2023 FINRA Annual Conference: Insights on Reg BI

This year’s FINRA Annual Conference, themed ‘Future Focused’, provided a great opportunity for the wealth management community to exchange ideas on today’s most timely compliance and regulatory topics. The conference covered several topics with conversations often revolving back to Regulation Best Interest (Reg BI). This article captures some key themes and observations from the conference.

- The Tone from the Top

The conference started with a fire-side chat between FINRA’s Robert Cook and the SEC’s Chairman Gary Gensler who both emphasized that Reg BI must not be viewed as a ‘check-the-box exercise’. Messrs. Cook and Gensler highlighted how regulatory examinations have uncovered opportunities for improvement across the wealth advisory industry. Mr. Gensler stated that advisors who want to ensure their recommendations are in clients’ best interests need to “go beyond merely making sure recommendations are ‘suitable and analyze all costs and relevant alternative investments”.

- Reg BI: Exams and Enforcement Implications

- Focused sessions on ‘Enforcement: Latest Developments and Trends’ provided much-needed clarity on areas of concern to our clients regarding Reg BI. Gurbir S. Grewal, Director of Enforcement at the SEC, pointed to the SEC’s first-ever action to enforce Reg BI – Western International Securities Inc. – which centered around the Care Obligation, and how illiquid securities were marketed to retail investors, without evidence of a reasonable basis or assessment of alternatives. Mr. Grewal noted that Reg BI is an exam priority for 2023, with a particular focus on share classes and 12b-1 fees.

- Christopher Kelly, FINRA’s Acting Head of Enforcement, said cases fall into three general buckets: Form CRS, the Compliance Obligation, and the substantive violations around Care or Disclosure obligations.

- Nicole McCafferty, Vice President of Examinations at FINRA, elaborated that advisors must consider a range of alternatives when giving advice to clients.

- Wendy Lanton, Chief Compliance Officer at Herold & Lantern Investments, said the documentation requirement of Reg BI is where many firms struggle. “As the SEC says, ‘you always have to consider cost, but it doesn’t have to be the only consideration. You don’t have to choose the lowest cost product,’ but without documentation we don’t know how to evaluate if this was an appropriate product.”

- Evan Charkes, Managing Director and Associate General Counsel at Bank of America noted that in the April Staff Bulletin on the Care Obligation, the SEC is imposing the Care Obligation on investment advisors “… now they [the SEC] are very prescriptive about, as an investment advisor, you need to consider this as you develop alternatives in the advice that you’re giving.”

- The Bulletin was also referenced by Peggy Ho, Senior Vice President and General Counsel at Commonwealth Financial, as “a great tool that should be looked at as a roadmap to what people [examiners] are going to be focused on.” Peggy also opined on the ambiguities surrounding documentation by urging firms to embrace the requirement versus contemplate its necessity.

Figure 1: Chris Kelly and Lisa Colone from FINRA join Gurbir Grewal to discuss Enforcement: Latest Developments and Trends

