Measuring the Impact of Reg BI’s Best Interest Requirement

Since coming into force on June 30, 2020, broker-dealers have struggled to define and demonstrate how Reg BI’s Care Obligation assessment of reasonably available alternatives (RAA) is improving client outcomes.

With a couple of years of data available, InvestorCOM conducted an analysis to understand if best interest can be measured, and more importantly if it can improve over time. We examined two years of recommendation data from financial professionals using InvestorCOM PeerCompare and the results of our analysis show that InvestorCOM’s technology is making a positive impact on helping the industry change outcomes.

Peer-based Approach to Assessing Best Interest

InvestorCOM PeerCompare takes a peer-based approach to assessing costs and reasonably available alternatives. In other words, instead of head-to-head comparisons of a limited number of product alternatives, PeerCompare provides a comparison of a product against all its peers in a single-click. An instant rating of a product relative to its peer group keeps the ultimate decision with the financial professional but shrinks the universe of reasonably available alternatives to a meaningful and manageable set of alternatives.

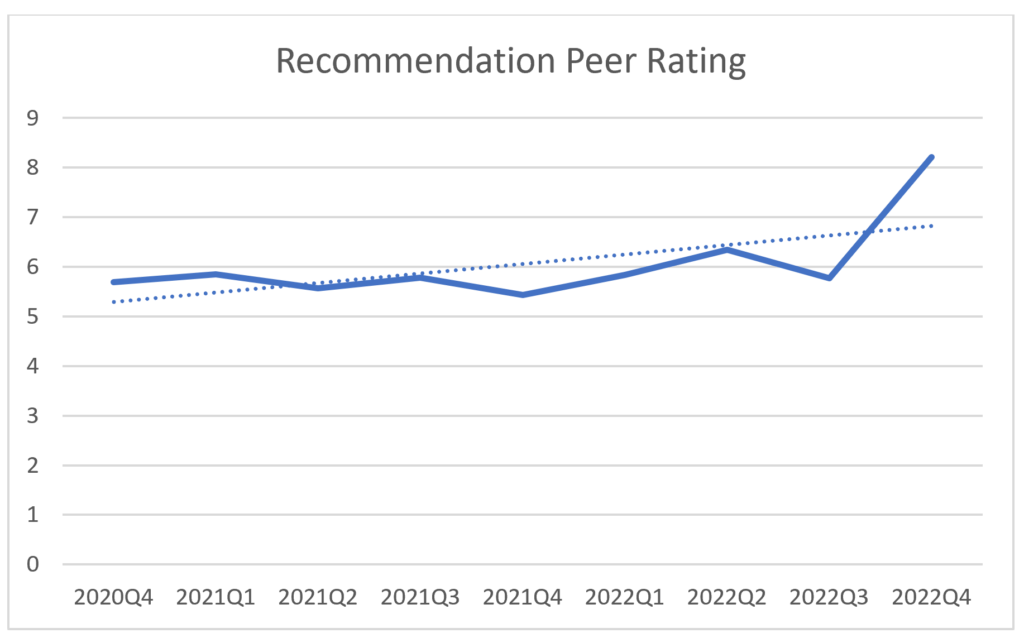

Figure 1: Recommendation Peer Rating

Using InvestorCOM’s proprietary Peer Rating algorithm to assess the relative rating of a recommendation, we observed an improvement to the average relative “quality” of a recommendation by 1.5 points on our 10-point rating scale over a 2-year period, a 29 percent improvement.

While the improved trend on recommendation quality was a positive outcome, we examined the data further to test the impact of the assessment of alternatives across cost, risk and return metrics.

Will Considering Alternatives Result in Lower Cost Recommendations?

One of the components of the Peer Rating is the Net Expense Ratio (NER), a significant factor in conflict of interest and best interest considerations. In our analysis, we explored whether the Care Obligation’s requirements would drive recommendations to the lowest cost products.

