CFR Compliance: An Analysis of Significant Changes to the Mutual Fund and ETF Landscape

The Client Focused Reforms (CFRs) introduced a higher standard of conduct for wealth management firms and financial advisors, with the goal of putting “investors first.” The regulations explicitly outline a set of enhanced Know-Your-Product (KYP) standards, requiring firms to assess, approve and monitor the securities made available to clients.

To help support InvestorCOM’s wealth management clients in meeting the KYP requirements, we periodically analyze the magnitude and frequency of change to investment products in Canada. One of our studies from 2019 showed that there were an average of 2,041 changes reported every week during a five-week period.

The industry has evolved in the three years since the regulations were originally introduced. Many wealth management firms explored pathways to defining specific requirements around monitoring “significant change” to their products, built solutions to comply with regulations, and broadly rolled them out.

To take a fresh look at the obligation to monitor significant change over the past three years, we recently performed a new analysis. Using the data available in InvestorCOM ShelfMonitor, we analyzed the changes to the mutual fund and exchange-traded fund (ETF) landscape over a 12-month period, from June 1, 2021 to May 31, 2022.

Analyzing Significant Change to the Mutual Fund and ETF Landscape: What We Discovered

There is no clear regulatory definition for what “significant change” means or how to track this information. From our experience working with many clients across the industry, the following four data points are considered the most important:

- CIFSC category

- Risk rating (NI 81-102 Appendix F)

- Management expense ratio (MER) (NI 81-106 Part 15)

- Prospectus time horizon (not consistently available for ETFs)

Table 1 summarizes the results of our analysis of changes at the Fundserv Code level that occurred during the 12-month period:

| CIFSC | Risk Rating | Time Horizon | MER | Total | |

| Mutual Funds | 2,173 | 1,135 | 2,317 | 38,940 | 44,565 |

| ETFs | 25 | 65 | N/A | 724 | 814 |

| Total | 2,198 | 1,200 | 2,317 | 39,664 | 45,379 |

Table 1: Frequency of changes to mutual funds and ETFs, June 1, 2021 to May 31, 2022

The analysis uncovered many insights. Here are the top four:

- Changes to CIFSC

Based on a combination of quantitative and qualitative factors, the CIFSC category is an important starting point for comparing mutual funds and ETFs. Because funds are classified based on what they invest in, monitoring changes to the CIFSC category is key to ensuring that enhanced suitability and Know-Your-Product (KYP) obligations are met.

Here are a few examples of changes or drifts to the CIFSC category:

- Changes in investment style: When a fund changed from Global Fixed Income Balanced to Global Equity Balanced, it represented a shift in exposure from equities representing less than 40% of total assets to equities representing greater than 60% of total assets.

- Changes in geographic focus: When a fund changed from Global Equity to Emerging Markets Equity, it represented a change in geographic focus from less than 90% to 90% or more of its equity investments in emerging markets.

- Changes in sector concentration: When a fund changed from Sector Equity to Natural Resources Equity, it represented a change in sector concentration from less than 90% to 90% or more of its equity investments in natural resources.

Given the best interest spirit of CFRs and the requirement to monitor products, these changes are paramount in an advisor-client dynamic. For example, a shift in exposure from fixed income to equity or a change in sector or geographic concentration will have significant implications for the overall asset allocation of an investor’s portfolio and could potentially swing a portfolio into an offside or unsuitable position. With 107 asset managers reporting a total of 2,198 CIFSC category changes to their funds, it is safe to say that a monitoring program is required to catch and respond to these changes as they arise.

