Demonstrating Compliance with the New KYP and Suitability Determination Requirements

In 2021, the Canadian Securities Administrators (CSA) introduced the Client Focused Reforms (CFRs) in two phases: first the implementation of the Conflicts of Interest rules, and the remainder came into effect on December 31, 2021.

The CFRs are holistic in nature and are based on the fundamental principle that clients’ interests must come first when providing investment advice. The requirements go beyond what was previously a matching exercise and require the advisor to fully understand the security she is recommending, assess the impact of the fees within the recommendation, and consider a range of reasonable alternatives.

As outlined under Section 11.5 of the National Instrument (NI) 31-103, the advisor must demonstrate compliance with the new Know Your Product (KYP) and suitability determination requirements. It also stresses the importance of documenting suitability determinations and documenting the KYP process.

While regulatory examinations haven’t yet focused on the advisor’s sales practices, there are lessons to learn from the US’s Regulation Best Interest (Reg BI) which came into effect in June 2020. Specifically, regulatory notices from the SEC and FINRA have indicated that a simple check the box exercise, or self-attesting that costs and alternatives were considered, will not suffice.

The Importance of Know Your Product and Assessing Reasonable Alternatives

While the CFR requirements are principles-based, it is important to understand why these regulatory requirements place attention on the investor’s interest. The following scenarios illustrate how the CFR’s new KYP and the reasonable alternatives assessments can improve the outcome and quality of recommendations for both advisors and clients. The scenarios also show how compliance technology can support the advisor in considering a reasonable range of alternatives.

Scenario 1: The KYP and Reasonable Alternatives Requirements Are Not Considered

Let’s join the advisor the moment she is ready to recommend a global equity fund to her client. As a caveat, this recommendation is suitable based on the client’s risk tolerance, time horizon, and investment objectives.

