Regulatory Compliance: How Manual Processes Impact the Home Office

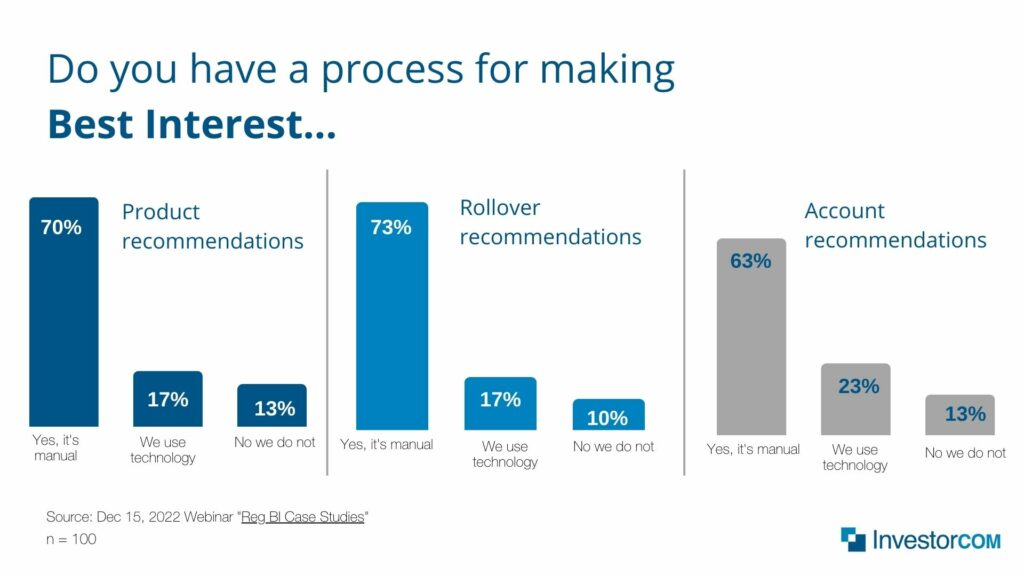

A wealth industry poll taken by InvestorCOM on December 15, 2022, indicated that 63-73% of respondents have manual-based processes in place for making best interest recommendations for investment products (70%), rollovers (73%) and account types (63%).

Much focus has been on how to make it easier for financial professionals to comply with Regulation Best Interest (Reg BI) and the DOL’s PTE 2020-02, whether that is through technology or manual forms and templates. But is anyone considering the issues facing the home office, and what these manual processes will mean to them? There is a never-ending supply of concerns that will keep CCOs and COOs up at night.

Here are a few that I think we should consider today.

Keeping Forms Up to Date

If you are relying on manual forms or spreadsheet templates as a pillar to your best interest recommendation practice, one key thing you need to consider is how you will keep your forms updated AND properly disseminated to the field.

Arguably, updating the form(s) versus updating a technology-based solution will be comparable in effort. However, disseminating the updated version to your field and insuring they are using the correct form is drastically different. You need to avoid the “black hole” that so often exists within shared drives and network folder structures, where information is stored in multiple disparate locations. And what could be worse, is the potential impact if the field uses the previous version. Depending on what changes were present, using the previous version of a manual form or spreadsheet could be a non-issue or it could result in significant work and/or cost to correct issues and have additional touchpoints with the end client that may be unpleasant.

Providing Accurate Supervision

Considering the regulatory focus surrounding best interest recommendations, how you provide supervision is important.

- How often do you review recommendations?

- Is there a review and or approval process, or are you relying on “after-the-fact” supervision?

- Can you spot errors as well as trends that could lead to errors?

- How can you identify the circumstances where a recommendation was not made but should have been?

- Can you easily test your recommendations against your transactions to prove your policies are being followed?

These questions feed into your supervision process. If you have any kind of significant volume in your recommendations, it will be a challenge for you to efficiently manage this process if your core best interest flow is based on manual forms.

If your firm has deployed compliance technology, it is important to make sure that you have the right visibility into your data and flows so you can answer these questions efficiently. Simply having access to data or having a dashboard does not necessarily check the compliance box. Make sure you have the right data and the right dashboard views that give you the information you need to efficiently monitor your activity.

Testing Policies and Procedures

Testing your policies and procedures will be paramount to a successful program. And it is really the only way you can find instances where the activity took place without a required recommendation being made. This may be called pre- to post-trade reconciliation, or account opening reconciliation. Regardless of the name, it takes data and procedures to analyze, which takes time. Trying to perform this type of analysis by leveraging manual forms will be very time-consuming and will take efforts away from other activities.

Not All Recommendations are Acted Upon

One of the most overlooked facts in the best interest conversation right now is that not all recommendations will result in positive action or execution of the recommendation. For example, a recommendation to roll assets out of a 401k could lead to a client NOT rolling their assets into an IRA. Similarly, a client may decide NOT to purchase a recommended security.

The risk is that many firms are choosing to embed their best interest discussions, rationale, and processes within other existing processes that are predicated on an action being taken. For example, if the rollover questionnaire is built into the new account form and if the analysis leads a client to NOT roll the assets over, how are you documenting that recommendation? Isn’t it just as important to document the best interest analysis of the recommendation, to be compliant from a regulation perspective, and to gain the trust of clients?

In short, the best interest problem does not impact only the financial professionals and their ability to serve their clients. It also impacts the home office, which could add more expenses and pressure to an already-taxed area.

Please keep both sides of the coin in mind when evaluating which direction you decide to take.