- Changes to Prospectus: Risk Ratings

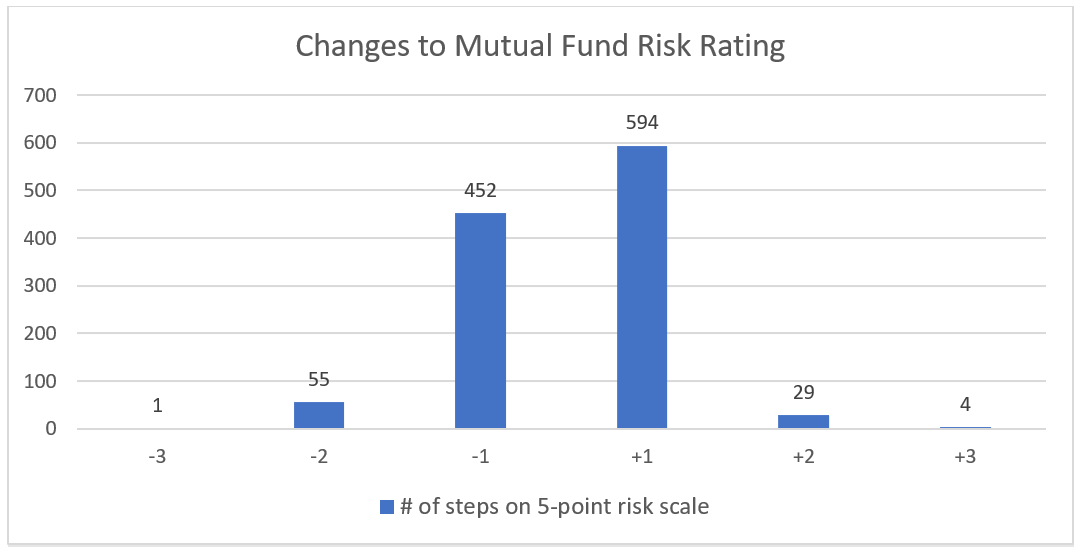

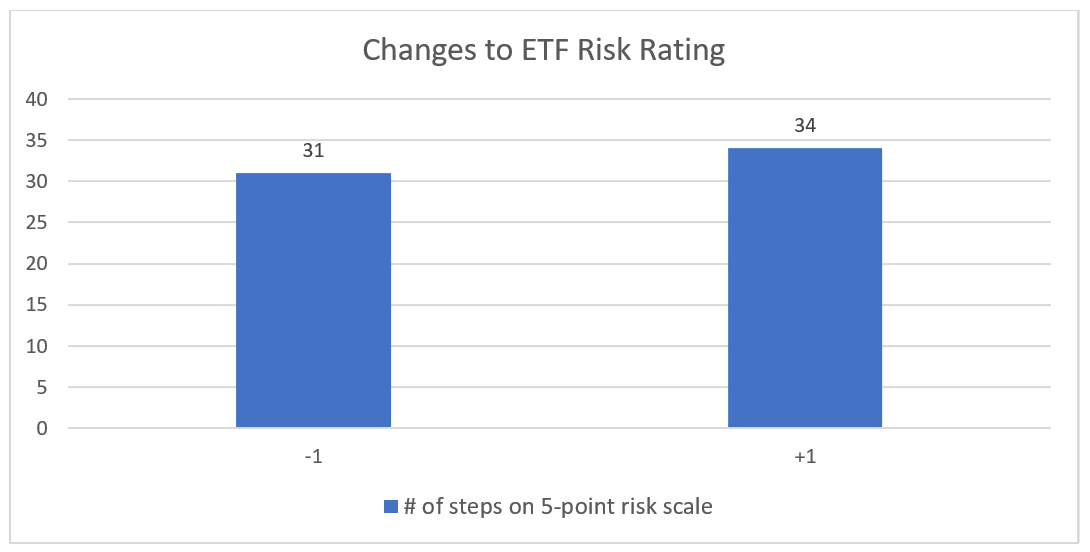

The Canadian Securities Administrators (CSA) mandates investment funds to issue a risk rating for each fund. This is intended to foster greater transparency and consistency and allow investors to more readily compare the investment risk levels of different funds. It is common knowledge that the prospectus risk rating of a fund may change periodically based on the degree of volatility in the underlying holdings. What may be surprising is the frequency of change. Specifically, in the 12-month period, 1,135 mutual fund and 65 ETF prospectus risk rating changes were reported. As detailed in the chart below, 627 mutual fund and 34 ETF risk rating increases were reported, while 508 mutual fund and 31 ETF risk rating decreases were reported in that same period.

A fund’s risk rating may be one of the most widely monitored data points, given its strong alignment with Know Your Client (KYC) and suitability determinations. And a change to a fund’s risk rating could significantly impact an investor’s portfolio. For example, a fund in the dataset increased its risk rating by two notches. The fund was introduced in the fall of 2020. At its inception, it was estimated to be a medium-risk product and was changed to a high-risk rating after its first year of operation.

While each client circumstance and portfolio is unique, changes to prospectus risk ratings, like the one above, are “significant” in nature and may require an evaluation by the advisor. After such a change, a client’s portfolio may be offside from a risk perspective. Moreover, how much time would an investor reasonably expect an advisor to take to become aware of such a change and perform a suitability evaluation? Considering this example, combined with the regulatory requirements surrounding product due diligence and advisor KYP programs, firms and advisors need to be able to identify and respond to the impact of changes in risk ratings.