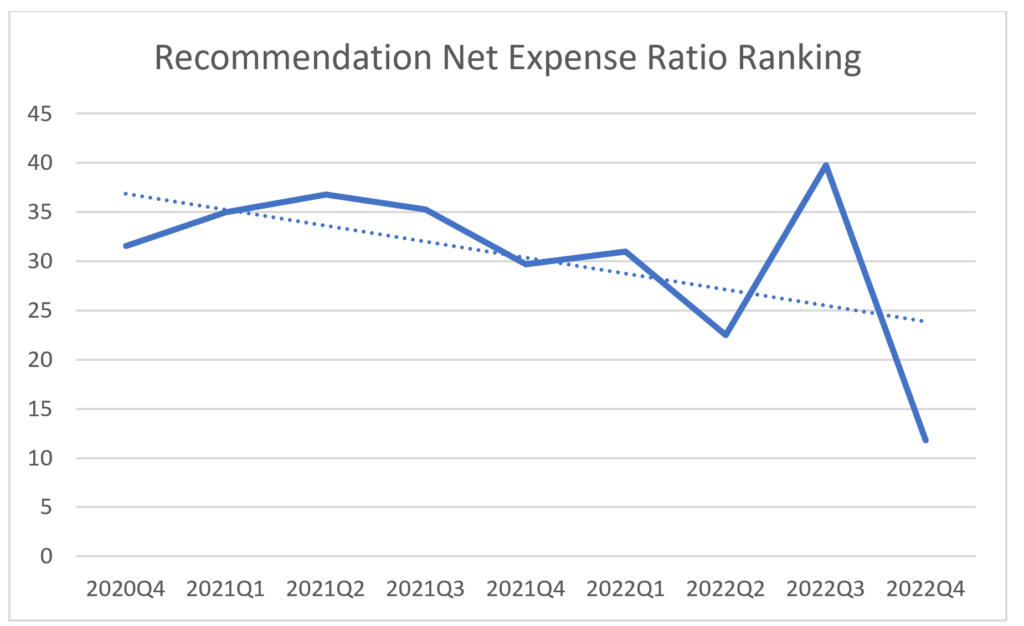

Figure 2: Recommendation Net Expense Ratio Ranking

The data showed that when financial professionals use PeerCompare as part of their recommendations workflow they tend to recommend products with relatively lower investment costs over time. Over the study period, the average relative peer rank of the cost of the recommendation dropped by 35 percent from approximately the 37th percentile to the 24th percentile. This is a significant trend that ultimately benefits the investor and one which we will continue to monitor over time.

Will Returns Justify the Cost?

To justify or offset a possible conflict of interest on recommending high-cost products, we originally planned to test whether financial professionals would begin focusing on products with higher historical returns. With the observed reduction in relative costs, we decided to test if the converse would be true – a sacrifice of historical performance in exchange for a lower cost.