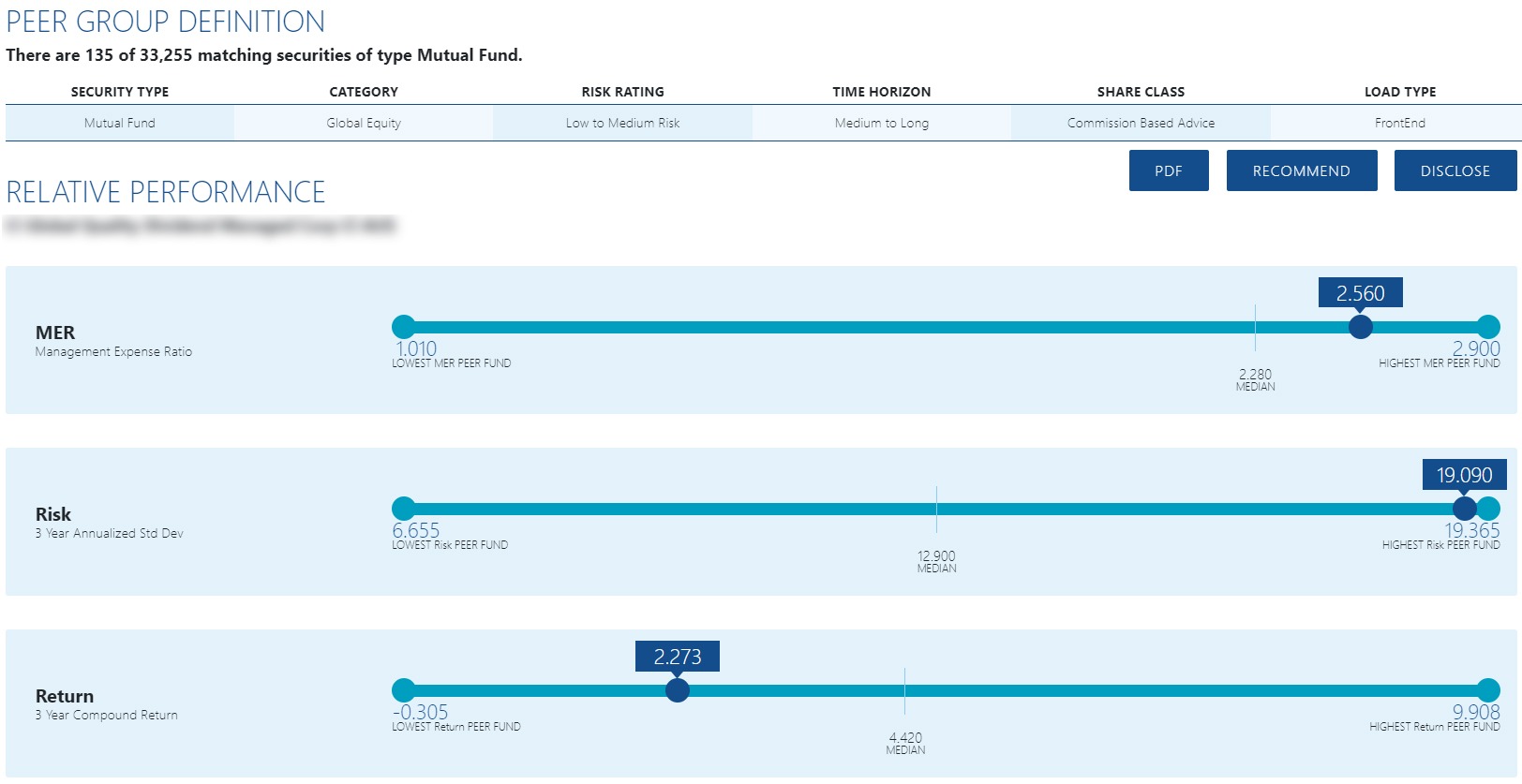

Without considering KYP and comparing to alternatives, the advisor is recommending a product that is more costly and risky than the majority of similar funds in the peer group. InvestorCOM PeerCompare is shown in the image below to illustrate how her recommended fund compares with its peer group.

