Implementing KYP: Client Conversations and Firm Preparedness

Throughout the CFR journey, InvestorCOM has met with regulators, wealth leaders and many compliance experts around the principles-based elements of the reforms. We are proud to have helped dozens of firms meet their KYP requirements with confidence.

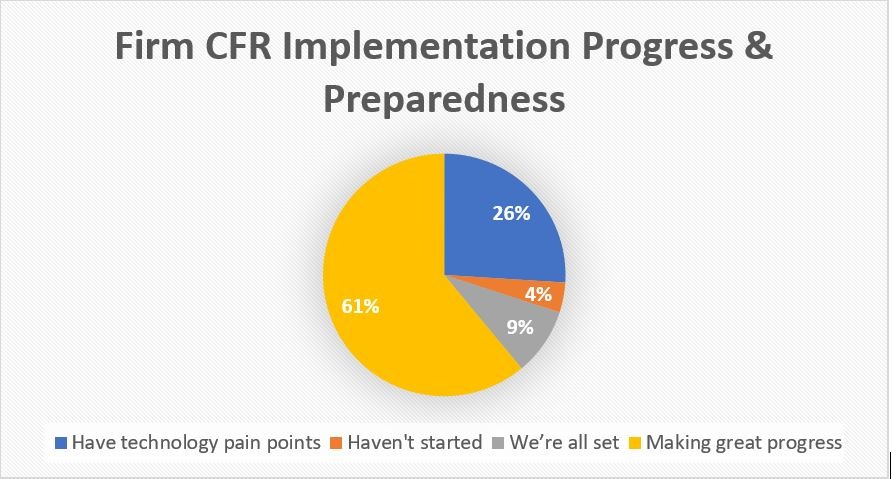

Reflecting on the approach firms are taking towards implementing a solution for the CFRs, we can group firms into five categories:

- Early Adopters. These firms are either visionaries or they had an opportunistic need that aligned with our products – for example, a messy process, a gap, a shelf issue, or something else. We’ve been working with firms for more than a year and they are well on their way to meeting the CFR requirements.

- Large Firms. These firms tend to move slower. They have long internal approval cycles, implementation timelines, and challenging integration requirements. Regardless of the complexity, these firms needed to start their project a year in advance in order to meet the December 31 KYP implementation deadline. KYP conversations at these firms started in late 2020. At that time, their challenge centered on making decisions in advance of the final rules being published – so there was a lack of clarity they were faced with.

- “Planful” Firms. These firms have an aversion to being pushed up against a deadline. They also have strict project and change management processes. Most of these firms started forming their CFR teams in March or April 2021. Throughout spring and summer, they assessed technology and made a decision by late summer. We onboarded four firms like this in summer 2021. Overall, these are firms that are planful and moving in a disciplined approach.

- “Many-of-us” Firms. Most firms fall into this category. These firms were focused on conflict of interest work until the end of June and started thinking about KYP after Canada Day. Decisions were made throughout August and September and firms are now launching technology, finalizing procedures, and planning advisor training. They are in good shape to meet the KYP implementation deadline by December 31.

- “Rest-of-us” Firms. These are firms that for various reasons, kicked off their KYP project after the summer. Since Labour Day, we probably get two to three inbound calls per week. It’s not uncommon in our initial calls to hear from dealers that “we are starting to brainstorm how to solve for KYP”. The principles-based nature of CFR means firms need to brainstorm and think about how to combine the elements of policy, procedure, supervision, and technology to achieve compliance in a way that suits their operating model.

Technology Deployment Trends: What We Are Seeing

Firms in these last two categories are experiencing an increased sense of urgency right now with work expected to continue into 2022. Firms just starting to deploy technology need to consider the time required for advisor training and the holidays – both of which will impact implementation dates. Furthermore, deferring to the new year to deploy a solution will occur at the peak RRSP season. For these reasons, we fully expect some firms to complete the rollout and deployment after February.

Even though we are coming close to the home stretch for KYP, some firms are just entering their procurement phase. At the time the “planful group” was kicking off their work, there was chatter that the regulations were not fully approved and still subject to change, and hence it may be a fool’s errand to create a solution for something that isn’t final yet. This theme was present with vendors and firms alike with many saying “let’s wait and then we’ll start”. But for projects just getting started, these firms are coming up against a deadline that will be very difficult to achieve at this point.

There’s also a financial component at play. Eighteen months ago when firms were setting their 2021 budgets, it wasn’t clear what would be required. They were asking, “Can we accomplish everything we need with people and process?, Do we need technology?, How much will that cost?” None of these questions had answers at the time. Or, perhaps some made assumptions that didn’t hold up over the course of the year as implementation plans started taking shape just in time for 2022 planning.

Figure 1: Level of Firm Implementation Progress and Preparedness, Poll Results of 149 Webinar Attendees on Oct 6, 2021. Source: https://investorcom.com/implementing-kyp-dealers-advisor-case-studies/

Meeting the KYP Implementation Deadline

How will this time crunch play itself out? Firms making their decisions this fall or later are taking a phased approach, at least in deploying a technology solution. There are various approaches to phasing in solutions.

- Launch a standalone solution now and save any customization or integration for 2022 since that takes extra time.

- According to products on the dealer’s shelf. This phase depends on the complexity of the product shelf. For example, launching with Mutual Funds and ETFs first since they are well structured and have a well-worn path, and adding other security types like equities and fixed income products one to two months later.

- Get through the year-end with a manual process. Firms know this approach is not sustainable. This is difficult as it requires more documentation, but it gives them time to implement the technology on their own terms.

- Wait and launch next year. Obviously, while the firms talking to us see the year-end threshold slipping past before its launch, they still have that sense of urgency and commitment to making it happen.

Contact our team to learn more or to see a demo of InvestorCOM’s compliance platform for the CFRs.

Watch the On-Demand Webinar “Implementing KYP: Dealer & Advisor Case Studies” where we share case studies on how Canadian investment dealers and advisors are tackling their KYP requirements.