FINRA’s 2022 Exam Findings: Reg BI and the Care Obligation

It has been almost two years since Regulation Best Interest (Reg BI) came into effect.

Recently, the Financial Industry Regulatory Authority (FINRA) published their 2022 Exam Report. The report brings renewed attention to meeting the regulatory requirements, as it shows that many broker-dealers (B-Ds) are failing to address various aspects of Reg BI’s Care Obligation. The good news for B-Ds is that many of FINRA’s findings related to making best interest product recommendations, documentation and disclosures can be resolved efficiently and cost-effectively by using technology.

Client Recommendations and Technology-Assisted Decision-Making

Reg BI’s Care Obligation requires financial professionals to evaluate reasonably available alternatives (RAA) for each client recommendation. Financial professionals must determine the merits (cost, risk and return) of other, similar investments to ascertain whether a security recommendation (or investment strategy) is in the best interest of their client. To compliantly evaluate RAA, financial professionals must evaluate as many as one million data points – a challenge that cannot be effectively met using manual methods.

FINRA’s 2022 Exam Report states that regulators are looking for meaningful improvements in meeting the Care Obligation and that firms and representatives have been “making [investment] recommendations that were not in the best interest of a particular retail customer based on that customer’s investment profile and the potential risks, rewards and costs associated with the recommendation.”

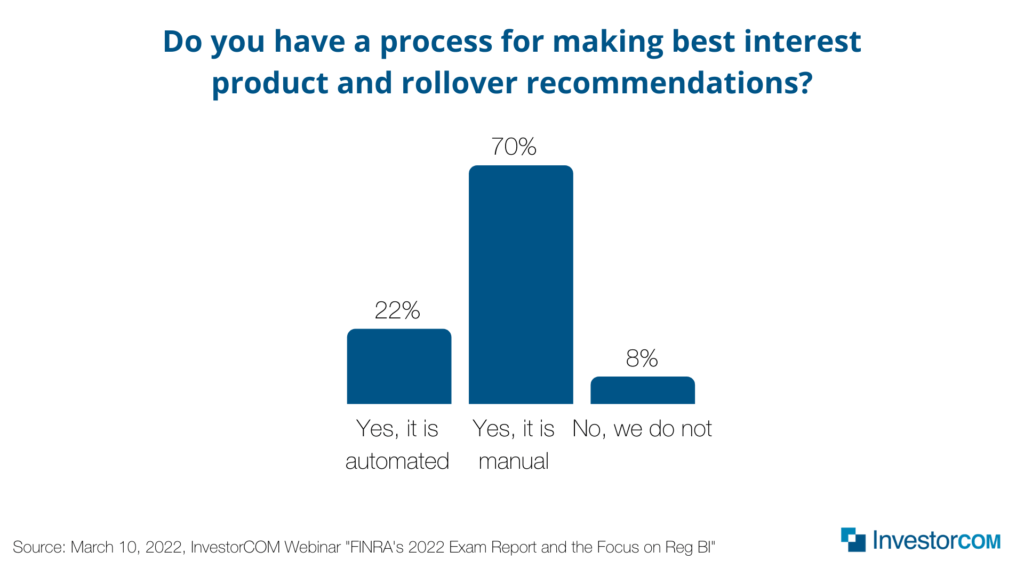

An InvestorCOM survey in March 2022 revealed that 70% of financial professionals continue to use manual methods to make their best interest product and rollover recommendations. Given the complex nature of making best interest product evaluations, we know that a manual process is not a viable approach to recommendations, and this could be a leading factor behind FINRA’s findings.

As firms ramp up their efforts to address FINRA’s findings, many are opting to deploy intuitive, purpose-built technology to empower financial professionals to make compliant rollover and product recommendations. The right technology can enhance a financial professional’s recommendation workflow, instead of hindering it. For instance, instead of “guessing” which products to compare, financial professionals can use a peer-oriented, technology-based framework to consistently compare the cost, risk and return of an investment against an entire group of reasonably available alternatives.

Find out what financial professionals think about using InvestorCOM PeerCompare to make compliant product recommendations.

Better Manage Documentation and Disclosure Processes Using Technology

FINRA’s Exam Report also highlights deficiencies around documentation and indicates that effective Reg BI practices would include “implementing systems enhancements for tracking the delivery of Reg. BI-related documents to retail investors and retail customers in a timely manner by automating tracking mechanisms to determine who received relevant disclosures and memorializing delivery of such disclosures at the earliest triggering event.”

Automation has been key to streamlining these processes, enabling software solutions that document recommendations at the time of the comparison, not after. Rob Dearman, CEO and Chief Innovation Officer of DCG Insight, has said, “the use of a purpose-built compliance platform specifically designed for making compliant recommendations, documentation and reporting allows broker-dealers to meet the many facets of their best interest obligations with minimal training time, intuitive programming, and easy implementation. Replacing manual paper-based processes with digital recordkeeping is essential to remaining compliant in an era of remote work. These efficiencies allow advisors more time with their clients, growing their book of business, and bringing them back to the primary focus of their jobs – helping their clients meet their financial goals.”

Furthermore, FINRA’s report states that Reg BI disclosures were also insufficient. B-Ds were “not providing retail customers with ‘full and fair’ disclosures of all material facts related to the scope and terms of their relationship with these customers.”

Paperwork is a costly overhead expense for any business. However, the Securities and Exchange Commission (SEC) allows electronic disclosure documentation to clients, and by embracing this, firms can enjoy an efficient and environmentally friendly approach to compliance. Automated solutions show when a client has received, opened and read their correspondence, while keeping the latest information and records available at the fingertips of financial professionals and compliance officers reporting to the SEC.

Contact us to discuss how purpose-built compliance technology can help your firm meet Reg BI’s Care Obligation.

Tags: Reg BI