- FINRA Conference: Takeaways and Next Steps

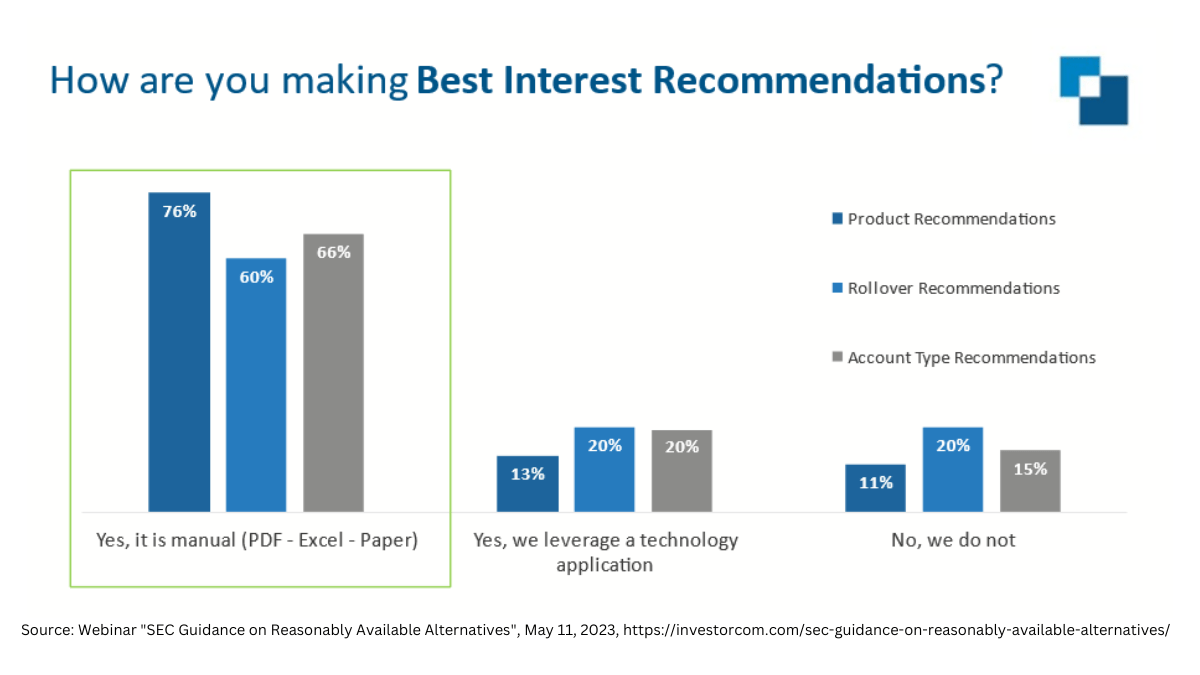

With the cycle of Reg BI enforcement and examinations in full effect, the message has never been clearer. Meeting the Care Obligation needs to be put into practice, and not just with respect to policies and procedures. This may be the biggest shift in the broker-dealer community given what we are seeing in our poll results which indicates that most firms are still tackling their regulatory obligation in a highly burdensome way – manually.

Figure 2: Most firms are relying on manual processes to make best interest recommendations.

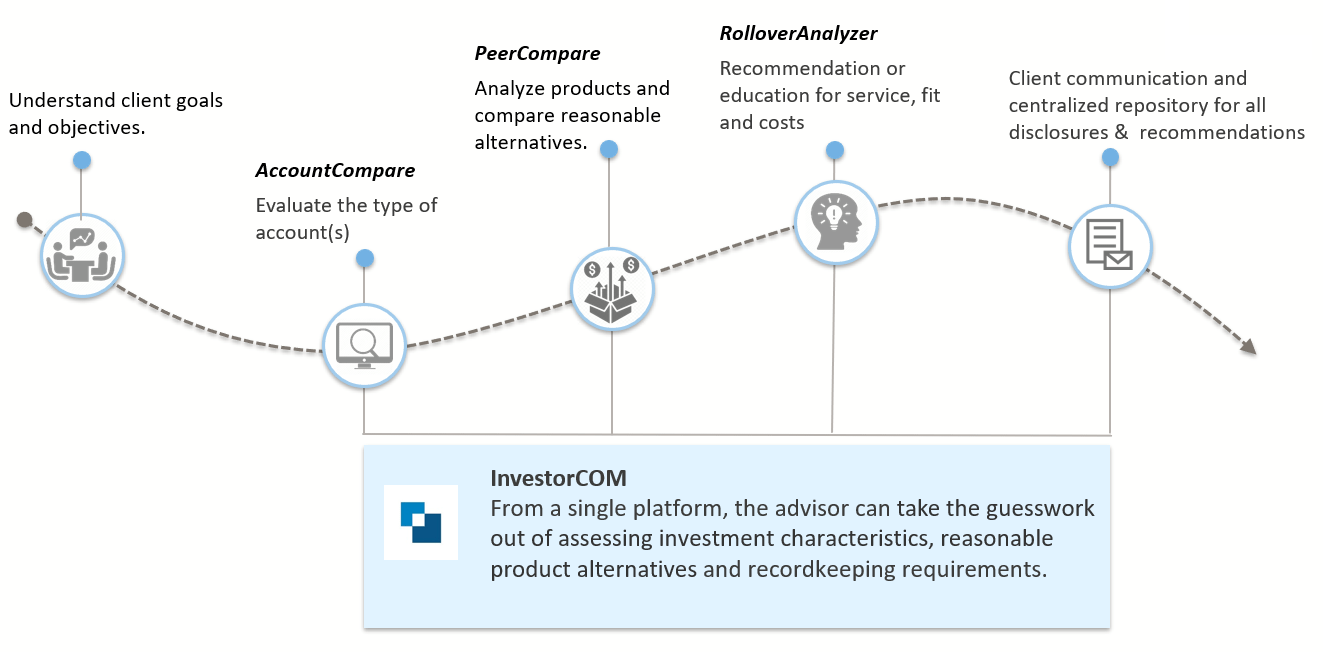

Two significant themes emerged from the conference discussions. First, the stream of Reg BI guidance establishes a clear level of expectation for financial firms and necessitates the development of a repeatable process for reasonably available alternative (RAA) analysis, encompassing various account types and product types. Second, documentation is the primary means for ensuring consistency with a firm’s processes and procedures. It became evident that implementing a digital documentation solution, such as InvestorCOM’s, can alleviate ambiguity and provide consistent and firm-configured frameworks for considering RAA.

Figure 3: InvestorCOM’s Investment Recommendation and Disclosure Workflow Model

—

Contact us to learn more about our findings at the FINRA 2023 Annual Conference.

If you would like to learn how InvestorCOM’s compliance platform is helping firms and financial professionals meet their Care Obligations, sign up to see a demo.