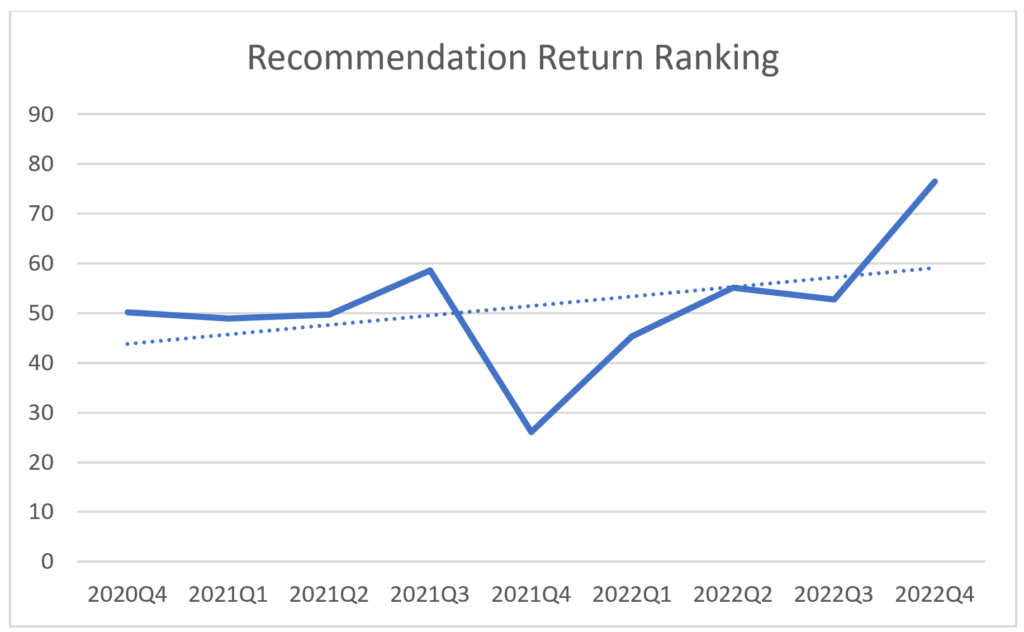

Figure 3: Recommendation Return Ranking

When observing historical 3-year returns on mutual fund recommendations, there was a 15-percentile or 34 percent improvement on the average recommendation. This suggests that financial professionals are leveraging PeerCompare beyond making suitable recommendations and exploring and recommending alternatives that are delivering a better cost-return balance.

Continuing to Manage Risk

The third dimension of Peer Rating is risk as measured by a fund’s 3-year standard deviation. Applying InvestorCOM’s balanced scorecard methodology, we tested further to determine whether the observed overall improvement in recommendation quality would also be reflected in the risk dimension.

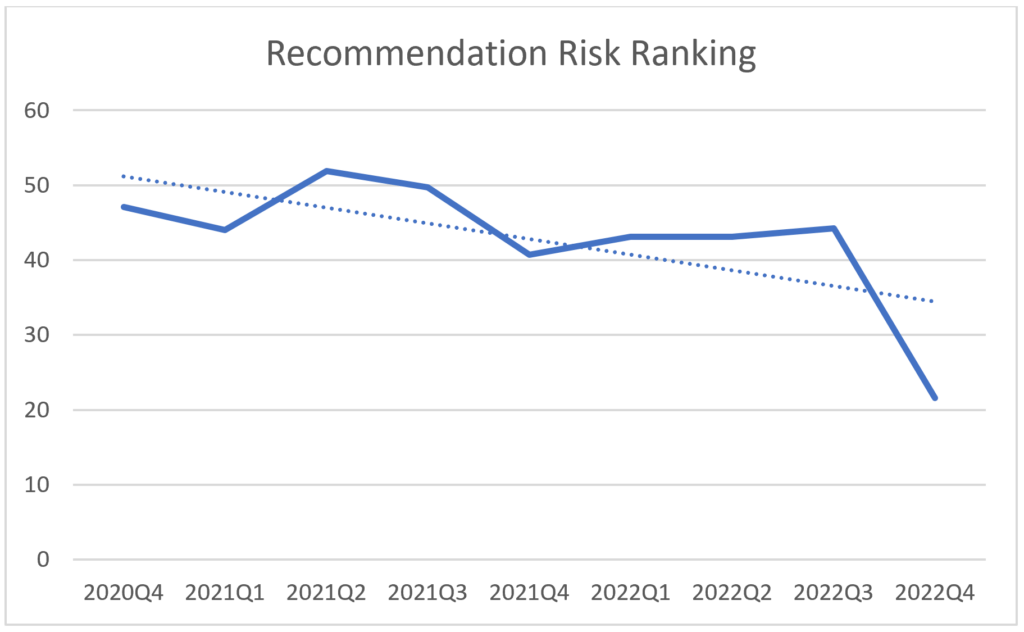

Figure 4: Recommendation Risk Ranking

The data indicated a gradual and consistent decrease in the relative risk level of recommendations during the analysis period. The average 16 percentile decline in the relative risk metric indicates that amongst reasonable alternatives, recommendation patterns also began to reduce the risk by 31 percent.

Conclusion: Compliance Technology can Enact Behavior Change

We plan on revisiting this analysis to see how the data evolves as Reg BI matures.

Early indications from this study suggest that providing more information through automated solutions can change behaviors and improve outcomes without limiting choice. Best Interest is a term that can be difficult to define and measure, yet InvestorCOM’s proprietary Peer Rating capability is shown to be an effective way to quantify its impact.

Please contact us at info@investorcom.com if you’re interested in getting a personalized assessment for your firm so you can move the Best Interest needle forward.