- Changes to Investment Costs: Management Expense Ratio

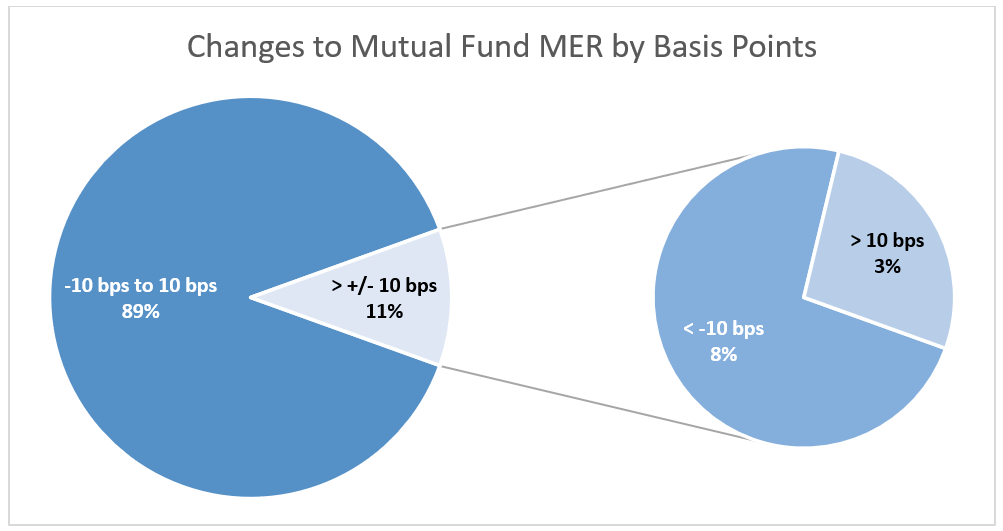

There is little debate around the impact of investment costs on an investor’s product or portfolio returns. Among the four data points outlined above, management expense ratio (MER) changes comprised 87% of all the changes. (See Table 1.)

While every firm determines what magnitude of change will be “significant,” InvestorCOM ShelfMonitor’s Materiality Index stratifies the degree of significance of MER changes so that firms can define the appropriate guardrails for their business. For our analysis, we set the guardrails for significance to changes greater than 10 basis points in either direction. We discovered that 11% (4,281) of mutual fund MER changes and 8% (61) of ETF MER changes were greater than +/- 10 basis points.

One of the examples of a change outside of our guardrails was a liquid alternative fund that reported two successive MER increases of 40.6% and 19.52%, for a total increase of 181 basis points. Unplanned cost increases like this will result in a drag or reduction in an investor’s portfolio performance, along with a potential conflict between the advisor and their client.

- Positive Consequences of the CFR Requirements: Time Horizon

One of the interesting and perhaps unintended consequences of the CFRs is that industry data is improving. Much of this improvement is thanks to the need for firms and financial professionals to better understand the products made available to investors and to use objective data and algorithms in their due diligence and best interest considerations. While much of this data is broadly available through various sources, there has historically been a degree of inconsistency and quality that made monitoring for significant product changes impossible to do manually. In our analysis, we found evidence of how this reliance on good data is raising the bar.

Of the 2,317 changes to mutual fund time horizon information, 1,935 were newly reported values. While the reporting of data not previously reported is not a significant change in itself, the visibility, or in this case the absence, of this data has encouraged many asset managers to ensure the accuracy and completeness of their data with providers such as Fundata. Further to our discussion of MER changes, many changes reported on the far end of the spectrum were generated by errors or inconsistencies in data reporting. The immediacy and visibility that tools like InvestorCOM ShelfMonitor offer to identify “significant errors” has raised the awareness of asset managers and dealers alike, encouraging swift remediation.

The Evolution Continues

In the past year, the industry has moved from the impossibility of monitoring investment products for significant change to approaches and insights that have helped firms target and refine their approaches.

The work the industry has done to identify and define significance and implement solutions has helped quantify and make product monitoring possible. While the analysis we performed used the universe of products, many firms have applied a shelf filter to only watch for changes on their approved product shelves. While the broad observations would still apply to those firms, those with smaller shelves have fine-tuned and reduced the amount of change data requiring review and action.

The next stage in this evolution is bringing this change information to the front lines. Doing so will empower financial professionals to continually educate themselves and determine what, if any, client-facing actions need to take place.

Many firms are looking to extend their change monitoring program to financial professionals. However, doing this effectively and efficiently requires that the amount of information made available is further focused and refined by an order of magnitude.

Learn how InvestorCOM can provide your firm with a comprehensive assessment of the significant changes that have occurred on your product shelf and to your advisors’ books of business.