The Rollover Tidal Wave Is Coming – Are You Ready?

Rollovers from employer-sponsored plans are one of the greatest sources of dollars flowing into individual retirement accounts (IRAs), with more than half of retirees choosing an IRA rollover.

According to a study by LIMRA’s Secure Retirement Institute, IRA rollovers represented about $565 billion in 2019 and swelled to $623 billion in 2020, with the wave expected to grow to more than $760 billion annually over the next five years.

The Requirements for Making Rollover Recommendations

The Department of Labor’s (DOL) Prohibited Transaction Exemption (PTE) 2020-02 has been in effect since February 2021, allowing financial professionals to receive compensation for rollover recommendations provided that their advice meets a set of best interest requirements.

Principal among these requirements is a documented analysis of why the rollover recommendation is in the retirement investor’s best interest. This requires financial professionals to:

- Obtain cost information for the existing and proposed plans

- Research the services and benefits available

- Assess the relative importance of the benefits and services to the retirement investor

- Write a balanced and clear rollover recommendation

With enforcement of the PTE 2020-02 documentation and disclosure requirements delayed until June 30, 2022, firms have a short window of opportunity to meet the deadline. Regardless of how efficient a financial professional may be, completing the analysis manually and drafting a professional and balanced recommendation can be time-consuming.

Meeting PTE 2020-02: Manual vs. Automated Approach

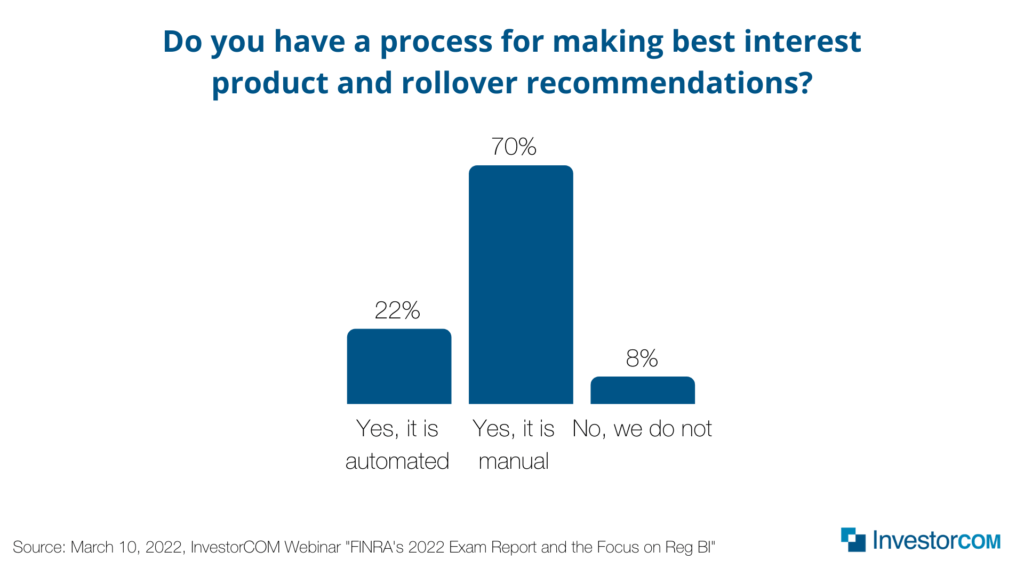

Not only is a manual approach to meeting PTE 2020-02 expensive and time-consuming for financial professionals, but it also puts the firm at risk. Financial professionals tend to find manual processes burdensome and prone to errors. Yet, when InvestorCOM polled 100 firms in March 2022, 70% indicated that their financial professionals are making best interest product and rollover recommendations manually.

Fortunately, purpose-built rollover technology is available to help firms meet the best interest analysis and disclosure requirements via an easy-to-follow, standardized process that can be implemented across the entire firm.

InvestorCOM RolloverAnalyzer is a comprehensive rollover application that helps financial professionals and firms meet regulatory requirements, saving significant time and money and reducing regulatory risk. The intuitive, cloud-based app delivers:

- All the required components of analysis, recommendation, documentation and disclosure

- An easy-to-use workflow of relevant questions that guide the financial professional throughout the process

- Access to standardized data fields, up-to-date Form 5500 plan information and benchmarking data, and firm-approved compliant disclosures

- Professional, client-facing rollover recommendation reports

- The option for financial professionals to print and/or electronically deliver rollover recommendation reports to clients

- A centralized data warehouse of all rollover recommendations that can be accessed by financial professionals, compliance teams and senior management

How to Capture the Rollover Wave

Steve Jobs observed that computers are like bicycles for the mind, meaning that computers can amplify the power of the human brain. A recent industry group discussion on the PTE 2020-02 rollover requirements indicated that a compliant rollover analysis can take up to an hour to complete manually. As our clients can attest, InvestorCOM RolloverAnalyzer leverages technology and data integrations to drastically reduce this time, empowering financial professionals to focus on serving more clients instead of simply checking compliance tick-boxes.

Making balanced recommendations that are in a client’s best interest goes beyond meeting regulatory requirements and getting more business. It’s about guiding clients through one of the most important financial decisions they will face in their lifetime. Financial professionals who approach this important investor decision with confidence will be in the best position to ride the wave of retirement rollovers.

Tags: PTE 2020-02