Rollovers and Reasonably Available Alternatives: Insights from Industry Experts

InvestorCOM recently chatted with Tom Selman, Founder of Scopus Financial Group and Rob Dearman, CEO and Chief Innovation Officer at DCG Insight to discuss the history on rollover recommendations, the drivers behind the growth of the rollover market, and the why behind the regulatory requirement to evaluate reasonably available alternatives (RAA).

Parham Nasseri [PN]: Tom, as a former head of policy at a regulatory organization, you’ve had an insider’s perspective on the intention of policy formation. Can you share a brief history on rollover recommendations?

Tom Selman [TS]: The whole interest in rollovers began with the variable annuity exchange business. For over 20 years, FINRA paid special scrutiny to variable annuity sales and to exchanges from one variable annuity another. Concern arose as the contract began to wear out, a holder of a variable annuity was deeper and deeper into the contract, and a commission broker had an incentive to roll that contract into another one and begin a new period of various fees, charges, and commissions.

There are several reasons why I think variable annuities exchanges in particular were concerned. First of all, there’s a commission business. Second, variable annuities have always been considered to be complex products, and third, variable annuities have a retirement element.

The primary purpose of buying variable annuities is to protect against the possibility that you’re not going to have regular income, particularly [from] retirement. So those elements I think cause specific scrutiny in variable annuities. But, to me, the variable annuity exchange issue was a predicate to the concern about IRA rollovers. For example, from an employer plan to an IRA, the factors or the circumstances of the rollover, at least in the case of a traditional broker, commission would be generated, so if a customer were an employee in a plan, the broker-dealer wouldn’t earn any money because the broker-dealer is not executing transactions or recommending securities in that plan. But as soon as that money comes into the IRA advised by the broker-dealer, then the broker-dealer would have a commission business. So, there’s a commission-conflict element. Second, you have the retirement component. Third, an employer plan typically has lower fees for the employee as it’s a commission IRA account. Finally, there is an assumption that employer plans are well managed. These plans typically have large asset management companies providing the management, may have index funds, relatively low fees, ERISA coverage. There is a bias among regulators towards the benefits of being in an employer plan and the risks of moving into an IRA.

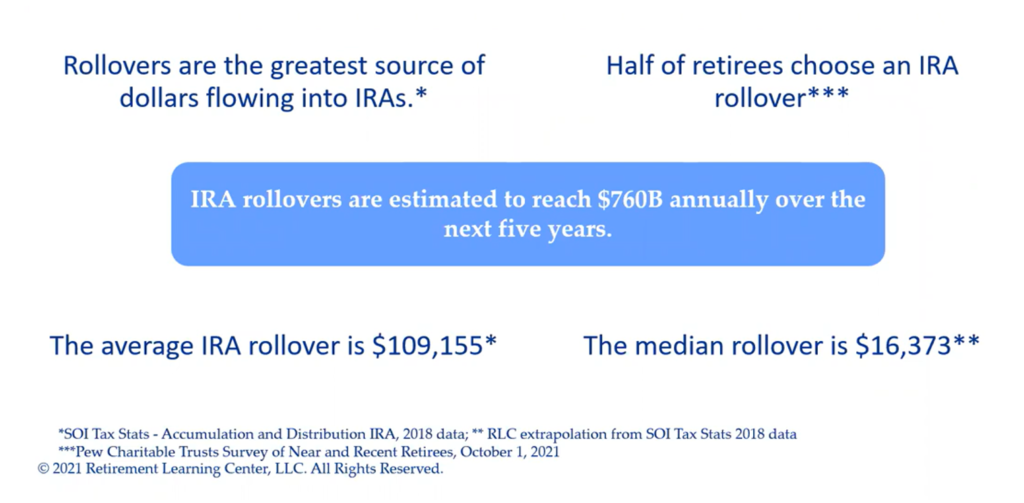

PN: It’s been estimated that the rollover market is expected to reach over $700 billion over the next five years. What do you see as the drivers for this shift across assets in our industry?

