CSA/CIRO Notice on Firms’ Conflicts of Interest Practices

The Canadian Securities Administrators (CSA) and the Canadian Investment Regulatory Organization (CIRO) published a joint Staff Notice (31-363) on August 3, 2023 summarizing their review of firms’ Conflicts of Interest practices as it relates to the Client Focused Reforms.

Of the 172 firms the CSA, IIROC and the MFDA reviewed, no deficiencies relating to conflicts of interest were raised for 37 firms.

Here is a summary of the findings:

For dealers, COI and KYP go hand in hand because a well-designed KYP program will ensure a firm has the necessary controls to mitigate and monitor conflicts. In particular, the exams found:

- firms lacked controls to address COIs, or those implemented were insufficient to address the COIs in the best interest of clients,

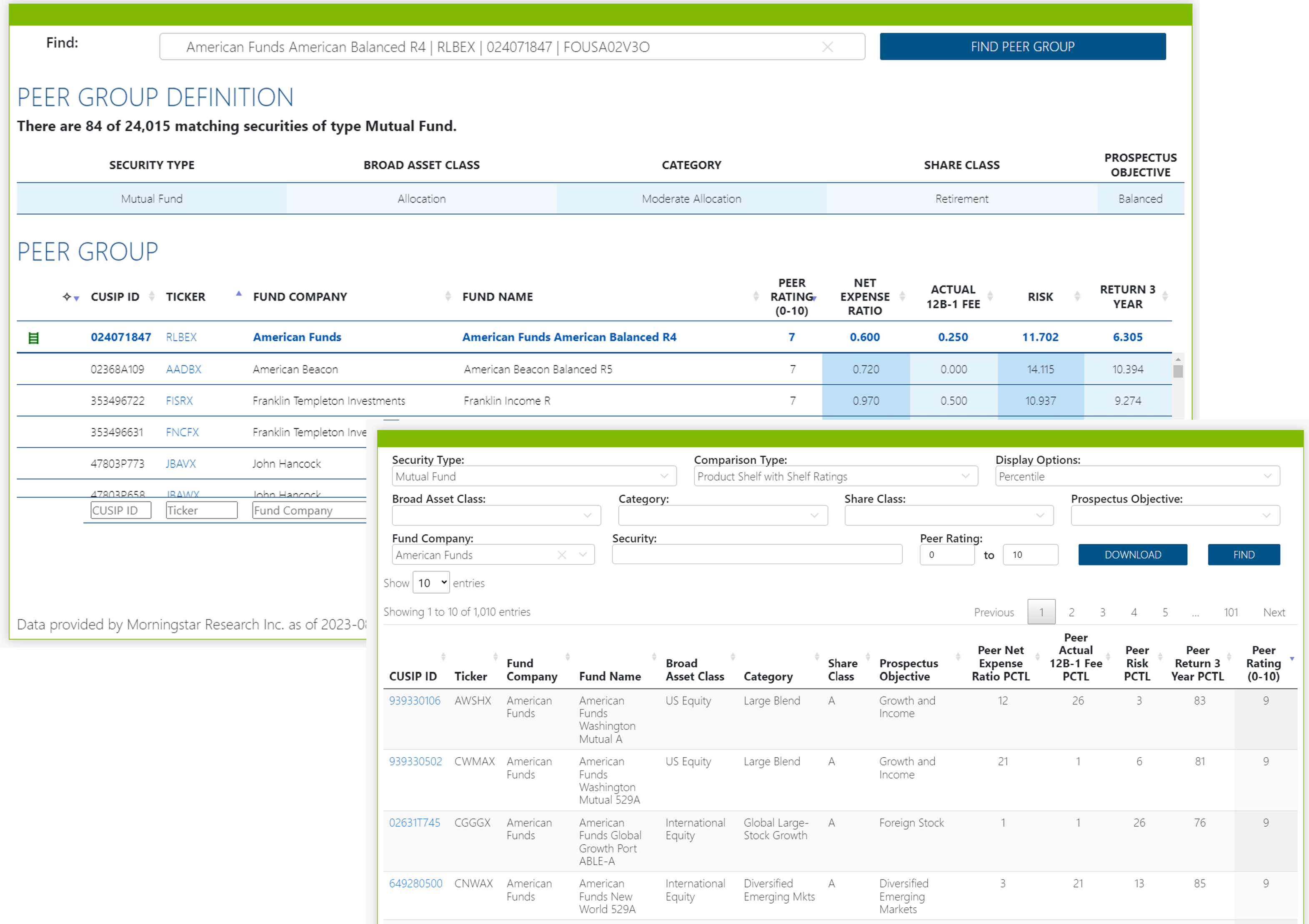

- firms need to conduct periodic due diligence on securities on the shelf that provide third-party compensation to determine if securities are competitive with comparable alternatives available in the market. (Learn how PeerCompare can help.)

Firms with proprietary products

- often relied on performing suitability assessments and disclosure to address conflicts. “In our view, this generally will not be adequate to address these material conflicts of interest in the best interest of clients.”

- will need oversight for KYC, KYP and suitability determination, as well as a KYP process, including subsequent performance and other monitoring, and an ongoing evaluation of the suitability of the securities for client portfolios

- conduct periodic due diligence on comparable non-proprietary products available in the market (ShelfAnalyzer) and evaluate whether the proprietary products are competitive with the alternatives available

Firms with prop- and non-proprietary products

- ensure proprietary products are subject to the same KYP processes, as well as ongoing performance and other monitoring, as non-proprietary products

- documenting how proprietary products fit within the firm’s business model and strategy, and how they are aligned with client interests

Figure 1: InvestorCOM’s PeerCompare and ShelfAnalyzer technology is used by firms to tackle best interest reforms which have placed increasing pressure on mitigating conflicts.