It was great to see the compliance and legal community back together at SIFMA’s Compliance & Legal (C&L) Annual Seminar in San Diego this month. With more than 1700 attendees, the continued growth and resilience of our industry is truly remarkable. The sessions were jam-packed with insights surrounding regulatory priorities, emerging market risks and the necessity of leadership amidst market volatility.

Regulatory Environment, Reg BI & Supervision

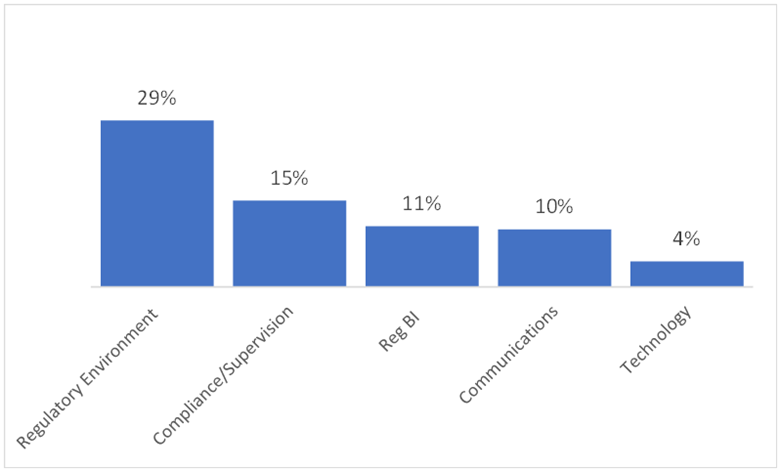

Many conversations at SIFMA C&L centered on the confluence of emerging regulations, including challenges pertaining to the implementation of Regulation Best Interest (Reg BI), technology and supervisory processes. (Chart 1).

In fact, Reg BI was such a hot topic at this year’s event that the session, “Reg BI and Best Interest Standards of Care – Navigating the Regulatory Landmines”, was over capacity and attendees were turned away at the door. Top of mind for many influential industry leaders was the topic of implementing Reg BI beyond updating the text in policies and procedures.

Many in the audience posed questions on the need to document investment recommendations and the assessment of costs and reasonably available alternatives. The overwhelming response from panelists and regulators was that without a consistent and repeatable process that can be evidenced, it would be impossible for firms to maintain compliance with their policies and procedures. In other words, policies and procedures need to be viewed along the same priority as having adequate systems in place to support advisors.

Given the regulatory focus on assessing costs and reasonably available alternatives, InvestorCOM was recommended by one of the panelists, Abby Armstrong, VP & General Counsel from Commonwealth Financial Network, as a key Reg BI solution provider. She noted that InvestorCOM’s end-to-end analysis-to-documentation capabilities are an intuitive way to capture the best interest analysis along with supporting documentation across all recommendations.

Chart 1: Top Five Compliance & Legal Priorities for 2023

Source: www.sifma.org/wp-content/uploads/2023/03/SIFMA-Insights-2023-CL-Annual-Seminar-Survey-Results.pdf

The sense of urgency around Reg BI was affirmed by regulators. Bill St. Louis, EVP of the National Cause and Financial Crimes Detection Program at FINRA stated that FINRA intends to examine 1,000 broker-dealers for compliance with Reg BI by the end of 2023. This represents approximately one-third of FINRA’s member base. Mr. St. Louis’ colleague, Chris Kelly, Senior Vice President and Acting Head of Enforcement, reiterated the sentiment by stating that findings are more likely to lead to enforcement, especially as many examinations have already called out certain deficiencies.

Market Volatility, Inflation and Recession Fears

At this year’s event, the focus on the pandemic subsided and attention instead zeroed in on the recent news around the bank failures. Many panelists stressed that during times of volatility and uncertainty firms need to be dually disciplined in ensuring they have the appropriate processes and technologies to comply with a myriad of regulations.

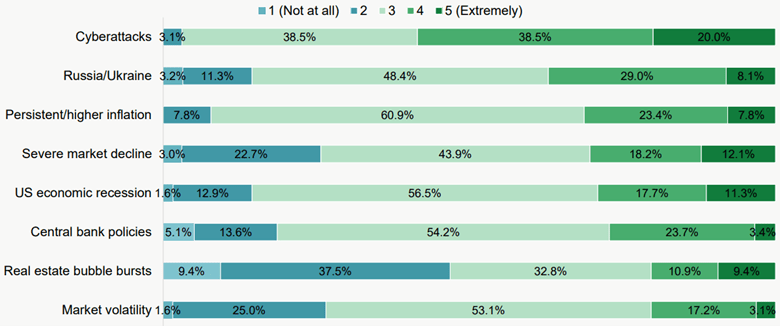

Chart 2: How Would You Rate Your Level of Concern About…?

Source: www.sifma.org/wp-content/uploads/2023/03/SIFMA-Insights-2023-CL-Annual-Seminar-Survey-Results.pdf

A major area of commentary surrounded the impact of changing investor preferences during market volatility. For example, LPL Financial’s President & CEO Dan Arnold stated that good compliance remains one of the firm’s primary strategies, especially during times of volatility. Rather than investing in compliance to avoid risk or cost, LPL is investing because it will make their business and their independent advisors more successful.

InvestorCOM’s data shows that during times of volatility, investors look to transfer assets. For example, data sampled over the period January to March 2023 across four clients showed that InvestorCOM RolloverAnalyzer captured more than 5,500 compliant rollover recommendations. Far too many to possibly track and ensure compliance using manual methods, especially when considering the regulatory focus on Reg BI.

Meet Your Regulatory Requirements with InvestorCOM

Wealth firms and financial professionals use InvestorCOM’s end-to-end compliance platform to assess reasonably alternatives when making investment recommendations, make compliant account-type recommendations and rollover recommendations based on service, fit and cost.

Learn how our purpose-built compliance technology can help you.