DOL Proposes New Rule to Improve Investment Advice for Workers and Retirees

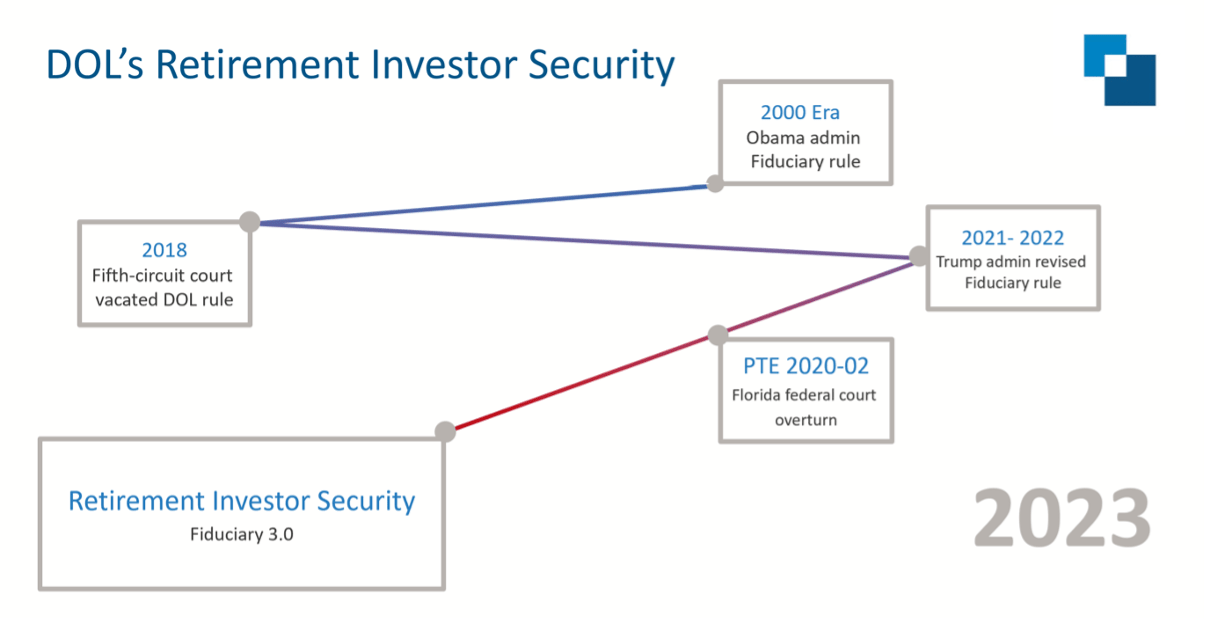

On October 31, 2023, the Department of Labor (DOL) proposed a new rule aimed at “Improving Investment Advice for Workers & Retirees”. This rule defines who is an investment advice fiduciary for purposes of the Employee Retirement Income Security Act (ERISA). The Department released proposed amendments to prohibited transaction exemptions (PTEs) available to investment advice fiduciaries, including PTE 2020-02.

InvestorCOM hosted a webinar, with the wealth industry’s most trusted and seasoned experts, to discuss the implications of this new proposal.

Mentioned below is a summary of insights drawn from the conversation. You may watch the complete webinar here: https://www.youtube.com/watch?v=xOdmXLhLkwA

Four Major Components

Fred Reish simplified the 600-page proposal in to four components that form the essence of the new rule:

- A new, dramatically revised fiduciary definition that will cause a lot more advisers and firms to be fiduciaries;

- Small amendments to prohibited transaction exemption 2020-02, particularly in the rollover area, that are more demanding on the documentation,

- Significant changes to prohibited transaction exemption 84-24, or the insurance exemption as it is referred to, in terms of rollovers to annuities, and,

- A group of other exemptions, from the past, modified to take the kind of retail transactions that PTE 2020-02 and PTE 84-24 apply to, out of them.

The retirement investor world now has three authorities: (i) The new fiduciary definition, (ii) the PTE 2020-02 which will probably be used for almost certainly be used by broker-dealers, investment advisors and insurance companies with career agents, and (iii) the new proposed PTE 84-24 used for independent producers and smaller insurance companies.

When Do These Rules Become the Law?

The present DOL proposal will be followed by a 60-day comment period from the date it gets published in the Federal Register, and then, 45 days after they are published, will open to hearings.

Once that proposal process gets over, the Department of Labor writes the final regulation which is sent to the Office of Management budget in the White House. If approved, the regulation gets published in the Federal Register – That becomes the final rule. While we can’t pinpoint what the effective date will be, the entire process likely implies it should be in the middle of 2024, with the applicability date possibly January 1, 2025.

Will These New Requirements Stick?

“I think 2020-02 is here to stay. It’s modified a little bit. I don’t see any basis for challenging the smaller changes.”

— Fred Reish

The new rule compels firms and advisors to document more, and, provide more information to participants and investors and retirement investors. The Florida federal court ruling that vacated the rollover part of the rule actually validated 2020-02.

Under new DOL rules, providing individualized advice for a fee – even one time – qualifies as fiduciary advice. Even as we wait for the proposal to be formalized as a rule, with possible retrospective lawsuits filed against it, it appears the DOL has anticipated litigation in the way they have built the Preamble and structured the rule.

Irrespective of pushbacks and legal outcomes, however, the private sector – insurance companies, independent agents, broker dealers, investment advisors, Banks and Trust companies – have no choice but to comply, considering the lack of predictability on the ultimate Court decision.

