Why Rollovers Are Increasing by 2.5X

It is no secret that rollovers from employer-sponsored plans are one of the greatest sources of assets flowing into retirement accounts, and a leading growth opportunity for advisors. A study by LIMRA’s Secure Retirement Institute found that IRA rollovers are expected to grow to more than $760 billion annually over the next five years. Moreover, Cerulli’s 2022 study estimated that between 2016 to 2021, rollovers from DC Plans accounted for $ 2.9 trillion in IRA asset growth, with the average rollover dollar value amounting to $211,100.

New Regulatory Reforms to Ensure Rollovers Are in the Investors’ Best Interest

Amidst the tsunami of assets rolling over, the Securities and Exchange Commission (SEC) and the Department of Labor (DOL), have introduced reforms that require wealth firms and financial professionals to ensure rollover recommendations are in the investors’ best interest. Principal among these is a documented analysis, outlining the rationale of the rollover, which requires financial professionals to:

- Obtain cost information for the existing and proposed plans

- Research the services and benefits available

- Assess the relative importance of the benefits and services to the retirement investor

- Document a balanced and clear rollover recommendation

The DOL’s Fiduciary Rule has led to increased scrutiny of investment choices and the promotion of rollovers when it is deemed to be in the client’s best interest. I think we should insert a sentence on the retrospective review piece here as well. Much of the SEC’s Regulation Best Interest’s (Reg BI) adopting release focused on making compliant best interest recommendations, including rollovers. Given the magnitude of rollover recommendations in a typical investor’s investment lifecycle, the SEC published further guidance in March 2022, to outline their specific expectations around rollover recommendations.

The Adoption of Regulatory Technology

With the amplification of regulatory requirements, a growing number of wealth firms turning to technology to streamline the best interest analysis and recordkeeping requirements.

InvestorCOM RolloverAnalyzer is a purpose-built rollover application that helps advisors grow retirement assets while meeting regulatory best interest analysis and disclosure requirements via an easy-to-follow, standardized workflow. RolloverAnalyzer significantly increases advisor and compliance productivity while eliminating regulatory risk. The intuitive, cloud-based application delivers:

- All required components of analysis, recommendation, documentation, and disclosure

- An easy-to-use workflow of relevant questions that guide the advisor throughout the process including up-to-date Form 5500 plan information and benchmarking data, and firm-approved compliance disclosures

- Professional, customized client recommendation disclosure

RolloverAnalyzer’s compliance dashboard centralizes the firm’s entire dataset of rollover recommendations across all advisors. The dashboard provides compliance management with a clear graphical view of all rollover activity enabling them to meet retrospective review requirements.

