Introduction:

In the intricate world of financial services, where regulatory compliance is paramount, InvestorCOM’s AccountCompare emerges as a robust solution. It not only streamlines the process for financial professionals but also ensures meticulous adherence to crucial regulations. In this post, we’ll explore how AccountCompare aligns with and addresses specific regulatory requirements, ultimately empowering financial professionals to make better decisions for their investors.

AccountCompare Features and Benefits:

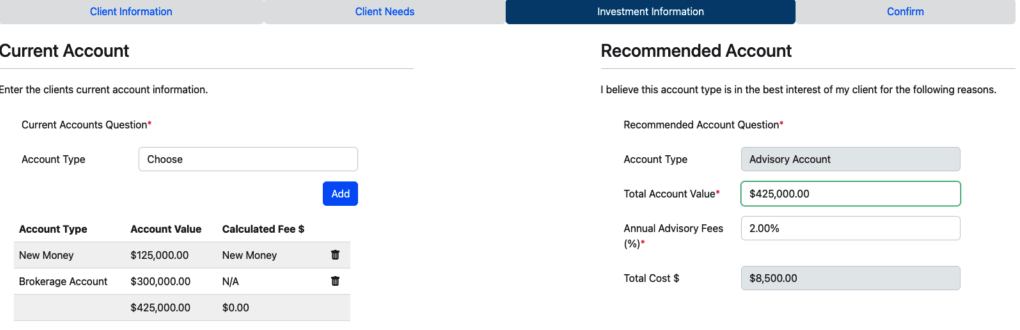

- Step-by-Step Recommendation Process: AccountCompare provides financial professionals with a step-by-step process that simplifies making advisory and brokerage account recommendations. This not only eases complexities but ensures alignment with the rigorous standards set by Regulation Best Interest (Reg BI) and Client-Focused Reforms (CFR). For example, Reg BI mandates that broker-dealers act in the best interest of their clients when making account type recommendations.

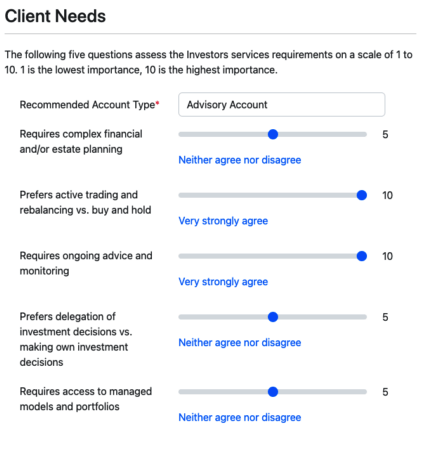

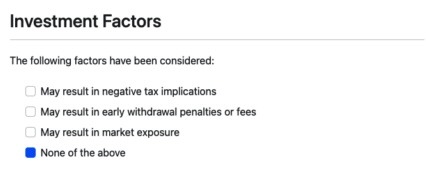

- Intuitive Analysis Framework: In compliance with best interest principles, AccountCompare facilitates a thorough analysis of account type recommendations. It considers factors like client profile, assets transferred, client needs, and transactional considerations. This comprehensive approach ensures recommendations meet the holistic view that consideres potential risks, rewards, and costs. The platform provides a clear rationale for each recommendation, explaining how it serves the client’s best interest and the alternative options considered.

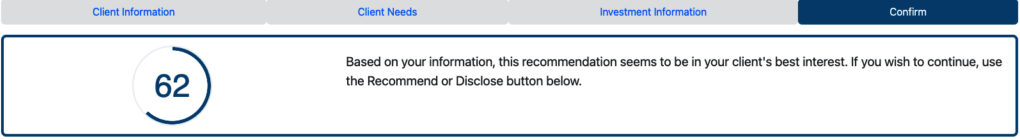

- Proprietary Scoring Methodology: To meet the regulatory requirement of considering the client’s best interest, AccountCompare employs a proprietary scoring methodology. This method enumerates the client’s best interest based on factors like the amount invested and specific needs for opening a new account, eliminating guesswork, and aligning recommendations with regulatory obligations. The scoring methodology enables financial professionals to compare different account types objectively.

- Investor Centric Summaries and Graphical Indicators: AccountCompare addresses the communication requirements of Reg BI and CFR by generating plain language summaries and graphical indicators. These features enhance transparency and understanding for both financial professionals and clients, meeting regulatory standards of clarity and accessibility. Summaries provide an easy-to-read overview, while graphical indicators visually represent the scoring methodology.

- Customizable Configuration: Recognizing the dynamic nature of regulatory landscapes, AccountCompare’s customizable configuration ensures adaptability to evolving standards. This flexibility allows financial professionals to align with emerging regulatory frameworks and tailor the application to meet specific compliance needs. Customization options include adjusting the scoring methodology and tailoring the content and layout of the account recommendation document.

- Documentation and Disclosure: AccountCompare helps financial professionals meet documentation and disclosure requirements stipulated by various regulations, including Reg BI. The platform enables one-click generation of a PDF account recommendation document, automating record-keeping processes and facilitating compliance with disclosure obligations.

- Audit Trail for Compliance: In the context of regulatory audits, AccountCompare’s robust audit trail becomes invaluable. It records all activities related to recommendations, including the sending, receiving, and viewing of disclosures. This comprehensive audit trail ensures that financial professionals can demonstrate compliance with regulatory standards during examinations.

Addressing Key Financial Regulations:

AccountCompare from InvestorCOM is designed to assist financial professionals in complying with various regulations, with a primary focus on Regulation Best Interest (Reg BI). Here are some of the key regulations that AccountCompare can help address:

- Regulation Best Interest (Reg BI): AccountCompare is specifically tailored to help financial professionals comply with Reg BI. This regulation requires broker-dealers to act in the best interest of their retail customers when making a recommendation of any securities transaction or investment strategy.

- PTE 2020-02: Prohibited Transaction Exemption 2020-02 (PTE 2020-02) is another regulatory framework that AccountCompare can assist with. This exemption provides relief to investment professionals who provide advice to retirement investors in IRA accounts.

- Client Focused Reforms: AccountCompare aids in meeting the requirements of CFRs, which are regulatory changes aimed at enhancing the relationship between clients and financial professionals, ensuring that recommendations align with client needs. The CFRs specifically require firms and financial professionals to ensure ‘the type of account recommended, and the nature of the service offered to the client, including the use of investment strategies such as leveraging, are both suitable for the client and put the client’s interest first.’

It’s important to note that the regulatory landscape can evolve, and specific features of AccountCompare may be adaptable to emerging regulations or changes in existing ones.

Conclusion:

AccountCompare is not just a tool for streamlining best interest recommendations; it’s a strategic asset for financial professionals navigating the intricate terrain of regulatory compliance. By addressing the nuances of regulations such as Reg BI and providing a comprehensive solution, AccountCompare stands as a reliable partner in the pursuit of excellence in financial services.