Scenario 2: The KYP and Reasonable Alternatives Requirements Are Considered

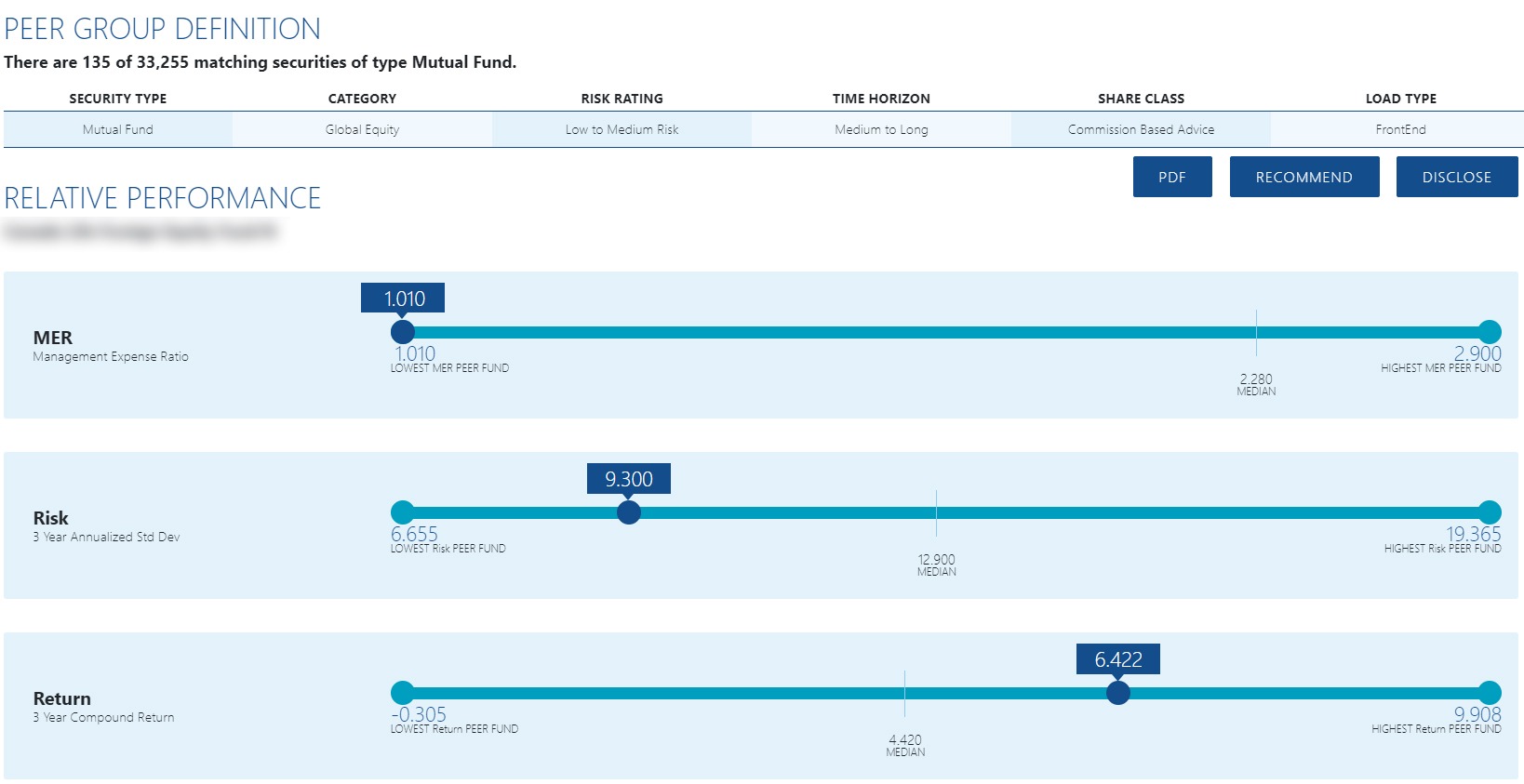

In this scenario, the advisor is using InvestorCOM PeerCompare to fulfill the KYP and reasonable alternatives assessment. She can quickly identify the various attributes of the recommendation and see how a significantly less costly and less risky recommendation will better serve the investor’s interests.

Documenting the Analysis

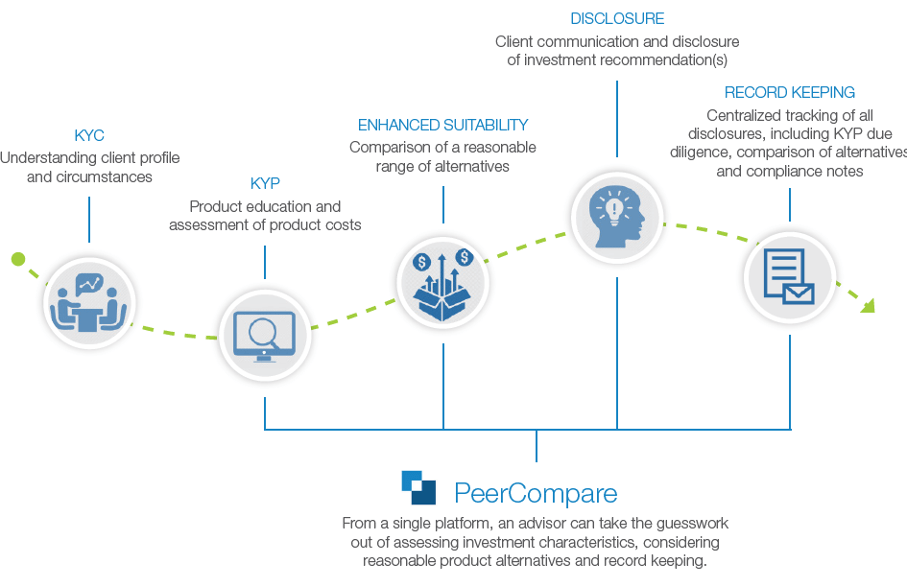

PeerCompare makes it intuitive for advisors to identify an investment’s costs and a product’s alternatives. The solution seamlessly fits into the advisor’s existing workflow, allowing her to compare a specific fund to its peer group based on configurable criteria, including asset class, product category and share class. PeerCompare generates a product peer group based on similar products on a firm’s shelf, including mutual funds, ETFs, seg funds and variable annuities.

PeerCompare also enables firms to track disclosure and facilitate supervision to perform a best-interest analysis and to disclose and/or record a transaction for supervision and audit functions.

Firms are choosing InvestorCOM PeerCompare to meet the Client Focused Reform’s KYP requirements and Reg BI’s Care Obligation requirements. Learn more about PeerCompare or request a demo.