Growing Retirement Assets by 2.5X With Compliance Technology

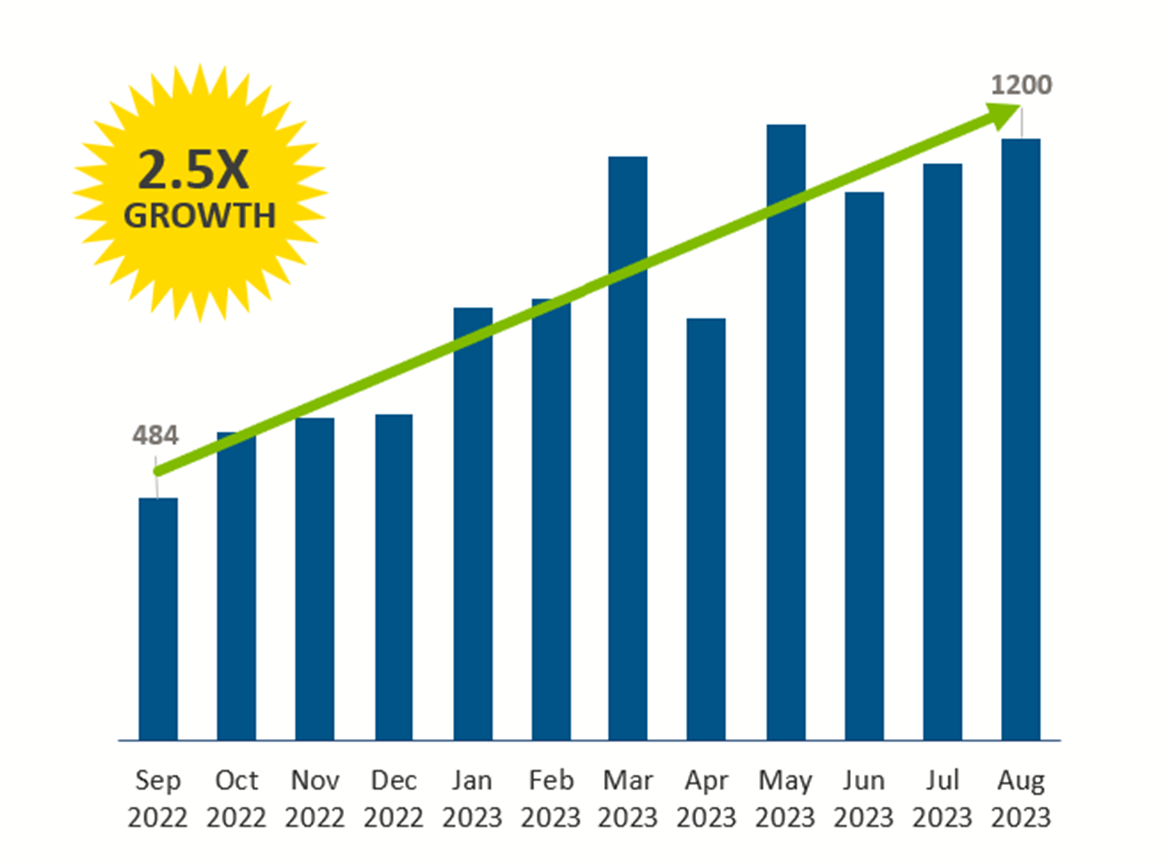

We examined 12 months of RolloverAnalyzer data from four mid-sized wealth management firms. While we expected an increase in rollover recommendations due to automation, we were surprised to see rollover activity increase from month 1 to 12 by 2.5X! Furthermore, this analysis shows that rollover growth is the result of activity, not an increase in users.

Results from InvestorCOM’s study which analyzed recommendation data captured in InvestorCOM RolloverAnalyzer over a 12-month (Sept 2022-Aug 2023) and across four firms.

Secular Shifts Behind the Surge in Rollovers

One of the primary reasons behind the surge in rollovers is the shifting industry landscape. Several factors contribute to this phenomenon:

- Job Changes: A rapidly changing job market, characterized by increased job mobility and the gig economy, has led to individuals frequently switching employers. This often results in the need to manage retirement savings from multiple accounts, prompting rollovers.

- Retirement Trends: As the baby boomer generation reaches retirement age, there is a significant uptick in retirement-related financial decisions. Many retirees choose to consolidate their retirement savings into a single account through rollovers for easier management. Others simply commence the de-accumulation phase of their retirement and explore opportunities for transferring assets to accounts and avenues that allow them to access their capital.

- Freedom and Control: Today’s investors value flexibility and control over their financial assets. Rollovers offer individuals the freedom to choose how they want to invest and manage their retirement funds.

Why RolloverAnalyzer Drives Retirement Asset Growth

We asked our clients about why they feel that RolloverAnalyzer is driving dramatic retirement asset growth.

Q: Are there specific features of RolloverAnalyzer that have proven to be particularly valuable for your business?

A: Yes, absolutely. The integration with Form 5500 & benchmark data and the overall comparison of existing vs. recommended investments are particularly valuable. On top of that, it is very user-friendly and easy to understand for both the advisor and the client, and great for our compliance department because it is customizable to our business.

Q: Has RolloverAnalyzer contributed to increasing your business’s efficiency or productivity?

A: Yes, productivity has significantly improved. In one example, a client estimated “manual” rollover processes required 4 hours of advisor’s time vs. minutes when using RolloverAnalyzer.

Q: Has RolloverAnalyzer helped you increase potential AUM growth opportunities?

A: Yes, by 20-50%

To learn more about InvestorCOM RolloverAnalyzer, please visit our website or sign up for a demo.