at our Written Supervisory Procedures (WSPs). One of the five requirements is to have policies and procedures. One thing that is interesting about the policies and procedures requirement is for most of us that are under FINRA and SEC requirements, it says we must have WSPs that are “reasonably designed”. But the DOL says that it must be designed in a “prudent manner”, so there is a little bit of nuance in the wording there.

We had an outside consultant review our WSPs for us and we also had some items that were missing that we needed to update.

Then, you look at your methodology. Are you complying with the Impartial Conduct standard? Have and how have you communicated that Impartial Conduct Standard? You cannot just communicate it and then say that you are done. You always need to re-communicate, you need to look at your training and you need to look at your WSPs. Are you in some instances using your Reg BI disclosures?

I do not think you can have DOL PTE without Reg BI and I tend to marry those a lot in these instances because you must provide a description of your services. That’s the same thing you have to do with Reg BI and Form CRS. So how do you do that? How do you provide those disclosures? How do you provide your material conflicts? How do those get to the client? The fiduciary status was required to be delivered back in February; how did you do that mailing? Did you review that? Do you have documentation of how those clients went? What was your methodology? How do you substantiate that that was mailed?

Did you create your own fiduciary language? Did you use the DOL’s language and then how do you have that for new accounts or for ongoing relationships and for prospects? How do you get that out to the client? And it must be under the meeting of title one of the Implied Employee Retirement Income Security Act or the Internal Revenue Code?

So, making sure that is correct, you are looking at your methodology and you are looking at that fiduciary statement. Does it make sense and are you capturing all the required elements? Then looking at your sample size, what is the sample size and how many rollovers did you have across that time period?

The time period that we chose to look at was from February 1, 2022, to February 1, 2023. We were able to pull that data and then select a sample size, and we picked two different approaches. 1) We looked at all new rollovers, meaning new accounts that were open, and then 2) we looked at rollovers that were received into existing accounts. Then we broke that sample size down into how we would determine best interest, we looked at the age of the client, we looked at the asset sizes of the client, we looked at the account choice of the client, i.e., was it a commission-based account versus a fee-based account.

So, we looked at all that type of data to determine the best interest, we looked at the rollover form that was received and whether it was completed correctly. Were they not completed at all? Did it make sense in the categories that we selected? Did it have the right disclosures provided? If it was a higher cost, why? Were there notations made as to why that was in the client’s best interest?

We all know that cost is not the only factor, but it is an important factor. So, we looked at all those items and then we reduced it to writing. How do you reduce it to writing? What does your final report look like? What are you going to present to senior management? How and when are you going to present it to senior management, and how is that going to be signed off on? So, we presented ours to senior management, had it signed off, and then we also presented it to our audit committee and to our risk committee.

We wanted to make sure that the firm and those in a position to make decisions understood that this needed to be seen and heard and then any of those recommendations that we had based on our findings were then reported to our centralized supervision unit.

What did we find in their WSPs that were missing that needed? Did they need more in the escalation area? Did we need more training and communication in the field? One area we found was Form 5500 was not being used. They were utilizing more benchmarking, well reiterating the importance of asking for that form, and explaining to the client why that form was important. If the client did not want to provide that form or did not have it, making sure they included a note that was sent back to the client that said ‘client did not provide,’ and explain the importance of making sure the proper disclosures about what they could do instead of rolling over, they could keep it in their plan or they could take it out in cash, what type of disclosures were there?

So, then we looked at all that, and then we presented our findings.

==

If you enjoyed this article, you can listen to the full webinar discussion. Watch the Replay 2023: DOL’s Retrospective Review- A Practitioner’s Guide to Compliance.

If you would like to learn how InvestorCOM’s compliance platform is helping firms and financial professionals meet their Care Obligation requirement to assess reasonably available alternatives, sign up to see a demo.