Rob Dearman [RD]: A lot of factors. I think the obvious one would be 10,000 boomers are retiring every single day. More and more people are wanting to shift from accumulation-related risks and market-related risks, to longevity risk-management, as well as other inflation-related risks and ensure that that their nest egg is going to last for their lifetime and maybe for the generations to follow.

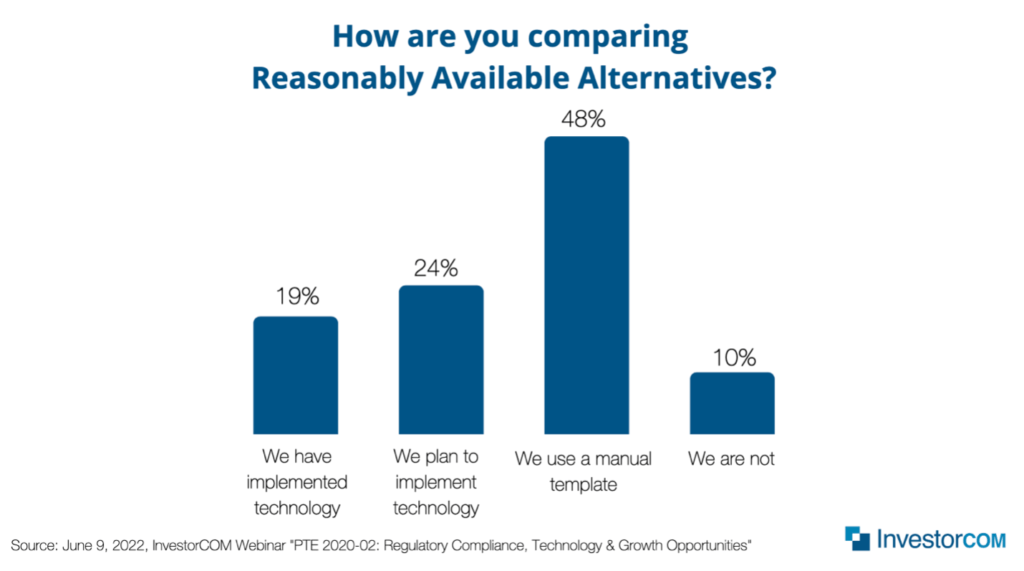

PN: As we saw in the poll, another main regulatory requirement has been the assessment of reasonably available alternatives (RAA). Can you share a bit about the why behind this regulatory requirement?

TS: The expectation that the best interest standard requires consideration of reasonably available alternatives is a fairly new requirement.

I think the first thing the firm needs to do is consider what products are available on the platform. Firms are not required to have a broad array of products. Unless a firm is a limited purpose B-D for example, then I recommend the firm have a variety of products. The firm needs to then decide the categories of those products. Typically, you would look at mutual funds, ETFs, variable annuities, alternative investments of different types. You would try to categorize those and then within each category have some type of technology would be very important to allow for an easy comparison by the associated person. The more difficult it is for the rep to consider the alternatives, the less likely that the alternatives will be reasonably considered.

One big question which has come up, is whether RAA cuts across categories. So far, FINRA and the SEC have been fairly consistent in that they are only looking within categories. Nevertheless, firms ought to be careful. For example, if we consider unlisted REITs vs publicly traded REITs, I don’t think FINRA or the SEC right now requires a comparison between these significantly different products. Earlier this year, FINRA issued a complex products notice and they specifically stated if a B-D is recommending a complex product to retail customers, members should consider whether a less complex product could achieve the same result.

I think cross-category comparisons could become an issue in the future.

—

Firms of all sizes are choosing RolloverAnalyzer to meet their PTE 2020‑02 requirements. Learn more about RolloverAnalyzer or request a demo.

If you enjoyed this article, you can listen to the full discussion online – Watch the replay of the webinar, PTE 2020-02: Regulatory Compliance, Technology and Growth Opportunities