Get product comparison data and in-depth insights to stay ahead of your rivals and mitigate potential conflicts of interest.

In a highly regulated and competitive market, you need access to up-to-date product data to drive product strategy and decision-making. Best interest reforms have placed increasing pressure on mitigating conflicts, bringing increased importance to the competitiveness of a firm's offering.

Compare your products to their peers

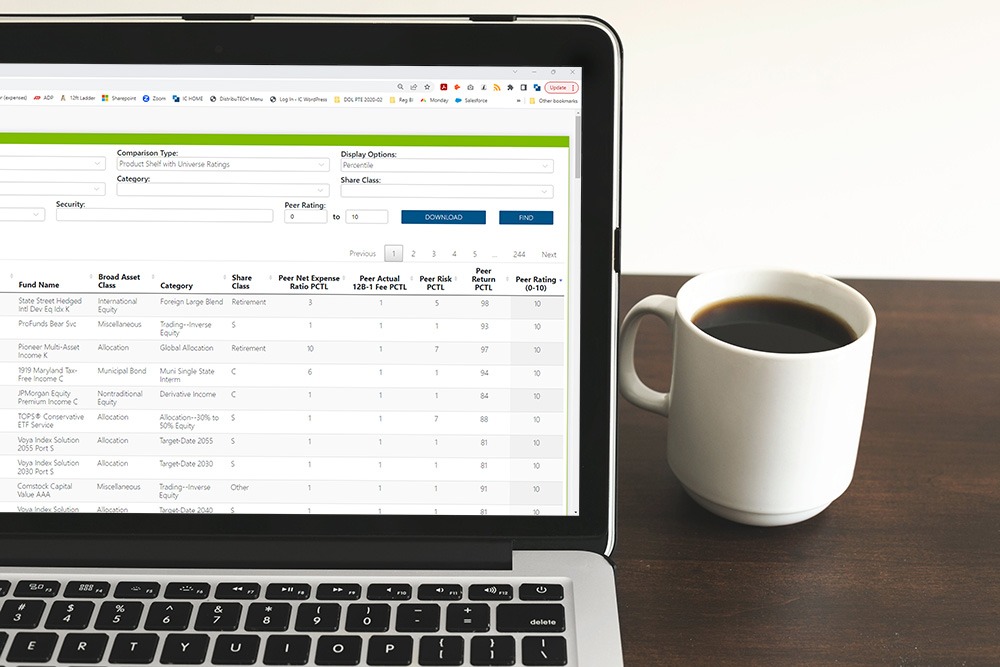

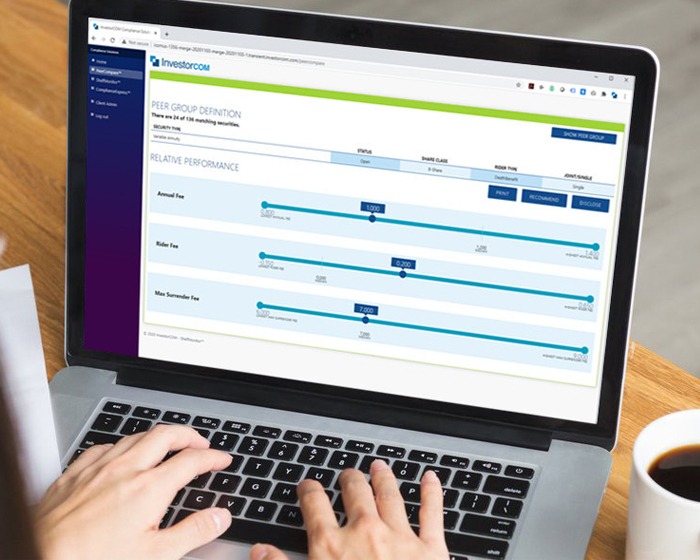

PeerCompare generates a product peer group based on similar products on your shelf or the universe – including Mutual Funds, Segregated Funds, ETFs, North American Equities, Fixed Income, Liquid Alternatives and Variable Annuities.

Compare a specific fund to other funds in the peer group, based on configurable criteria that include Category, Risk and Time Horizon.

Our proprietary peer ratings capability identifies peer groups for all security types and assigns a rating for each security relative to its peers based on cost, risk and return characteristics.

Your research can be automatically stored for future reference and shared electronically with your peers.

Focus on the data that matters to you.

Products are constantly changing. Use ShelfMonitor to see changes to products on a daily, weekly or monthly basis. Set up customizable alerts to find out when change happens. You choose which products to watch and the fields to monitor.

Use our ShelfAnalyzer add-on to see see how your products stack up against peers by comparing cost, risk and return characteristics. ShelfAnalyzer generates a Peer Rating for each product on your shelf making it easy to evaluate product competitiveness efficiently and without bias.

Limit your research to your product shelf, or expand it to include all products available in the market (the universe).