Impact on Wealth Management Practice

Department of Labor rules have, for almost fifty years, underscored a one-part test to qualify a fiduciary: Discretion over an investment. On the other hand, for non-discretionary advice, there has usually been a five-part test, one of which is that the advice must be given on a regular basis. Previously only one-time advice was not considered ‘regular basis’. Providing episodic advice, such as one made today and the next in another three years, yet buying, selling or holding recommendations annually would be considered ‘regular basis’. The DOL’s new proposal takes that ambiguity out. One-time advice, Point-in-time advice, or episodic advice – All these distinctions go away, qualifying anyone as a fiduciary for that.

What this impacts most is rollover recommendations. Previously, a recommendation to roll over from any plan to an IRA was considered regular – the Department considered these connected. This qualified someone as a fiduciary. The Florida federal district court, on the other hand, considered these as distinct plans and consequently dismissed the DOL’s interpretation.

The new DOL Fiduciary Rule effectively sets aside that case. Now, a whole new regulation defines one-time advice, which includes a rollover. From the perspective of both the SEC and the DOL, a rollover is advice to liquidate your account in the plan.

DOL’s Proposed Requirements are Going to Weave in to the SEC’s Care Obligation

“They’re very definitely coming together. I mean it seems pretty obvious to me that there are conversations between the SEC staff and the DOL staff. I mean, there the similarities are too great to assume that they arrived at them independently.” —Fred Reish

Few of DOL’s requirements found a mention in SEC’s March ’22 staff bulletin, including a best interest recommendation. You have to look at how participants invested in a plan compared to how they would be invested in the IRA. There is a distinction, though – Under DOL’s rule, you have to provide the participant with the specific reasons in writing by the rollovers. In the SEC Guidance, you need to do the analysis, but you don’t have to do provide it in writing.

The bulk of it – the process and the information – has to be examined, and the fact that it has to be best interest, is in both.

The DOL has mentioned that they model their expectation on the retrospective review on FINRA’s rule 3120. Firms engaging in retail recommendations, including recommendations to roll over, and broker-dealers have the same expectations under 3120 that they would under the retrospective review – including the expectation that there be a certification as per FINRA’s rule 3130. Investment advisors, under rule 206(4), have to assess their programs, the supervision and compliance.

It seems as though the DOL believes that under Reg BI and the investment-advisor Standard of Conduct, interpretations are aligned. The DOL has now imposed some additional requirements.

The Big Question: Who Is Going to Be Impacted the Most?

“I would definitely have clear procedures about when you document, and, what you document and make sure that you’re communicating that to your Field Force and your supervisors. So when the SEC or FINRA or someone else comes in and they ask for that, you can say well here’s a determination we made we think it’s reasonable and then you can show that you were documenting in those cases.” — Ed Wegener

Which industry is going to be impacted by this, and how? Within the insurance industry, particularly Independent Producers. Most large ones, with career agents, are already using PT 2020-02, even for rollovers to annuities. However, for people using PTE 84-24 for their rollover to annuities, and particularly for Independent Producers, the changes may be dramatic.

Much of 2020-02 has been drafted on to 84-24 – writing to the participant why it’s in their best interest to roll over to an annuity that is part of the new PTE 84-24. That has moved over a fiduciary acknowledgement – moved over an obligation on the insurance company to supervise compliance, to do an annual retrospective review on the insurance company. This clarifies that rollovers are fiduciary acts regardless of any other tests. This impacts the insurance industry and particularly, independent agents.

Most broker-dealers, it seems, are already in compliance. Investment advisors with PTE 2020-02 treating rollovers as fiduciary advice already will not be majorly impacted either. It has, anyway, been hard for all parties to get planned data to do rollover analysis.

“We faced all those challenges (gathering planned data)… Everybody who is relying on the 84-24 is going to carry over and it’s going to be plowing brand new ground for a lot of people specifically Insurance Advisors”

— Dawn Thomason

Practical implementation is easier said than done – It requires preparing something that is suitable to be client facing, and, doing it repetitively and at scale.

Firms that, as a result of the Florida federal court ruling, thought they didn’t need to do the retrospective review will now need to comply. Opportunities for improvement include training consistency, the use of appropriate plan information, benchmarking information quality of documentation, and, monitoring for compliance.

The impact of these changes will vary between firms using technology supported systems to help with their reviews, and, firms using manual processes. For firms using technology supported processes, there is the benefit of consistency in providing plan information or benchmarking information. There is also help with documentation. An InvestorCOM analysis discovered that technology can help firms save two hours per recommendation, while instilling assurance and consistency.

Regulatory Requirements, Growth and Technology

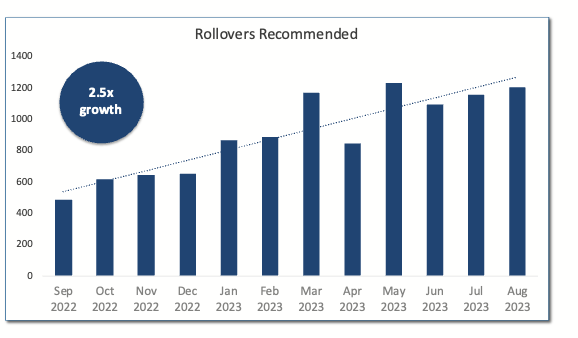

“We’ve observed data over the past 12-months while helping our clients with their retrospective review requirements. We worked with four clients who were using our application (RolloverAnalyzer) and its compliance dashboard. We knew anecdotally that using technology to look up plan costs, document and digitally deliver rollover recommendations to investors would improve compliance and productivity. However, we were VERY surprised about the steady growth experienced by our clients during a 12-month period. You can see the results for yourself contact us to learn more.” — Parham Nasseri

One critical aspect is that firms and advisors – irrespective of size or industry – need to examine if they have been in compliance with the old rules, before rushing to adopt the new rules. There may be a small chance that something have been overlooked and now is a great time to set things right in order to plan for the future.